Columns

Are the protests of professionals against increased income taxes justified?

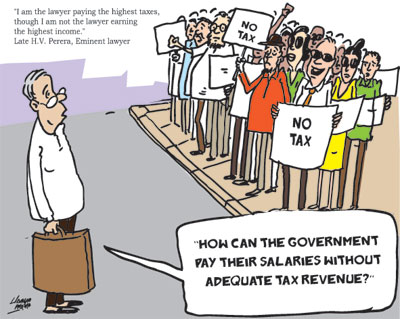

View(s): The protests of professionals against increased income taxation are symptomatic of our society being used to receiving a host of benefits from the Government without realising they have to pay for them in one way or the other.

The protests of professionals against increased income taxation are symptomatic of our society being used to receiving a host of benefits from the Government without realising they have to pay for them in one way or the other.

Protests

The protest for reduced taxation of professionals’ incomes on February 8 is likely to continue tomorrow. Doctors, university academics, bankers and other professionals are protesting against the increased taxation of their incomes from the beginning of this year.

Justification

Although there is some merit on their objection to the lower threshold of taxation of monthly incomes at Rs 100,000, their opposition to taxing higher incomes is quite unjustified.

Higher incomes

The objection of professionals earning Rs 450,000 a month, paying around 25 percent of their employment income is quite reasonable. Certainly, those receiving 450,000, paying around Rs 115,000 is quite unreasonable.

Tax evasion

What is unjust is that a large number of others earning more than such an income evade or avoid taxation of their incomes. These include lawyers, consultant doctors, businesspeople, tui-tion masters, and of course those in the black economy. This fundamental flaw in the tax sys-tem needs to be remedied over time.

Tax administration

It is well known that the tax administration is plagued by corruption, inefficiency and political interference. Reforming the system is a long-term objective. What is immediately needed is an effective equitable and pragmatic means of increasing Government revenue.

More equitable

The tax system could have been more equitable and indeed more effective than that introduced in the 2023 Budget. While employees pay taxes, much higher earning professionals and others evade and avoid taxes. Had the tax system been able to increase revenue through a more ef-fective system of taxing the rich, the taxes on employees could have been less burdensome.

Impractical

It is utterly impractical to reform the tax administration overnight or in the foreseeable future. The pragmatic approach is to devise a system of taxation that invariably fall on the rich and af-fluent who avoid and evade taxes.

Way forward

Previous columns have pointed out that the way forward is to devise a system of taxation that relies on expenditure and property taxes that tax the high expenditure of the rich, such as high value luxury vehicles. For instance, the annual licence fee for motor cars should be increased progressively with the increasing engine capacity. Similarly, property taxes on high value prop-erties should be increased. Import duties on non-essential luxury consumer commodities should be increased.

Increased revenue

It is only by taxes that fall on the rich that the Government would be able to rake in tax reve-nues from those who evade and avoid income taxes. Such a system would be more equitable and acceptable to people.

Inadequate revenue

Sri Lanka has one of the lowest, if not the lowest, government revenue to GDP ratio of only eight percent of GDP. This has to be increased to about 12 percent of GDP and increased fur-ther in the next few years.

Expenditure

The process of fiscal consolidation is two pronged. It must contain excessive wasteful and avoidable Government expenditure, while increasing Government revenue. There is little evi-dence of the Government curtailing public expenditure.

Independence celebration

The expenditure for the 75th Independence celebration with guns, acrobatics and a parade of an armed forces larger than the British army, not only was an ill affordable expenditure, but an irritant to the people. It displayed a lack of sensitivity to difficulties faced by large sections of people in cities and rural areas alike.

This was not the time for panem et circenses (bread and circuses), the distractive strategy of corrupt Roman emperors. In fact, such extravagant expenditure of the government has in-creased public discontent.

Tax administration

All things considered, there can be no doubt whatsoever that increased revenue is needed. However this must be obtained by widening the tax net and by reducing tax evasion and tax avoidance by a large number of high earning professionals and business entrepreneurs.

However, innovative tax evaders will find ways and means of evading taxes. Corruption of the tax administration makes the implementation of direct taxes ineffective. The realistic and pragmatic way forward is to introduce high expenditure taxes on conspicuous consumption. In brief, an expenditure-based tax system will not only be effective it will also be equitable. Then direct taxes of employees could be reduced.

In conclusion

The fundamental flaws in our fiscal system are the inability to obtain adequate tax incomes and reduce wasteful public expenditure. Increased direct taxation is inevitable in the current finan-cial context. As these will not yield adequate income, and not tax some of the highest income receivers, it is imperative to devise expenditure based taxes that tax the extravagant and con-spicuous consumption of the rich.

Final word

Finally, the tax system must not only be equitable but just and equitable, and Government ex-penditure frugal and justified in the current economic context.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment