|

6th June 1999 |

Front Page| |

Contents

|

||

|

At 55, still smells good

Thirty three years later his mother passes away and the pack of tea is found tucked away in the back of a cupboard. The now not so young soldier too rather than throwing it away decides to put it away in the back of a cupboard where it has remained all these years until it was rediscovered recently. This ordinary looking pack of tea is the very same pack the young soldier bought and probably the world's oldest known packet of tea. K.G. Bailey the then young soldier was thoughtful enough to contact the Planters' Association of Sri Lanka and confer it back to the country of origin. This pack thought to contain orthodox Broken Orange Pekoe (BOP) a leafy variety famous back in the good old days, packed in lead, still gives out that strong tea aroma one would look for in a good tea. This historical find will be exhibited at the Tea Museum to be opened at Hantane, Kandy.

CB to regulate leasing companies soonBy Mel GunasekeraLeasing companies and other financial institutions engaged in leasing activities would soon be regulated under a proposed Central Bank regulation. The proposed Finance Leasing Bill will provide a regulatory and supervisory framework for the leasing industry, a Central Bank official said. Central Bank will also licence and supervise companies engaged in leasing. The law will also define finance leasing transactions and specify the rights and obligations of lessors, lessees and suppliers of leased equipment, the official said. At present, leasing companies are not regulated. The companies do not even have a minimum capital requirement. The proposed legislation comes after the Asian Development Bank gave technical assistance for an extensive study into the leasing industry. At present, there are five specialised leasing companies, of which three are subsidiaries of commercial banks operating in Sri Lanka. In addition, a number of other financial institutions such as commercial banks, development bank, finance companies and merchant banks engaged in leasing business. In the midst of intense competition, the activities of these companies increased over the years. According to the 1998 Central Bank report, total assets of the five leasing companies increased from Rs. 7.5 bn at end 1997 to Rs. 10 bn. The total value of new lease finance provided by these companies increased by 60 per cent in 1998 compared to 63 per cent in 1997. As in 1997, lease finance was mainly for commercial vehicles (55 per cent), passenger vehicles (15 per cent), plant and machinery (12 per cent) and office equipment (11 per cent). In terms of sectors, the trading sector received 32 per cent of the total lease finance, while the services sector (22 per cent) and the transportation sector 21 per cent. In addition, the industrial sector (16 per cent), construction sector (4 per cent) and agriculture sector (3 per cent) also received significant levels of finance. Leasing companies have been complaining that they are affected by competition from other financial institutions. GST slapped on leases are also eating into their profits, companies lamented. Another constraint faced by most leasing companies is the difficulty in obtaining long term funds for financing leases. To overcome this obstacle, LOLC recently issued a debenture to finance their long term leasing activities. Another Rs. 500 mn debenture from Commercial Leasing company is expected in the market soon.

CSE raises brokers' net capitalThe minimum capital requirement for stockbrokers will be raised to Rs. 11 mn with effect from December 31, 1999. The net capital will be further raised to Rs. 15 mn by December 31, 2000, Colombo Stock Exchange Director General, Hiran Mendis said in the annual report. The rules pertaining to the minimum liquidity requirements of stockbrokers have been rationalised and made independent of the net capital requirements. The minimum capital requirement was raised from Rs. 3.5 mn to Rs. 7 mn in April 1999. The purpose of the liquidity requirement is to provide a hedge against settlement risk.

Reduced rates for home zone callsBy Shafraz FarookMobile phone users will be charged at a reduced rate for calls generated from their home zones, The Sunday Times learns. The proposal has been put forward by a mobile phone service provider, to charge customers a reduced rate for calls generated from within their respective boundaries. For example, if a mobile phone operator makes a call form the area he belongs to, which would be specified by the operators, he would be charged at a discounted rate. This discount applies to all calls made irrespective of mobile or fixed phones. The proposal seems to be biased towards the rural areas since most of these areas use very few transmitting towers. Whereas in the highly urban areas, there are many towers' transmissions overlap one-another. Telecommunication Regulatory Commission Director General, Prof. Rohan Samarajiva said that the proposal was before the Commission and a decision was expected soon. At present, Britain is the only other country providing this service. Experts in the field feel that if this system is introduced, Sri Lanka's already accelerated growth will get turbo charged. Present statistics show that Sri Lanka has over 180,000 mobile phone users, connected to the four mobile phone operators. The sector recorded a growth of over 52 per cent in 1998 surpassing the growth recorded by fixed phones. Industry officials said that if one service provider goes ahead with this system others will have to follow suit to stay competitive.

