Money is someone’s debt

View(s):

Not all of them have an international value.

A man who was walking ahead of me suddenly stopped and stooped down eagerly to see something at his feet. He was a few metres ahead of me – we were both walking along the same street in Amsterdam city.

Although he stooped down to pick up something, he didn’t take whatever it was. Then, he kicked it off with his boots and, continued to walk. As I was behind him, I was curious to know what and why he kicked it off. It was a currency note with a face value of 1,000 from a Southeast Asian country. For him, it was nothing more than a useless piece of paper with pictures. If it was a 1,000 Euro note or a US dollar note, definitely he would have picked it up.

“Design fault”

Last week I had to chair a seminar session, organised by the Sri Lanka Economic Association. It was an online video seminar through which today we have the technology to connect people from anywhere in the world. The presentation was by Dr. Kaoru Yamaguchi, Director of the Japan Futures Research Centre, who joined from Japan. It was 10:00 pm for him, as we started the one and half hour short seminar at 6:30 pm Sri Lankan time. The discussant was Hema Senanayake, joining from the United States where he lives, early morning for him.

By the way, the topic of Dr. Yamaguchi who had about 40 years of teaching and research experience in the areas of Money and Monetary Economics looked controversial to many who would look at it through conventional wisdom. It was about “Debt Money as a Design Failure and Japan’s Loss of 30 Years”. The presentation was about how “money” has caused Japan’s long economic recession since the 1900s!

His example was catchy: If an aircraft crashed due to the pilot’s fault, then such incidents could be minimised by recruiting a skillful pilot. But if it was due to a “design failure” of the aircraft, then changing pilots is not the solution.

I am not expecting to talk about this seminar presentation. However, this seminar inspired me to talk about the basics of money and debt, which is apparently, going to be an interesting economic lesson today.

What is money?

If we ask somebody the question “what is money?” he would take some coins and notes out of the pocket or wallet and show it as ‘money’. For you and me, that answer is fair enough. But “what is money for a country?” Should it be the value of all the coins and notes in the country?

As the legitimate issuer of currency in a country, the Central Bank knows the value of all the coins and notes that it has issued. But it is a wrong answer to say that money is all the coins and notes! It is wrong because “though coins and notes are money, money (alone) is not coins and notes”.

As the legitimate issuer of currency in a country, the Central Bank knows the value of all the coins and notes that it has issued. But it is a wrong answer to say that money is all the coins and notes! It is wrong because “though coins and notes are money, money (alone) is not coins and notes”.

In order to count the amount of money in a country, we need to know that money is a medium of exchange. There may be other purposes too, but primarily money is what people generally use for buying anything they want.

When you get a 1000-rupee note into your hand, it is different from a piece of paper or a picture, because it is legally accepted within Sri Lanka as a currency note with that exact value. But if you drop it on a street in a foreign country, nobody would dare to pick it up.

Magic business of banking

Now here is the main problem: In a situation where there is a modern banking system, “medium of exchange” is not just the coins and notes – the notion that it is not money (alone). If you deposit that 1,000-rupee note in a bank account, the bank will use it to give a loan to somebody else. The person who got a bank loan will spend it because for him it is a medium of exchange – debt money!

When the borrower, which may be a household or a business firm or the government, spends the money, whoever got it may spend it again or credit it to his bank account. And the bank can lend it again to somebody else who would also do the same as the previous borrower. All that began with just the 1,000-rupee deposit that you made initially, which was used for a series of debts one after the other and multiplied by the banks.

The Central Bank can intervene in debt money creation by imposing the so-called Statutory Reserve Ratio (SRR) on bank deposits. Accordingly, the banks must deduct required reserves as per the SRR, and credit to their Reserves’ accounts at the Central Bank. Of course, if the banks find it more-profitable or less-risky to maintain excess reserves above the required reserve level without lending, they can do so.

Apart from coins and notes issued by the Central Bank, now its liabilities also include reserves. These two components make the country’s “reserve money” stock which can be controlled by the Central Bank using its monetary policy tools.

Too much debt money?

All the bank borrowers use their “debt money” as medium of exchange. Therefore, it is now necessary to add debt money too to the amount of coins and notes. Thus, the amount of money available in a country is made up by these two components, as depicted by monetary aggregates.

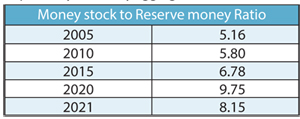

Money stock to reserve money (MS/RM) is a ratio that gives the money multiplier; if this ratio has been rising over the years then it means debt money is on the rise. If it goes too far, it is not the amount of coins and notes, but the amount of debt in the country that is going too far.

Let’s have a look at what has happened in Sri Lanka: In 2005, the value of this ratio was 5.16, indicating that every rupee of the reserve money stock gets multiplied into Rs. 5.16 to the country’s money. The ratio has been rising over the years due to the increase in debt money. Twenty years later in 2020, it was 9.75, indicating that every rupee of the reserve money gets multiplied into Rs. 9.75 adding to the country’s money stock. And the increase is due to an increase in debt money, indicating that a large part of the country’s money is debt money – someone’s money is another’s debt!

Whose debt? Households’ consumption debt, business firms’ investment and operational debt and, and more importantly, the government debt. When they borrow more the money stock goes up, while the Central Bank can encourage them to borrow more by lowering the SRR and reducing the interest rates.

US debt and our debt

If somebody finds a 100-dollar note on the street, no matter wherever that is, he would pick it up, because all over the world it is much more than a piece of paper. It’s because the US dollar as well as some other international currency note in the world have earned that international value. One day, if the Sri Lankan rupee can also earn that international value, anybody would love to pick up a 100-rupee note too.

The US is also a highly indebted country; government debt alone is 137 per cent of GDP, compared with 105 per cent in

Sri Lanka. But the difference is, the US can “print” US dollar notes and pay off its both foreign and domestic debt. Countries like Sri Lanka must “earn” dollars to pay its foreign debt; even to pay off their domestic debt they have limitations to print even their national currency. It’s a problem of a weak currency which has no international value.

(The writer is a Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk and follow on Twitter @SirimalAshoka).

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!