Sufficient Capital for Starting a Company: Differentiating Starting from Growing

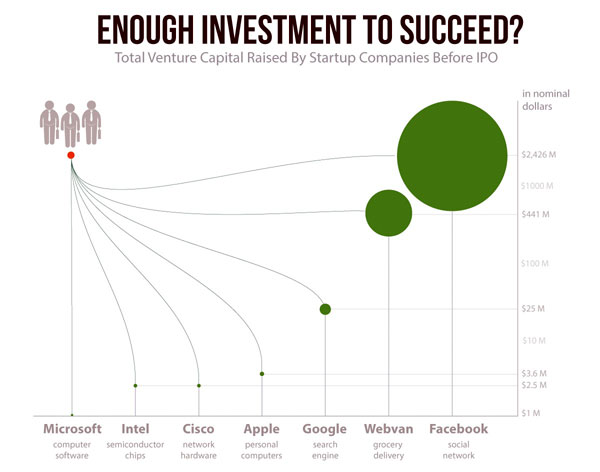

View(s):When it comes to launching and expanding a business, there is a clear distinction between the initial startup phase and the subsequent growth phase. Even if one can start with a modest sum of $10,000, the question remains: How much capital is needed to build a business that is worthy of an initial public offering (IPO)? The disparity in numbers is striking, and even when adjusted, it follows a logarithmic pattern. This leads us to question the underlying reasons for such variation.

Several possible explanations can shed light on this phenomenon:

Some businesses deliberately choose to start on a smaller scale, and the ultimate outcome may not be significantly affected by the initial investment size. Certain founders have a propensity for over-raising funds, opting for a larger capital base than strictly necessary.

Certain types of businesses inherently attract more investor interest, resulting in higher funding amounts.

So, how much money is truly required? Putting aside personal preferences and cultural factors, does the construction of a company like Google genuinely cost more than that of Facebook? If the costs involved are relatively similar (which is likely the case), can we establish a clear correlation between the amount of money invested and the value generated?

This analogy can also be applied to the realm of writing. Books penned by authors in prison or during times of adversity are often just as exceptional as those written by well-nourished writers. Nelson Mandela, Oscar Wilde, O. Henry, and Martin Luther King Jr. have demonstrated that dire circumstances can yield some of the finest literary works. However, does the same principle hold true for startups? Intuitively, it may seem counterintuitive, as more money typically leads to greater financial returns.

In my opinion, the answer lies in meeting your basic needs. People are the fundamental requirement for any startup. If you have enough capital to attract and retain the right talent, provide them with a conducive work environment (assuming they don’t already possess the necessary tools), you have everything essential for startups to thrive: the ability to create value. That being said, there are instances where additional funding can be allocated within a startup. Marketing expenses are a prime example. While renting a luxurious office space and purchasing designer furniture may boost team morale, it is crucial to recognize that these expenditures are one step removed from actually creating tangible value. Lavish chairs, for instance, come at the cost of a portion of the business.

Ultimately, striking a balance between meeting basic needs and allocating resources wisely is key. Startups must prioritize investments that directly contribute to value creation while avoiding unnecessary extravagance. By doing so, they can maximize their chances of success in an increasingly competitive business landscape.

-W.M.T.S Silva

HitAd.lk is the best and biggest mobile phone market in Sri Lanka, and we guarantee you will find what you need here from our extensive listing of mobile phones for sale in Sri Lanka. Whether it’s a budget-priced smartphone for communication, or higher end features with advanced connectivity, there are many different options from which to choose from on our site!