CSE takes on Central Bank over government debtThe Colombo Stock Exchange (CSE) is questioning Central Bank's refusal to list government debt on the stock exchange. At present, the government and corporate debt markets operate in isolation of each other. CSE Director General, Hiran Mendis in a hard hitting statement said, "the main drawback to the development of the debt market is the lack of uniform and integrated approach between the institutions responsible for the regulation of these markets." The CSE does not list government debt unlike many other FIBV (International Federation of Stock Exchanges) member exchanges. The trading and settlement of government debt remains under the Central Bank's purview and is presently done using manual systems. The Central Bank is expecting to automate the trading system. Given that the infrastructure of the CSE is world class and that trading of government debt is common in other Exchanges, there is no reason why the resources of the Exchange should not be utilised to trade government securities, he argues. Furthermore, the Exchange possesses the core competence to trade, clear and settle securities. It is disturbing to note that interest rates on sovereign debt are higher than bank deposit rates. This in turn, translates into higher debt service payments to the government (exerting further pressure on the budget deficit) and increases corporates' cost of funds of as they use the treasury bill or bond as a benchmark. The promotion of a common exchange to trade equities, corporate debt and government securities will result in the accelerated development of the capital market, he says. Investors will benefit by the availability of many investment options on a common platform while issuers will have the advantage of lower interest rates. Hence, the trading of government debt in the CSE makes sense from more than one point of view. The regulatory body for equity and corporate debt can be the Securities and Exchange Commission while the Central Bank continues to regulate government debt.

Following Thailand and Malaysia Sri Lanka mulls opting out of international rubber pactSri Lanka is contemplating leaving the International Natural Rubber Organisation (INRO) as the global rubber pact has failed to prop up tumbling world prices, a Plantation Ministry official said. A firm decision will be taken once cabinet approval is given, the official said. In April this year, INRO unveiled a proposal that would substantially raise intervention price levels to win back two departing producers and save the global rubber pact. Upset by low prices, Malaysia and Thailand, two main pillars of INRO, are leaving the world's only commodity pact with power to intervene in the market to shore up prices, in October 1999 and March 2000 respectively. The two Asian members, who produce more than 50 percent of the world's rubber, said they would start their own rubber intervention schemes. INRO, worried that the departures would spell its premature demise, countered by proposing to raise the market intervention reference price by a hefty nine percent. The plan, spearheaded by consumer states, would allow the body to intervene more quickly in the world market. "We are still hoping that this proposal will bring back those countries that have withdrawn," INRO Council Chairman Walter Bastiaanse said after the group's meeting in Kuala Lumpur in April. Currently, the INRO reference price is a hybrid of the Malaysian ringgit and the Singapore dollar. INRO has proposed to replace it by a single currency - the relatively stronger Singapore unit. This will lift the reference price by nine percent, Bastiaanse said. INRO rules state that a single currency can be adopted if there is a big divergence between the ringgit and the Singapore dollar. The Singapore dollar has shown a certain degree of stability. However, the proposal will be discussed further when INRO meets in September, after member countries get a mandate from their government. Producers had in October 1998 asked for a six percent increase in reference price to help them tide over prolonged low rubber prices. INRO meeting also considered whether to move its Kuala Lumpur headquarters after Malaysia leaves the group. INRO groups six rubber producing and 16 consuming countries. The producers are Thailand, Indonesia, Malaysia, Ivory Coast, Nigeria and Sri Lanka. Consuming members are the United States, Japan, China, Germany, France, Austria, Belgium, Luxembourg, Denmark, Finland, Greece, Ireland, Italy, the Netherlands, Spain, Sweden and Britain. Belgium and Luxembourg are considered one.

