IMF and Sri Lanka’s yo-yo economy

View(s):

File picture of IMF officials at an earlier media conference in Colombo.

This week the IMF Board approved its long-awaited programme for crisis-ridden Sri Lanka with an Extended Fund Facility (EFF) of about US$3 billion to support Sri Lanka’s economic policies and reforms. While the IMF will disburse its first tranche of US$ 330 million immediately, the balance of the EFF will be issued over a period of 48 months with periodic assessments of the progress.

Whatever it is, the IMF Board approval was welcomed by Sri Lanka with the sounds of firecrackers in some parts of the country. In fact, we must more than celebrate it because we have a free-hand to mess up our own economy with the support of our own elected politicians, and then we can cry out to the IMF to save us. I am not sure if the IMF too ever asked that important question: How does Sri Lanka ensure that “we would do it at least this time” after 16 attempts?

The IMF Board approval of the EFF is not a panacea for Sri Lanka’s economic crisis neither does it address the fundamental cause of the crisis, which is the foreign exchange problem. But the IMF programme is expected to give a “perilous helping hand” addressing our internal problems and leaving the fundamental cause of the problem in our own hands. I thought of addressing this issue today again, as I have done so on many times in the past.

Dangerous help

EFF is a loan that Sri Lanka will have to pay back in the future, as even now we have been continuing to pay what we have borrowed in the past at the so-called 16 attempts with an IMF programme. The IMF Board approval will unlock some of the pending foreign borrowings that got jammed due to the declaration of defaulting foreign debt payments on 12 April 2022.

As the IMF programme is due to unlock the pending multilateral loan disbursements, Sri Lanka is expected to receive about $7 billion loans from various sources. Obviously, the multilateral foreign borrowings which are mostly tied up with projects, have a longer repayment period, but still they all are loans.

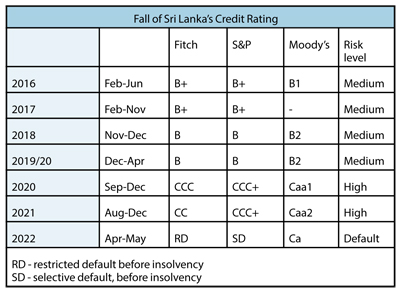

Sri Lanka was not a country with “credit worthiness” at least since it declared the debt default last year. While Sri Lanka never had a better credit worthiness than “B Grade”, as measured by the international credit rating agencies, it had also been deteriorating since 2018. Accordingly, Sri Lanka’s credit risk level fell down to “high” levels, and then to a “default”, although we were raising counter arguments and denying the facts.

Sri Lanka was not a country with “credit worthiness” at least since it declared the debt default last year. While Sri Lanka never had a better credit worthiness than “B Grade”, as measured by the international credit rating agencies, it had also been deteriorating since 2018. Accordingly, Sri Lanka’s credit risk level fell down to “high” levels, and then to a “default”, although we were raising counter arguments and denying the facts.

The IMF programme is expected to improve the country’s credit worthiness again, so in the coming years we would be able to borrow again from both multilateral and bilateral sources as well as from market sources. We might be able to issue international sovereign bonds (ISBs), which we had to abandon in 2019, again to borrow from market sources.

Moratoria and haircuts

By the way, along with the anticipated successful conclusion of Sri Lanka’s debt-restructuring negotiations with the country’s bilateral and private lenders, we must restart paying our foreign debt again, of course with arrears for the past 12 months. As the lenders have already declared their consensus, there might be debt moratoria – spreading the repayment schedules thinly over a longer period; there might be haircuts too – cutting down the asset value of the bonds currently held by our lenders.

Along with debt restructuring, however, Sri Lanka would be able to improve its debt-sustainability. This means that the country will have some breathing space to start paying our remaining debt out of the resources we have in a sustainable manner. In order to pay the foreign loans back, we can borrow more and pay little-by-little. Accordingly, we may not repay $5-6 billion a year as we did prior to the default, but, in manageable lower amounts.

In order to support foreign debt service plus relaxing import restrictions, we may be improving our tourist incomes and foreign remittances again. We were barely managing such a state of affairs in the past too. As we often used to say it, our growing trade deficit has been “cushioned by tourist earnings and private remittances”. We will soon be in a position to say that again. Whatever the remaining internal and external finance imbalances, they were supported through further borrowings. With the support of the IMF, we are already there again.

Gala time again, after EFF

What is remarkable about the IMF programme is not its EFF or the unlocked opportunity to borrow again, but the implementation of its accompanied policies and reforms. Although, going by the Sri Lankan way, the policies and reforms are implemented partially with “exemptions” and “unfair” practices, arousing public anger and protests, we have anyway started them.

What is remarkable about the IMF programme is not its EFF or the unlocked opportunity to borrow again, but the implementation of its accompanied policies and reforms. Although, going by the Sri Lankan way, the policies and reforms are implemented partially with “exemptions” and “unfair” practices, arousing public anger and protests, we have anyway started them.

What has happened in the past 16 times that the Sri Lankan government entered into IMF agreements, the reforms were not fully implemented in order to establish a better macroeconomic management practice; the reforms were often hijacked by the politicians who wanted to take popular political mileage out of it.

This time too, it could be seen that such attempts have already being launched, and there may be more to come. In that sense, what is to come after the next presidential and general elections will determine the cause of our journey in the years and decades ahead. Whatever that journey may be, one thing is guaranteed: we will reap as we sow!

Besides, at some occasions after the IMF rescue mission saved the country there was a real gala time in the Sri Lankan political arena. As the opportunities for borrowings were unlocked, we made use of those opportunities not to embark upon investing for economic progress, but to raise both public and private consumption and to expand our corruption-driven economic dealings.

Perhaps, we are in a dangerous position now. We can forget all policies and reforms and begin another “gala time” again. Whether our course of actions leads to a consistent and progressive growth path or back to our “yo-yo” economy is yet to be seen in the years to come.

Answer to the crisis?

There is one last question to answer: Does the IMF programme provide the answer to our economic crisis? A clear answer is “it does not”. Sri Lanka’s economic crisis is a “foreign exchange crisis” which we have nurtured over the years. The IMF programme does not disclose the policies and reforms that we need to adopt in order to answer the foreign exchange crisis. Neither does the $3 billion EFF or the unlocked foreign borrowings bring an answer to it.

But this time, the IMF has indicated that Sri Lanka must promote “trade and investment” by liberalising the country’s “highly protective trade regime” and by reforming its “restrictive and cumbersome investment regime”. This is just an advice, and not a conditionality. In other words, it is in the hands of the Sri Lankan authorities to decide our trade and investment regime, which is beyond and above the IMF conditionalities.

If Sri Lanka’s economic crisis is a “foreign exchange” crisis, Sri Lanka needs to come out of the crisis with export growth, and definitely not with foreign loans. Therefore, export growth requires investment promotion, while the investors – both domestic and foreign investors – seek a competitive business environment to put their money for productive use.

(The writer is a Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk and follow on Twitter @SirimalAshoka).

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!