|

2nd August 1998 |

Front Page| |

Contents

|

||

|

Mind your businessby Business BugGiant Groan The state Telecom giant is making its displeasure known these days about the private networks charging low rates for international calls, using the hefty discounts offered by the state firm. The private companies thereafter have agreed to take a second look at the pricing. So, the chances, are consumers once again will be asked to pay more, so Telecom could have its market share back. More chaos Wednesday's public holiday announced within city limits for SAARC probably: caused more chaos, confusion and security risk than if there was no public holiday at all. The Tuesday announcement said the "government expected the private sector to follow suit." Employees did not know whether their employers, would "follow suit" and trekked to work, only to be turned back. There was even some confusion at the Stock Exchange which was trying to decide whether it was a government or private organisation... Shell Shocked Rumours are afloat that irate workers could shell-shock the country if their dues are not paid by the state. Workers who are waiting to sell their shares back to the state have given an ultimatum of August 10th for the transaction to be completed or else…….we hear.

Debt markets to be open to foreigners?By Mel GunasekeraGovernment is expected to open the debt market to foreign investors, a top primary dealer in government debt securities said. Foreigners are not permitted to buy and trade in government or corporate debt at present. But primary dealers are looking at the possibility of marketing a limited

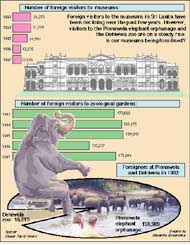

amount of long term Foreign investment in the debt will initially be limited to Rs. 10 bn to Rs. 20 bn a year, he added. This would be something similar to the system in India where there is a limit on foreign investment in debt securities, he said. Meanwhile the Central Bank is planning to issue a dollar/foreign currency denominated debt instrument exclusively for foreign investors or non-residential Sri Lankans, a top Central Bank source said."It is not a Treasury bill or a Treasury bond, but a new type of debt instrument. We are yet to decide what type of instrument to issue," he said. Permitting foreigners to buy debt instruments would tantamount to opening the capital account. The Central Bank is keen to mobilise foreign sources to fund the budget deficit. There is a shortfall in anticipated loan recoverable as predicted in the budget last year. There is a shortfall in revenues as well and a lack of foreign sources available for concessional finance. The suggestion is still in its initial stages. The Business Times learns that even Central Bank Governor, A S Jayawardena is keen to explore the idea of permitting foreign investment in the local debt market. The government is expecting a shortfall in revenue to bridge the budget deficit, hence the authorities are keen lure foreign investors into the debt market, market sources say. There is a shortfall in GST revenue in the second quarter for 1998 as compared to the Turnover Tax revenue in the same period last year. Defence expenditure also has overrun estimates, they said. The government was expecting a neutral stand on GST revenue in the second quarter of 1998, after its introduction in April 1998, but revenue fell short of estimates, they said. Central Bank is expected to adopt one of a few available methods to finance the deficit without tightening the liquidity in the local market, dealers said. The government could borrow more from the domestic market by increasing their short and long-term debt. The government has reduced their short term domestic debt by limiting government securities of three, six and one year T bills to Rs. 115 bn, after retiring Rs. 10 bn through privatization. The CB also announced that they would stop issuing new treasury bills, instead continue to re-issue the existing bills in circulation. They may have to increase the limit to Rs. 125 bn, and then if there is no money in the market, the Central Bank can buy the bills up," the dealer said. The next option is to increase the treasury bonds to raise money. This could drive interest rates up, unless there is some foreign inflow. The government could also borrow in dollars. The other available option for the government is to issue rupee securities in the form of bonds and permit foreign investment, which is most probably what the government, intends to do, he said. "This is what we (the primary dealers) are looking at the moment," he said. "This is the positive side of improving the market. The negative side is that we are desperate for finances," he said. Though the equity market is opened to foreigners, the debt market has been closed to foreigners. Foreign ownership in equity markets is limited up to 49 per cent in the areas of plantations, banks and insurance. Though full ownership is permitted in other industries. By Asiff Hussein The drop in tourist interest in the country's cultural sites, museums and the Dehiwala Zoological Gardens over the past few years has raised questions whether the real tourist potential of these sites is being tapped. Although it is generally claimed that the bad performance of the tourism industry as a whole is responsible for the downturn in tourist visits to these sites it is surprising that the Pinnawela Elephant Orphanage should have attracted as mush as 159,969 foreign tourists in 1997, compared with the insignificant 16,015 tourists who visited the Dehiwala Zoo and 144,517 tourists who visited the Cultural Triangle sites the same year. What is most disconcerting is that there has been a massive drop in tourist visits to these sites over the past few years. For instance of the 370,742 tourists who visited the country in 1981, as many as 224,354 visited the Cultural Triangle sites. In 1997 of the 366,165 tourists who visited the country only 144,517 visited the sites. As for tourist visits to the National Museums this too has seen a sharp decline since 1981 when only 30,560 tourists visited them. In 1997, this figure had declined to 13,916. Many feel that given better facilities and promotional strategy a much greater number of foreign visitors could be attracted to these sites. One has only to take a look at the sorry state of Sigiriya's spiral stairway to realize the plight of our cultural sites. To this day, our National Museums remain as dreary as ever, characterized by its lacklustre atmosphere and the same old artefacts. Indeed a tourist who visited the Colombo Museum 10 or 15 years ago will hardly notice the difference. Besides many believe that the Ceylon Tourist Board is not promoting the museums and cultural sites aggressively enough. The Dehiwala Zoo, which is said to have been one of Asia's best in the 1960's and 1970's has also seen a decline since the 1980's. According to the Director of the National Zoological Gardens, Senarath Gunasena, who took over nine months ago, the Dehiwala Zoo has been unfortunate in that, it has not changed with the times to accommodate visitor demands. He observed that unlike in the 1960's and 1970's when entertainment was the prime objective, in later times, emphasis was placed on ex-situ conservation, education and research. Unfortunately this development has not been well received by the public, and especially foreign tourists. As for the lack of entertainment facilities besides the usual elephant dances and sea-lion shows, Mr. Gunasena pointed out that there exists a strong conservation oriented Animal Rights lobby in the country who are against using animals for entertainment purposes. He also observed that unlike in the entertainment centered Singapore Zoo which has as much as 80 acres, the Dehiwala Zoo has only 20 acres, which is not conducive for expansion purposes. He however noted that steps are being taken to give the public a modern type zoo in line with public demands in about 3 years. This includes the introduction of a greater number of animal species, new enclosures for bears and penguins and the establishment of a children's park. Mr. Gunasena however admitted that the zoo has not been active in promotional campaigns, leaving such matters to the purview of the Ceylon Tourist Board.