Is water a brake on agricultural production?Agriculturists, bureaucrats, water experts, econo- mists, geographers, and environmentalists gathered together at a Workshop (which could have been called a Watershed) to fashion out a Water Vision for Sri Lanka. It was in fact a foundation stone for a regional vision for water and then a Global Vision for water in the year 2025. As to be expected from a diverse group of this nature, there was no consensus even on the fundamentals. Some thought there was a serious problem of water availability in the future, others disagreed. This was so with respect to both the global picture as well as the Sri Lankan prospects. Optimists and pessimists aired their views and no doubt the country would come out with Water Vision for 2025. Whatever the differences of views there were important facets and figures which were disclosed. Apparently by the year 2025 a fourth of the world would suffer serious water shortages. The problem is worse in the developing countries where a third of them would have serious shortages. In many countries of the world the situation within them is more serious owing to regional differences in water. The two most populous countries of the world we were told have not only an overall shortage of water, but will have regions with critical water shortages This would mean inadequate food production, leading to a heavy demand for international supplies and consequently higher prices. That would impact seriously on the capacity of poor countries which are deficient in food to purchase their needed food requirements. So the water constraints globally could create serious problems of famine and malnutrition for the underdeveloped world. There are important implications of these facts for Sri Lanka's agricultural and economic policies. We cannot stick to our old policies of self-sufficiency, but the emerging global scenarios of food production require appropriate policies to ensure food security. Better water management, more rational land and water utilisation, cropping patterns which take into account water as a scarce resource and overall economic policies which would strengthen the economy so that non food exports would be adequate to finance the import of our food and other requirements were mentioned among others as the strategies for meeting the needs of the future. The thought we would like to leave with our readers is this. Are our research institutions dealing with agriculture looking into these issues? Are our policy makers taking into account the futuristic possibilities in designing our agricultural policies?

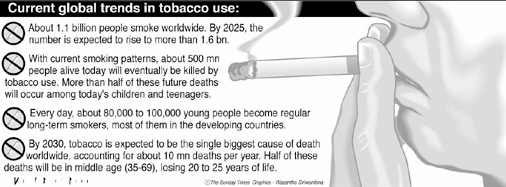

World Bank debunks tobacco industry claimsBy CalculusTobacco giants are switching their fo- cus on poor Asian nations as

