Budget 2008: Will expectations be realized?The Budget could be viewed in many different ways. The common perspective is one of self interest. How does the Budget benefit me or my business? Will the cost of living rise? Are the tax rates less burdensome? What are the concessions that would help me? The standard question, “What are the benefits from the budget for me this year?” looks at the Budget from a narrow personal perspective and in terms of short term benefits of a year. Governments are very much aware of this and make every effort to dole out some concessions that please the people. The 2008 Budget is no exception. What most people don’t realise is that it is not necessarily the specific items that affect them ultimately, but the impact of the government’s revenue and expenditure, their quantum as well as their quality.

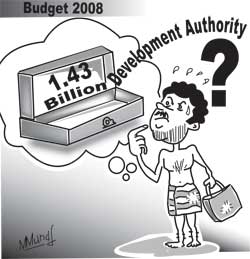

Since this Budget was presented in a background of sharp rises in cost of living, a budgetary response to the escalating cost of living was required. The government, conscious of the need to relieve the people from their crushing burdens of escalating expenditures that did not match with their incomes, made several overtures to appease the public. Among the benefits given were the allowance of Rs 2500 to public servants to cope with inflation; the announcement of stable prices of petroleum to consumers “temporarily”; and the increase in the allocation for Samurdhi. Whether these and other measures would in fact relieve the burdens adequately and be sufficiently broad-based is the pertinent issue. They would benefit a small number but even they may find the continuing rise in prices eroding the immediate relief and benefits. What is not queried is whether these concessions or relief in fact add to people’s cost of living in due course. What the government gives, the government must get. The government has added on new taxes. The environment tax is an example of adding to the cost of living of a large majority, while giving relief to some such as government servants, car and vehicle users and Samurdhi beneficiaries, for instance. This tax is almost a poll tax, with the exemption of those who do not have electricity. One would have thought that the collection of Rs. 20per month from every household with electricity would have a high cost of collection that would render it of little benefit. This has been avoided by including the tax in the electricity bill. Although it has resolved the problem of collection, it is a bad tax as it is regressive. One would have expected it to have been a progressive tax with the amount of the tax increasing with the amount of electricity consumption. That would have made the tax more equitable, seem an environment tax and also yield a higher revenue. Maybe, an amendment at committee stage of the Budget would make such an adjustment. One of the subtle ways in which a government taxes the people is through inflation. And the Budget deficit is the fundamental factor in generating inflation. In as far as this budget is concerned, it is expected to result in a 0.9 per cent revenue surplus. The large capital expenditure target of 8.0 per cent of GDP will result in a budget deficit of about 7 per cent. The overall deficit of 7 per cent is due to capital expenditure. This is a laudable achievement to the extent that the budget estimates materialise. The doubts are as to whether the final out turn will be closely aligned to the projected figures. However, merely because the deficit is due to capital expenditure does not render it non-inflationary. The budget deficit would have an inflationary impact. The Budget for 2008 envisages the government’s revenue to meet nearly all its current expenditure. This is mainly achieved by a projected increase in tax revenues. There has been a favourable development in the past two years of a fairly significant increase in revenue collection. The improvement in revenue collection can be gauged meaningfully by relating it to the total value of goods and services produced in that year. The Tax: GDP ratio has risen from 15 per cent of GDP in 2006 to an expected 16.4 per cent in the current year and the tax proposals of this year are expected to raise it to 17 per cent in 2008. The continued improvement in the government’s revenue collection is indeed a significant development in improving fiscal management. Two questions are at issue nevertheless. How much of the projected revenue the government expects to raise in taxes would it in fact obtain? Can the government contain the expenditure within the projected amount? For many years now the budget deficit has been high. Despite budgetary expressions of intent that a key objective is to bring down the deficit and the enactment of the Fiscal Responsibility Act, there has been no progress in containing the deficit. This Budget contains the deficit in 2008 to 7 per cent of GDP. Will this materialise? Invariably the final outcome overtakes these figures. The ongoing war is the excuse for the inability to contain the deficit. International oil prices are another reason that would be trotted out. The increased capital expenditure in the Budget is commendable. It must be recognised that the government has undertaken several vital infrastructure projects, such as the Norochcholai, Kerawalapitiya and Upper Kotmale power generation projects that lay dormant for sometime. A new highway network too has commenced. These developmental expenditures are no doubt most needed. The Budget has allocated Rs. 790 billion for capital expenditure. We hope that this capital expenditure would be efficiently, effectively and expeditiously expended and that the country’s infrastructure would be raised several notches. The fear is that the final out turn would be different. We hope that unlike in the past when financial stringency and over expenditure resulted in the curtailment in capital expenditure, as a measure of containment of the fiscal deficit, there would not be such a development next year and that the loan of US $ 500 million recently borrowed would in fact be spent on infrastructure. The expenditure side of the Budget equation is of particular concern in this Budget. It has been the experience of past budget estimates of revenue falling short and of government expenditure exceeding the budgeted figure. As in the past, recurrent expenditure could exceed the budgeted figure and the amount allocated for capital expenditure would be unspent. In 2007 a 7.4 per cent public investment target was eventually trimmed to 6.6 per cent. Fiscal irresponsibility has characterised this regime with respect to government expenditure. In the current economic and financial context, the expectation of the government to be frugal and to cut down unnecessary expenditure is a vain one. Instead, the war is used as an excuse for public expenditure extravagance. For instance, the 2008 budgetary allocations for the Office of the President are doubled to more than Rs 5.75 billion -- with about Rs. 1.43 billion of this going for a new category called `development activities. No where are any details of this “development activities” given. In recent years wide powers are given for expenditure to be moved from one purpose to another that the details of expenditure are quite irrelevant. Financial extravagance and wastefulness are the order of the day. Notwithstanding our critical comments on Budget 2008, we hope that the aspirations and objectives of the Budget would be fulfilled. More specifically we hope the envisaged capital expenditure would be effectively spent, that current expenditure would be contained and even reduced and that the revenue collection targets would be achieved. Fiscal discipline rather than political expediency, we hope, will characterise economic management. |

|| Front

Page | News | Editorial | Columns | Sports | Plus | Financial

Times | International | Mirror | TV

Times | Funday

Times || |

| |

Reproduction of articles permitted when used without any alterations to contents and the source. |

© Copyright

2007 | Wijeya

Newspapers Ltd.Colombo. Sri Lanka. All Rights Reserved. |