Paper Sacks sold?By Ruvini JayasingheAbout 40 disgruntled shareholders including its chairman have sold out 60% of Ceylon Paper Sacks the Mikechris Group flagship to an Edna Group subsidiary, Edna Investment and Marketing Pvt. Ltd. Edna Investments' Chairman/MD, Mr. Lal Edirisinghe, who also is a director

of gold and media giant, E.A.P Edirisinghe Group will become the new majority

shareholder, once the transaction is The large-scale sell out will obviously lead to a change in the board of directors and the top management with the huge question mark hanging over the incumbent managing director's position. The MD, a member of the partly family owned Mikechris group owns 28% of the company and together with one other family member and others make up the balance 40% of Ceylon Paper Sacks Ltd. Insiders said that the shareholders including the Chairman, an eminent criminal lawyer who held 7%, other directors who held over 20% and family members who held over 15% were waiting for an opportunity to sell off their shares to a prospective buyer and were eventually paid almost double the value of their shares. Insiders allege that shareholders were unhappy that they had not been paid dividends and that certain board members who had not sold out were surreptitiously using Paper Sack's raw material for another business registered in a separate name. MD, Mike Cadiramanpulle told the Sunday Times Business that no such share transfer forms have so far been lodged with the company Secretaries Vanik Corporate Services Ltd. Paper Sacks a public company not quoted on the Stock Exchange commands approximately 60% of the market in craft paper packing for tea, poultry and cement. Formed in the late 1960s Ceylon Paper Sacks makes the supra tea sack for bulk packing of tea exports over 50 kg.