the rich western nations stub out The study, Curbing the Epidemic: Governments and the Economics of Tobacco Control, demands a ban on tobacco advertising, recommends governments to raise cigarette taxes and suggests the funds raised from the taxation be spent on more research and anti-tobacco education. "Higher cigarette taxes, advertising bans, and health warnings could bring unprecedented health benefits without harming economies," the Bank said candidly backing governments' action to curb smoking. However, Ceylon Tobacco Company spokesman said they have not received the report and hence unable to comment on it. The report, a joint initiative with the World Health Organisation (WHO) and others, says the economic fears that have deterred policymakers from taking action against tobacco "are largely unfounded". "A 10 percent increase in the real price of cigarettes worldwide would cause 40 mn smokers alive in 1995 to quit and prevent a minimum of 10 mn tobacco-related deaths," World Bank health specialist Prabhat Jha said. The report was issued to coincide with the annual World No-Tobacco Day says by 2030, tobacco is expected to be the single biggest cause of death worldwide, accounting for about 10 mn deaths each year. Half of these deaths will take place in developing countries. Tobacco is different from many other health challenges. Cigarettes are demanded by consumers, and form part of the social custom of many societies. Cigarettes are extensively traded and profitable commodities, whose production and consumption have an impact on the social and economic resources of developed and developing countries alike. The economic aspects of tobacco use are therefore critical to the debate on its control. However, these aspects have until recently enjoyed little global attention. The report is also timely. In light of the rising death toll from tobacco, many governments, non-governmental organisations and other agencies within the UN system, such as UNICEF, the International Monetary Fund and the Food and Agricultural Organisation, are examining their own policies on tobacco control. This report is intended mainly to address the concerns raised by policymakers about the impact of tobacco control policies on economies, Jha said. The benefits of tobacco control for health, especially for the world's children, are clear. There are, however, also costs to tobacco control, and policymakers need to weigh these carefully, the Bank said. Focusing on Asia, the WHO said, that while smoking fell from 40 percent of adult Americans in 1964 to 23 percent in 1997, it is now rising in poor countries by 3.4 percent a year. In India alone, there were 383,000 tobacco-related deaths in 1998. And, compared to vigorous anti-smoking legislation in many Western countries, experts say the attitude in Asian countries such as Japan, China and Vietnam is relaxed. American tobacco makers are aggressively trying to penetrate the Japanese market because it is getting harder for them to sell tobacco in the American market. And, under pressure at home from US competition, Japan Tobacco Inc. is now starting to pursue markets in Asia, particularly China and Southeast Asia - something like a domino-reaction. In China, whose China National Tobacco Corp. is the world's biggest with 1.7 trillion cigarettes made in 1997 according to WHO, a 1996 survey found two-thirds of respondents did not know smoking's link with lung cancer. Even in poverty-struck Nepal, where tobacco advertising on electronic media is banned and the state funds an anti-smoking campaign, the use of traditional forms of tobacco like the small "beedi" cigarettes is still "especially widespread beyond the Kathmandu Valley," a WHO report found. And, wealth was little protection for Japan's 126 mn people, where the market is controlled by mostly state-owned Japan Tobacco — maker of 288 bn cigarettes in 1997 and the fifth biggest in the world. There were 26.47 mn male and 6.81 mn female smokers in Japan in 1998, down from the previous year's 26.69 mn men and 7.36 mn women, according to Japan Tobacco Inc. In Taiwan, where five million of the 21.8 mn people are smokers, taxes are far too low, according to officials of the private anti-smoking group John Tung Foundation. But, the government is now reported to be preparing extra taxes including a 20 percent health tax. The Taiwanese government has kept the tariff at such a low level partly because it hopes to accelerate Taiwan's entry to the WTO. Tobacco is still big business despite falling consumption in rich nations, the WHO said, with the global retail market worth US$ 300 bn dollars and profits estimated at more than US$ 20 bn dollars. But, some nations are reporting success. In Thailand, where the government forced tobacco firms to reveal the content of their cigarettes in 1997, consumption has dropped four percent among males and almost three percent among 15 to 19-year-olds, the UN organisation said. In Sri Lanka, the anti-tobacco lobbyist said the report 'did not come as a surprise and the necessary legislation are to be enforced soon'. The Sri Lankan government is in the midst of drafting necessary legislation to ban advertising of cigarettes and alcohol. The controversial ban was to be enforced in January this year, but is held up due to complications arising out of connected legislation. Despite these legal snags, this year, the WHO selected President Chandrika Kumaratunga for the 'Tobacco Free World Award', for her outstanding contribution towards addressing the health and economic problems to the consumption of tobacco. The WHO recognised Mrs. Kumaratunga for developing a national tobacco policy, an official release from the President's secretariat said. In 1998, the government earned Rs. 17.5 bn (US$ 267 mn) from making and selling cigarettes while spending Rs. 11.2 bn on health. Sri Lanka has relatively high taxes, health warnings and a (at least theoretical) ban on advertising in the electronic media - via a code of ethics on advertising. However, studies have yet to be done on the effect of health warnings in Sri Lanka. But, the regular tax increases is probably one of the two major causes of cigarette sales being more or less constant during the last ten years, a member of the Presidential Taskforce that prepared the national policy, Dr. Sajeewa Ranaweera said in an interview. The other major cause being the energetic and effective community level prevention activities. Here too, no formal scientific evaluations have been done. "But at least the taxation part is consistent with finding from many other countries, where increasing tobacco taxes, increase government revenue and at the same time reduces consumption," he said. The Bank report recommends a tobacco tax increase of between two-fifths and four-fifths of the retail cost of a packet of cigarettes. Despite the consequent fall in demand, higher taxes bring in higher revenues, with a 10 percent increase in taxation raising revenues by seven percent on average. Decreasing consumption will in addition to preventing quite a lot of morbidity and mortality in the most productive periods of a smokers life, will also reduce the spending on tobacco by the lower income groups. Surveys have shown that spending on tobacco and alcohol is the most preventable cause of poverty in Sri Lanka. "Studies have shown that over one third of the family income is spent on these substances in the lowest income groups. Studies among Samurdhi recipients have shown that they spend a larger amount of money on tobacco and alcohol than the concessionary loans they receive," Dr. Ranaweera said. Since money saved on cigarettes would be spent on other things, most countries would see no net fall in employment, and some would see net gains, the report argues. While a few, mostly in sub-Saharan Africa, whose economies are dependent on tobacco farming, could lose from a global fall in tobacco use, the Bank says the answer is to help these farmers diversify into other crops. One of the more inter- esting recent devel- opments in Sri Lanka was the circular banning government agencies from accepting sponsorships from the tobacco and alcohol industries. Meanwhile, in preparation for the advertising ban comes into effect, the President's Fund has assured the Sports Ministry that sponsorship monies needed for various sporting bodies will be released from the Fund. Tobacco is among the greatest causes of preventable and premature deaths in human history. Yet, comparatively simple and cost-effective policies that can reduce its devastating impact are already available. For governments intent on improving health within the framework of sound economic policies, action to control tobacco represents an unusually attractive choice.

