Columns

Reduction in large trade deficit strengthens balance of payments

View(s): The reduction of the trade deficit by 20 per cent in the first half of this year is likely to result in a significant balance of payments surplus. The trade deficit of US$ 4.4 billion in the first half of last year decreased to US$ 3.5 billion in the first six months of this year. Although the trade deficit in the first six months of this year is much less than that of the first half of last year, it is likely to exceed US$ 7 billion in 2014. Such a high trade deficit brings out the need to address the weaknesses in the trade structure to achieve a lower trade deficit that would enable a stronger position in external finances.

The reduction of the trade deficit by 20 per cent in the first half of this year is likely to result in a significant balance of payments surplus. The trade deficit of US$ 4.4 billion in the first half of last year decreased to US$ 3.5 billion in the first six months of this year. Although the trade deficit in the first six months of this year is much less than that of the first half of last year, it is likely to exceed US$ 7 billion in 2014. Such a high trade deficit brings out the need to address the weaknesses in the trade structure to achieve a lower trade deficit that would enable a stronger position in external finances.

Despite this large trade deficit, the balance of payments is likely to be in surplus by a significant amount, owing to worker remittances offsetting most of the trade deficit. Increased tourist earnings, earnings from other services and capital inflows are likely to generate a balance of payments surplus of more than US$ 2 billion this year.

Internal shocks

In the first half of the year, the economy faced a prolonged drought that affected agricultural production adversely and reduced hydroelectricity generation drastically. Although food imports increased by only 2 per cent, it is likely that the second half would register higher food imports.

Owing to the drought hydropower generation fell from about one half of the electricity supply to as low as 17 per cent. The problem was aggravated by repairs to the refinery and damage to oil pipes that increased imports of oil by nearly 11 per cent in the first six months. Consequently oil imports accounted for 27 per cent of the import expenditure in the first half of the year.

The biggest internal shock to the economy could have been the ethno-religious tensions in June this year. It could have affected the tourist boom, worker remittances and foreign investments. Worker remittances that offset almost the entire (96 per cent) of the trade deficit in the first half of the year could have been put at risk. The expectation of about US$ 2.5 billion in tourist earnings could have also been seriously dented. Fortunately there has been a restoration of peaceful conditions and the feared flare up of communal tensions has been douched.

Favourable external factors

Favourable external factors

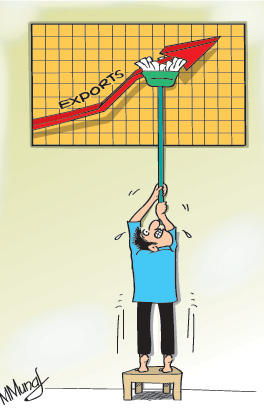

The internal shocks in the first half of this year have been of a manageable magnitude owing to favourable external conditions that enabled a significant increase in exports. The recovery of the US and EU economies increased demand for industrial exports. According to the Central Bank, there was a significant increase in exports to the US and the EU. Exports to the EU grew by 34.6 per cent, while exports to the US grew by 12.1 per cent. There was also a growth of exports to nontraditional markets by 44.5 per cent. Consequently exports increased by 16.8 per cent in the first half of the year.

An even more positive development has been the increase in manufactured exports by 14.4 per cent with the country’s main manufactured export – garments — increasing by as much as 20.6 per cent in the first half of this year. There has been a trend of increasing exports both of agricultural and manufactured goods and indications are that the market for manufactured exports would continue to improve in the second half of the year and in 2015.

Imports

Imports declined by a mere 1.2 per cent. However, the decrease in investment goods imports by 15.8 per cent is a favourable development that must be sustained. Owing to the reasons discussed earlier, oil imports increased by 10.9 per cent and cost US$ 2.46 billion in the first half of the year.

The oil import expenditure was 27 per cent of imports, 47 per cent the value of total exports and accounted for 69 per cent of the trade deficit in the first half of the year. Although oil imports are likely to be less in the second half of the year owing to lesser needs and likely lower prices, the huge expenditure on oil continues to make a dent in the trade balance.

Remittances and tourism

Although the trade deficit is still high, worker remittances and tourist earnings have made it possible to sustain the higher cost of oil imports. Consequently the balance of payments is expected to record a significant surplus of about US$ 2 to 3 billion.

Worker remittances in the first half of the year increased by 10.8 per cent from the large amount of remittances in the first half of last year to reach over US 3.36 billion to offset 96 per cent of the trade deficit in the first half of the year. Earnings from tourism increased by as much as 38 per cent to US$ 1 billion in the first half of the year. These together with other earnings from services and capital inflows would result in a significant balance of payments surplus.

The second half

Some of the favourable as well as adverse developments are likely to flow into the second half of the year. The import bill is likely to rise owing to increased imports of food, especially rice and intermediate imports. However, the trade deficit is likely to be contained at about US$ 7 billion owing to increased export earnings. The balance of payments could be in surplus by US$ 2-3 billion as remittances and tourist earnings are likely to continue their increasing trend.

Concerns

The improvement in the trade balance and the prospect of a significant balance of payments surplus should not mask basic weaknesses in the trade structure: Imports are nearly twice the value of exports; oil imports absorb nearly half the value of exports and are over one quarter of total imports. The trade deficit is sustainable due to the large amount of worker remittances that now more or less wipe out the trade deficit.

The trend of increasing exports should be sustained to decrease the trade deficit to strengthen the balance of payments further. The improvement in the balance of payments provides an opportunity to reduce the high external debt.