Weavers unhappy about assistanceDomestic textile manufacturers are fretting that they are yet to receive promised government assistance under the Textile Debt Recovery Fund (TDRF). Local manufacturers were hit when the November 1997 budget eliminated import duty on yarn. Following representations made by the industry, the government introduced a rehabilitation package to help manufacturers modernise and cater to the direct and indirect export markets. Domestic companies manufacturing yarn, textiles, woven fabric, labels and gauze are eligible for concessions. The TDRF was set up under this relief package. The amounts to be transferred to the TDRF are the capital plus accrued interest up to October 31st 1997, re-calculated at an interest rate of 12 per cent. The government will pay this sum to the banks in 40 quarterly instalments. Interest will be calculated at the average weighted deposit rate (AWDR), adjusted for reserve requirements, until the loans are fully repaid to the banks. Companies accepting this relief package are required to pay only the capital sum transferred to the TDRF within a maximum period of seven years following a grace period of three years. No interest payments are due to government. Further to encourage investments, government will bear the full interest cost on new loans given for modernisation for a period of 18 months. Weavers say nine months have passed since the state-sponsored bailout package was announced, but the authorities have yet to transfer the debts to the fund. The Business Times learns the sticky point in the issue, is the interest payable on debts. The bankers want the government to settle the debts at a higher interest rate, but the government wants to pay a lower interest rate. Negotiations are in process between the Finance Ministry and the bankers. Once both parties come to an amicable solution, an agreement would be signed between the banks, weavers and manufacturers. All debts related to the manufacturers would then be transferred to the TDRF, financial sources said. Meanwhile, the weavers lament that the lack of finances is hampering the day to day operations. "The banks are not giving us any credit facilities nor are they opening L/Cs for us," President Textile Manufacturers Association, A Y S Gnanam said. Bankers say they are unable to take the risk, as they believe duty free textile imports and GST makes the industry not viable. "We are unable to approach the commercial banks to fund a modernisation programme, when our balance sheet carries a heavy loss," he said. "Nobody can modernise their factories unless the government re-thinks their textile policy," he added.