Mind Your BusinessBy Business BugDouble-EdgedIf you thought that the biggest issue on the market this year was the stake in the state telephone company, you may be wrong. The bank that claims to develop the nation is planning a debenture issue and they plan to make it the biggest ever. But, the only snag is the timing. Promises, promises!! The bankers are waiting and waiting, uneasy about launching an issue under these uncertain conditions. So, they promised all these development projects for the south so they could win the election, but where is all the money coming from? When the question was forwarded to the Treasury, the answer was equally emphatic- definitely not from next year's budget because a bigger slice of the cake has been set aside for defence expenditure in 2000. Why, you may ask, and it's the same old strategy of win a war and win an election. But what about the promises to the south, then? Well, the promises were made but no one said when they would be fulfilled, did they? . A googlyThe knives are out for our willow wielders after their recent dismal performances in Old Blighty. No one knows exactly where the orders came from, but everything appears to be related to the cool captain's fall from grace at the highest levels. Instructions have been given to check on the tax returns of some of the superstars, just to make sure that the state has not been cheated of its due revenues. We love our heroes. But when we don't like them, we sure hate them don't we?

Tea from the beginning at new museumThe introduction of tea by James Taylor over 132 years ago made history and set the stage for a whole new adventure. Today efforts are being made to preserve part of this history and one

of the country's largest To redress this issue and preserve it for future generations, the history, traditions and values of Ceylon Tea, the Sri Lanka Tea Board and the Planters' Association of Ceylon have joined forces with key institutions in the industry to establish the Ceylon Tea Museum. The primary objectives for the house of tea history include exploiting the tourism potential of the tea industry, strengthening Sri Lanka's image as the world's leading producer. The museum will be located at the four story Hantane Tea Factory, located four miles from the historic hill capital, Kandy. The ground floor will accommodate heavy machinery used in the good old days where every thing was manual; the first floor will house examples of the withering process while the second floor will consist of a library of old and new books with facilities for audio visual presentations. The third floor will be allocated to sales outlets while the entire fourth floor will be converted to a deluxe restaurant. What more can one ask for? The grounds surrounding the tea factory are to be landscaped with different varieties of tea, making it a one-stop destination for all. The exhibits will include the packet of tea shown on page one of the Business section, hand operated rollers, hot bulb engine and many other machinery, documents, books, pictures and other objects used in the production of tea. The tea factory is being renovated and will be a commercially viable enterprise when it opens to the public. The typical exhibits at the museum would include items such as: a "Little Giant" tea roller - a 100 year old hand operated roller; a Rustom Hornsby three cylinder vertical engine over 60 years old; a hot bulb engine also over 100 years old; a handwritten visiting agent's report dated June 25, 1895 and many more items depicting the evolution of Ceylon's greatest industry. The Sri Lanka Tea Board, the Planters' Association and other Tea associations are involved in promoting this venture. The project is expected to cost around Rs. 46 mn, and the promoters are appealing for contributions.

