News

As construction costs rise, demand turns to houses and apartments

View(s):By Sadisha Saparamadu

The rate of increase in Sri Lanka’s land prices has slumped as consumers turn to houses and apartments due to rising construction costs.

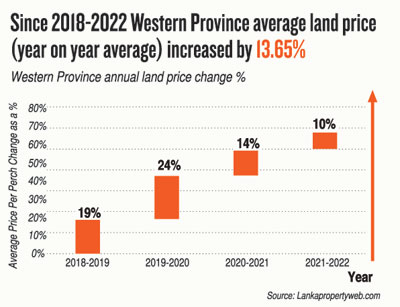

A recent survey by Lanka Property Web (LPW) shows that between 2021 and 2022, the increase in land prices was just 10 percent. This is in contrast to the trend over the past five years when there had been a year-on-year rise of 14 percent.

Daham Gunaratna

Meanwhile, prices of houses and apartments rose dramatically in 2021-22 despite prevailing economic conditions.

Demand for land turned towards Colombo suburbs and outskirts, said Tharindu Jayarathne, Head of Development Consultancy and Research at LPW. More expensive properties in Colombo city stagnated. Cheaper lands–costing around Rs 500,000 a perch–were in most demand.

Stagnation in land prices might partly be attributed to investor fears due to the current economic conditions, pointed out Chamara Samanpriya, who works for property firm Real Lands in its marketing department.

Both Mr Samanpriya and Mr Jayarathne agreed that rising construction costs had also contributed, especially as first-time homebuyers–a key demographic in the demand for land–turned to houses and apartments.

Demand for land in the Colombo suburbs and outskirts also grew as rising food and living costs drove people out of the city, says Murtaza Jafferjee, Chairman of JB Securities.

Mr. Jayarathne noted that, especially in Ingiriya and Kelaniya, which saw more urban development, land prices were increasing steadily.

Areas like Biyagama, Mulleriyawa and Horana also see an increase in demand for commercial real estate due to infrastructure developments, while Kaduwela, Panadura and the Gampaha district saw increased residential demand, said Nithila Talgaswatte, Co-founder and Executive Director of Flat List, a commercial real-estate broking company.

When asked about increased supply when migrating Sri Lankans sold their lands, LPW Managing Director and Founder Daham Gunaratna said the difference was only marginal and had little effect on prices. This view was shared by Mr Samanpriya.

Mr Gunaratna noted, however, that traffic from foreign countries–especially from the UK, the United States, Australia and the UAE where significant Sri Lankan expat populations reside—had significantly increased.

Tharindu Jayarathne

Overseas Sri Lankan who had rupee savings seek to convert their cash into real assets as the rupee depreciates. The depreciation of the rupee also meant that foreign currencies now had more worth in Sri Lanka, giving expats an incentive in the Sri Lankan real estate market. Sri Lankan law, however, does not allow land ownership by foreign nationals, so it is usually dual citizenship holders who can buy land.

Despite this, Mr Talgaswatte said foreign investors still found 99-year leases an attractive option when it came to real estate, but emphasised that improving pricing transparency of the market and long-term government policy on foreign holdings of property to create a stable framework were key to attracting foreign investors to the Sri Lankan real-estate market.

In the long term, both Mr Talgaswatte and LPW said there was potential for the real estate market to bounce back after the economic downturn. Especially in tourism and leisure, Mr Talgaswatte said there were opportunities to attract foreign investors.

Mr Gunaratne said the current slump in price growth was a real estate investment opportunity, which could see big returns when the Sri Lankan economy stabilised in the future.

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!