Asian tiger success carried the seeds of crisis with itThe pre-eminent role of the IMF in crisis management following the Asian crisis, its surveillance function, as well as its involvement in the growth and development of the economies in transition, were the focus of a symposium held in Frankfurt Germany, on July 2. The symposium on 'Role of the IMF in the Global Economy' was organized jointly by the IMF and the Deutsche Bundesbank, with the co-operation of the newspaper Frankfurter Allgeneine Zeitung. It brought together more than three hundred participants from government and the private sector, as well as from the press. All the speakers at the symposium agreed that the IMF, with its unique expertise, had played and should continue to play a central role in crisis resolution. They also agreed on the prime importance of transparency and a fuller disclosure of information on the part of all those involved - international financial institutions, governments and the private banking sector. Participants disagreed, however, on the extent to which moral hazard - the expectation on the art of private creditors the subsequent official financing would protect them against the consequences of unwise investment - was an important element in the Asian crisis. Origins of Crisis Following an introduction by Jurgon Jeske, Editor of the Frankfurter Allegemeine Zeitung, Bundesbank president Hans Tietmeyer observed in his opening address that while the main causes of the Asian crisis were "the misguided, or at least risky, policies pursued by the countries in question their own internal weaknesses make them vulnerable." He added, though, that "it is also true that the global financial markets are sometimes a factor in making the magnitude of the reversal so great". Noting that the key fundamentals in the Asian countries were sound, Tietmeyer observed that on closer inspection it can be seen that economic successes of recent years already carried that seeds of the later crisis". These took the form of massive short-term capital flows, assert inflation, misapplication of capital, currency appreciation, decreasing competitiveness, and growing capital account deficits. The IMF had accumulated important experience with the strategy of countering a crisis of confidence by intervening very early with large amounts of financial assistance, Tietmeyer said. He cautioned that there were risks in this approach: The frequent application of this strategy was expensive for the IMF; the levels of early financial assistance acted as a kind of benchmark: and the early massive intervention by the IMF could undermine the ability of the financial markets to function in the long run, leading to a danger of moral hazard. The first requirement, in his view, was that the IMF should concentrate less on correcting market outcome that has already occurred. Instead it should try to influence the ex ante setting in which the financial markets operate and to improve their functioning". This requires more transparency and information so that, on the one hand, financial markets might form their expectation more rationally and realistically and on the other hand, the IMF itself could assess the need for action more quickly. The IMF is not a rating agency, he said: "The ultimate responsibility for correctly assessing chances and rises in a given country remains with the players in the financial markets." Tietmeyer recommended that the IMF should minimize its provision of financial assistance by bearing only the absolutely necessary portion of a financing package: defining a maturity and interest rate for its financial assistance that would give the debtor an incentive to repay as soon as possible and making its assistance subject to strict conditionally. "The central role of the IMF needs to be strengthened rather than reduced," he concluded. "In performing this role, the IMF will contribute to enhancing the stability and openness of the global economy". Role of IMF Delivering the keynote address to the symposium, IMF Managing Director Michael Camdessus outlined the key elements on IMF policy advice to members. With specific reference to the IMF's efforts to contain the Asian Crisis, he observed that "it takes time to turn around a situation where major structural transformations are called for - we had to marshal catalytic but alas sizable financial support, and convince public and private creditors to take their share in the burden of rebuilding the credit worthiness of these countries." An equally important effort, he said, was "to help other countries that were being threatened with contagion to strengthen their macro economic fundamentals and their economic structure". Recently, the Managing Director said, "A new crisis - a crisis within the crisis - has emerged with the weakness of the Yen". The fall of the Yen could seriously jeopardize the on-going recovery of the economies that were hit first and adds to the market instability that affects other countries within the region, as well as some countries, such as Russia outside it. He called on Japan to "Move aggressively and quickly to rehabilitate its banking sector, to adopt policies - including reforms that would provide significant tax relief - to ensure that fiscal stimulus is not withdrawn too quickly next year, and to open up and deregulate its economy". Camdessus responded directly to the question whether the IMF was creating a moral hazard for borrowers and investors "As for borrowers," he said "there is agreement that no country would deliberately pursue reckless policies because it thought the IMF would bail it out in the event of a crisis. The political cost would simply be too great. As for investors, the debate is going on, and it is a healthy one. Many private investors are taking heavy loses. He noted that foreign equity investors had lost nearly three fourths of the value of their equity holdings in some markets; many firms and financial institutions would go bankrupt; and overall the crisis has been very costly for many foreign commercial banks. Efforts should now be made, he said, to involve the private sector in resolving both sovereign and private debt problems. He outlined seven areas - seven pillars of wisdom where the membership could help the IMF at this time these he said, would be to: * show more of a presence in the IMF and take, head on, its responsibility as the biggest group of shareholders; * continue to recommend a tough approach to the IMF and evenhandedness. * be helpful and avoid holding back at financing consortia or creditor groups. * avoid undercutting the IMF by designing new schemes to institutions, such as the proposed Asian Fund, which would be gentler or kinder than the IMF. * help in the key task of surveillance and in emphasizing the IMF message to the rest of the world. * compete for excellence in economic policy making and * give generously to the IMF the benefit of the doubt and their full support. (IMF Survey)