Blue Diamonds suspendedTrading of the troubled jewellery firm, Blue Diamonds Jewellery Worldwide Ltd., was suspended last Thursday, following a Securities and Exchange Commission (SEC) inquiry. Official inquiries commenced over allegations that Seylan Bank had foreclosed the jewellery stocks of Blue Diamonds to recover its outstanding loans. At the time of going to press, the company had not submitted its explanation yet. Blue Diamonds is negotiating to sell part of Energen Holding Co. Ltd, shares at par. Technological rights to the value of Rs. 230 mn were purchased by the company during the 1997/98 period to develop a solar chimney technology to generate power. According to the 1997/98 annual report, the shares were valued at Rs. 287 mn as at March 31, 1998. Blue Diamonds recorded a massive loss of Rs. 426.7 mn during the year ended March 31, 1999, after reporting a turnover of Rs. 104.8 mn, the company's provisional accounts stated.The company reported a net loss of Rs. 98.6 mn during the previous accounting year.

Hayleys profits down but turnover up 14.8%Profits from operations of Hayleys Exports Ltd have declined by 8 per cent to Rs 27.4 mn for the year ended 31st March 1999. This was despite a 14.8 per cent increase in turnover to Rs. 258.6 mn, Hayleys Exports Ltd annual report states. Hayleys Exports increased the volume of mattress fibre exports by 67 per cent.. Commissioning of a second baling station in the coconut triangle was a major contributor to this. Exports of machine twisted fibre also increased by 17 per cent. Turnover of Eco Fibres Ltd, a fully owned subsidiary, increased by 3 per cent but profits declined marginally. Eco Fibres recorded declines in the export of geotextiles and erosion control products. This was primarily due to a reduction in demand from major user countries such as Korea which underwent economic turmoil. Increased competition from India stemming from its weaker currency also affected the company. However there were significant increases of exports of bio fibre. Bonterra Lanka, another subsidiary, made substantial increases in its exports of stitched blankets.

DDB bags 32 Clio awards at 50 yearsThe 50th anniversary of the founding of DDB, fell on June 1. Their classic campaign for Volkswagen, Avis, Seagram, revolutionized the advertising industry in the fifties and sixties. In the eighties and nineties, DDB was joined by other creative agencies to form a worldwide communications group unsurpassed in creative excellence, says a company release. But creativity at DDB is hardly a thing of the past. At last week's Clio awards ceremony in New York, nine DDB offices combined to win a record 32 Clio awards including Clio's first ever recognition as "Agency Network of the Year". DDB is associated with some of the world's best known brand names including McDonald's, Volkswagen, Mobil, Compaq Computers, Michelin, Digital and Johnson & Johnson. Some of the DDB international clients represented by Masters Advertising in Sri Lanka include McDonald's Mobil and Compaq Computers.

DFCC gets new chairmanA former member of the Ceylon Civil Service, E.M. Wijenaike was unanimously elected chairman of DFCC Bank at the bank's board meeting last month. Mr. Wijenaike takes over from the long serving chairman Deshamanya C.A. Cooray, says a press release. Mr. Wijenaike, who holds a degree in Economics from the University of Colombo with a Post Graduate Diploma from the University of Bradford, UK, started his career in the public sector. He was a Director at Civil Aviation, Government Agent Kandy and Kurunegala and also the Controller of Imports and Exports. He was also the Chairman, Industrial Development Board and the Chairman Ceylon Cement Corporation when three cement plants were being set up. He retired prematurely to join the private sector as GM of Walker Sons Ltd. He worked abroad for several years as a consultant to the United Nations Industrial Development Organization and the Commonwealth Fund for Technical Co-operation. On his return, he commenced his many years of involvement with the financial sector by joining the boards of People's Bank as Director and People's Merchant Bank as chairman. Mr. Wijenaike, who has considerable experience in the banking industry has been on the board of DFCC Bank for nearly 15 years and has taken an active role in the bank's new restructuring programme. He is also chairman of several private sector firms in the fields of industry, finance and travel, etc.