WIPO paves way for new domain namesThe World Intellectual Property Organisation this month unveiled plans to solve the corporate trademark disputes that have bedevilled domain-name creation. The organisation aims to have a system for resolving disputes in place by next March, removing one barrier to the creation of new generic top level domains (gTLDs), alongside .com, .net and .org. A plan to create new gTLDs was effectively blocked by corporate users, who demanded that procedures for protecting trademarks be established first. They worried that without specific policies on domain name allocation, the trademark problems that plagued .com would migrate to new gTLDs, creating extra consumer confusion and holding back electronic commerce. "How to protect your trademark in an environment where there may be a free-for-all for domain names" is "absolutely very important," said a Brussels-based vice president of a large multi-national media and broadcasting company, since "a lot of money has (already) been put up for .com domains." Those concerns were backed by the U.S. government, which last month urged in a White Paper (CWI, 29 June) that no new gTLDs be created until a new body is established to oversee broader governance issues including domain names, Internet Protocol numbers and root server operations - today performed by the Internet Assigned Numbers Authority (IANA). But some observers believe that the problem of resolving disputes between domain names and trademarks may be inherently impossible to achieve. Trademark headaches They worry that in trying to solve the insoluble, Geneva-based WIPO may lean towards trademark holders - so disadvantaging individuals and small companies, while favouring corporate titans. "Domain names must not be equated with trademarks,'' said Milton Mueller, a telecommunications policy expert at Syracuse University in New York. In a study released this month, he found the majority of gTLD trademark conflicts involve parties that both have a legitimate claim to a name: For instance, a computer company and grocery store both called "Apple." "Trademark law," he said, "cannot resolve the disputes fairly." Despite these concerns some advocate the immediate creation of new gTLDs, arguing that the swathe of possible meaningful names in .com, .net and .org is saturated, and new names are needed to enable the Internet to grow. "We need new gTLDs now," emphatically stated David Maher, a Chicago-based trademark lawyer who heads a plan to create new gTLDs under the International Ad Hoc Committee (IAHC). WIPO, a United Nations-affiliated agency, will also study the impact of creating new gTLDs, and intends to host meetings in Africa, Asia, Latin America, Europe and the United States this autumn. "People can come forward and say what they feel needs to be said," said Christopher Gibson, the head of WIPO's electronic commerce division. Maher and others believe that the creation of new gTLDs will protect users by increasing the amount of Internet "real estate," and dilute the monopoly power of Network Solutions Inc., the Herndon, Virginia based company that currently holds an exclusive right to register .com and other gTLDs under a U.S. government contract. The government and NSI this month began negotiations on whether NSI may keep its monopoly on the .com registry database. Don Telage, president of NSI, maintains the company has invested heavily in the brand name of .com and has the rights to develop it commercially. "The introduction of new TLDs has a trademark problem, but it also has a problem with stability," said Joseph Alhadeff, the director for electronic commerce at the U.S. Council for International Business in New York. "Business has both concerns and wants to see both addressed," he added. Net bodies prepare for new governance While corporations worry about domain names and trademarks, Internet leaders are actively founding new Internet institutions and procedures to support a new central governing organisation, expected in September. Regional Internet Protocol address registries in North America, Europe and Asia are laying plans to harmonise policies and create by September an umbrella organisation, a so-called "Global Address Registry" council, to represent their interests before the new governing body. The IP registries are also developing a shared database system to seamlessly share information, said Kim Hubbard, the director of the American Registry of Internet Numbers in Chantilly, Virginia. ISPs and large users have complained that better co-ordination of IP number allocation is needed. Additionally, national top-level domain name registries in Asia this week will form a confederation to ensure policy-making representation, in the same way as European TLD registries did earlier this year. The inaugural meeting of the tongue-twisting Asia-Pacific country-code Top-Level Domain (APccTLD) council, is set for Geneva this week at the Internet Society's annual INET conference. Toru Takahashi, the president of Tokyo Internet, is expected to be the group's chairman. And the technical underpinnings of the domain name system itself are becoming more formalised and commercial. Palo Alto-based non-profit organisation Internet Software Consortium (ISC), which developed the BIND software that name servers use, will begin selling support services based on the free product to generate income, said David Conrad, the former chairman of the Asian IP registry APNIC, who recently became the ISC's executive director. (Source: CWI News)

More Business * Delayed stockdraw blocks oil recovery, say analysts * From rugger to the playing fields of commerce *Asia vs Latin America * The dos for Latin America * Asia : Cheap but still risky

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|

government

securities to foreign investors at the request of the Central Bank, the

dealer said.

government

securities to foreign investors at the request of the Central Bank, the

dealer said. finalised,

market sources said. The Sunday Times Business understands that shareholders

have been paid a steep premium, as high as Rs.90 for a Rs. 100 share. Vanik

Secretarial Services is handling the registration procedure.

finalised,

market sources said. The Sunday Times Business understands that shareholders

have been paid a steep premium, as high as Rs.90 for a Rs. 100 share. Vanik

Secretarial Services is handling the registration procedure.