DPE completes five yearsDocument Parcel Express completed its fifth year of service in Sri Lanka on June 1. As a part of Mayne Nickless Transportation Ltd., one of the world's leading transport organizations with a commitment to technology, product design and quality, DPE provides the local community with reliable and efficient, time critical international courier service. Mayne Nickless with a history in transport since 1886 and a distribution network that spans the globe, is a major operator in the world market today with wholly owned operations in major global centers such as, Parceline -Uk, Helguerra Spain, Loomis North America. Wards Skyroad, IPEC, Jetsroad, Express-Australia. D.P.E. now operates through a network that spans over 190 countries.

French gemmologists to visit Facets '99Thirty Gemmologists from France are due to visit Sri Lanka to participate at FACETS '99, scheduled to be held at the Colombo Hilton from September 13 to 16. This arrangement according to a news release, has been made through. Ahmed A. Jawad former Counsellor of the Sri Lanka Embassy in France and is presently Director-Consular Affairs at the Ministry of Foreign Affairs in Colombo. Facets '99 promises to attract many leading buyers from all over the world. Buyers from Europe and America and South Asian countries realise that Sri Lanka offers a wide variety of the finest gemstones from any known "source country". Regular dealers/ buyers have visited Sri Lanka during the last decade as they have realised the potential demand for Sri Lankan gemstones. Sri Lanka stones - Rubies, Padparadschas, Alexandrites, Cat's Eyes, Star Sapphires, Star Rubies, Garnets, Spinels, Topaz, Aquamarine, Moonstones - will be on view. The wide variety of Sapphires - Blue, Pink, Yellow & Orange will add an extra glamour to this show. Also on view will be jewellery of exquisite designs by our skilled craftsmen.

Hilton case: Court allows remitting money to JapanThe Court of Appeal has confirmed an order made by the Colombo district judge in the cases filed by Cornel and Company Mitsui and company and Taisei Corporation of Japan The Court of Appeal has lifted the restriction on the remitting of money to Japan by Mitsui and Taisei, the two Japanese companies involved in the construction of the Hilton hotel. In a strongly worded fiftyseven page order the court comprising judges C.V.Wigneswaran and D Jayawickrama have held that the state must pause to think where and why it has gone wrong in this transaction. It is alleged that officers of the state unnecessarily committed the country in 1984 to guarantee the repayment of a loan by a public limited liability company incorporated in Sri Lanka to two private Japanese parties (Mitsui & Co Ltd and Taisei Corporation- 1st and 2nd defendant petitioners). Subsequent to the guarantees, several developments took place including a derivative action by the 4th defendant-respondent in which injunctions were issued in 1991 prohibiting any payment claimed by Mitsui and Taisei. Interest payments have been thereby accumulating significantly over the years. The plaintiff-respondent cannot be held responsible for that. In this case Cornel & Co Ltd , filed action in the District Court of Colombo seeking, inter-alia, to restrain the government of Sri Lanka from implementing and or giving effect to any or all the terms of the settlement agreement entered into in June 1995. The respondents were Mitsui & Co Ltd (1st respondent) Taisei Corporation, (2nd respondent) the Attorney General, (3 rd respondent) Nihal Sri Amarasekera, (4th respondent) and Hotel Developers Ltd (5th respondent). The District Judge having heard submissions granted an interim injunction restraining the Government of Sri Lanka, including the Secretary to the Treasury and the nominee directors of Hotel Developers Ltd from implementing and or giving effect to the terms and provisions of the settlement agreements. Mitsui Company and Taisei Corporation filed papers in the Court of Appeal by way of revision to have the said interim injunction set aside. Justice Wigneswaran in his judgement has stated that balance of convenience is on the side of the plaintiff-respondent and that irreparable injury would be caused to the plaintiff respondent, if the injunction was not granted. When the state entered into the agreement behind closed doors , so to say of Cornel & Co Ltd, presumably consequent to the pressures exerted by the 4th defendant respondent, it should have analysed and assessed the consequences of its action. A state is not its government. The government acts on behalf of the state. The state means each of us and all of us. Enhanced payment by the state means it pinches the pockets of every one of us citizens, however rich or poor. This fact should have been in the forefront of the thought processes of state officials when they on our behalf entered into questionable transactions The Deputy Minister of Finance said the following in parliament on 8.8. 1995. "Subsequently it was discovered by the Deputy Minister of Finance and brought to the notice of the Minister of Finance that the agreement signed by the Secretary to the Treasury on behalf of the Government of Sri Lanka in the course of this settlement committed the government to a number of obligations of an unacceptable nature, that had not been disclosed to the Minister of Finance or the Deputy Minister of Finance, nor been approved by the cabinet of ministers. These include the requirement that the government of Sri Lanka shall and will assist Mr. Amerasekera in settling three cases filed against him by the People's Bank and two cases filed in the Magistrate's court of Negombo by the Commissioner of Labour and to have him released and or held harmless and or indemnified therefrom and from any other proceedings and or actions presently instituted and or to be instituted in the future by the Commissioner of Labour and or others, in connection with Sun Cornel Textiles Limited and or the Colombo Apothecaries' Company Ltd, No sooner this was discovered and brought to the notice of Her Excellency the President, Her Excellency ordered that the implementation of the agreements should be halted forthwith." It would be wrong to allow the state to gain an advantage over an individual specially when the state officials appear to have acted irresponsibly. If state officials have committed the state to unnecessary financial burdens that by its self cannot be a ground to deprive an individual of his rights, in this instance the rights of the plaintiff-respondent. Maybe, it was the recognition of the questionable acts of some of its officials which prompted the Government of Sri Lanka to appoint a Special Presidential Commission of inquiry into the Hilton Case. The state must pause to think where and why it has gone wrong in this transaction. Irresponsible and may- be corrupt officers of the state unnecessarily committed the country in 1984 to guarantee the repayment of a loan by a public limited liability company incorporated in Sri Lanka, to two private Japanese parties(Mitsui & Co. Ltd and Taisei Corporation). Subsequent to the guarantees, several developments took place including a derivative action by the 4th defendant-respondent in which injunctions were issued in 1991 prohibiting any payment claimed by the 1st and 2nd defendant petitioners. Interest payment have been thereby accumulating significantly over the years. Courts should not be pressured to be swayed by the consequences to the state by the wrong doings or irresponsible acts or conducts of some officers of state in relation to the state. Courts determine the rights and obligations of parties according to law. Though judges are very much sensitive to social consequences of judicial acts they would not transgress the limitations placed by the four corners of the law. K.Kanag-Iswaran, PC, with Harsha Cabraal and M.A.Sumanthiran instructed by Abdeen Associates appeared for Mitsui & Co. Ltd and Taisei Corporation. Nihal Jayawardene, SSC, with Malinda Goonetilake, SC for Attorney General representing Government of Sri Lanka. I. S de Silva with M Bartholomeusz instructed by F.J & G De Saram appeared for Nihal Sri Ameresekera and H.D.L. S Sivarasa, PC, with S.L Gunasekera, S Mahenthiran and Naga-lingam. R Sivendran instructed by E. S Harischandra appeared for plaintiff-respondent, Cornel & Co Ltd.

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|

The

year 1944, World War II, Tea is rationed in Britain and in short supply.

A young British Naval Officer based at St. Joseph's College, Colombo, taking

advantage of the situation, sends to his mother back in Britain a one pound

packet of tea.

The

year 1944, World War II, Tea is rationed in Britain and in short supply.

A young British Naval Officer based at St. Joseph's College, Colombo, taking

advantage of the situation, sends to his mother back in Britain a one pound

packet of tea.  their

cigarettes, a recent World Bank study revealed.

their

cigarettes, a recent World Bank study revealed. money-spinners

for our future.

money-spinners

for our future.