News

Rs. 1000 minimum allowance for public sector employees, wider tax net on the cards for Budget 2024

View(s):By Damith Wickramasekara

A minimum allowance of Rs. 1000 for public sector employees, a provision to allow employees in certain sectors to be given service extensions beyond 60 years and a further widening of the tax net are among some of the proposals that will likely feature in Budget 2024, senior Finance Ministry officials told the Sunday Times.

A proposal has been made to increase allowances for public sector employees by at least Rs. 1000, with a concurrent increase for pensioners. The Finance Ministry is also exploring the possibility of providing relief through the upcoming Budget for professionals who have been subjected to a significant increase in income tax, said a senior Ministry official.

The retirement age for public sector employees will remain at 60 years. Nevertheless, those in the health sector, teachers, university lecturers and several other professions will likely be given the option of having their services extended by two or three years. This is mainly due to the severe shortages in these areas at present.

Entities such as the Urban Development Authority (UDA) and the Road Development Authority (RDA) will not be carrying out any mega development projects owing to the severe shortage of funds. Only projects that can be completed within a year and essential maintenance work will be carried out.

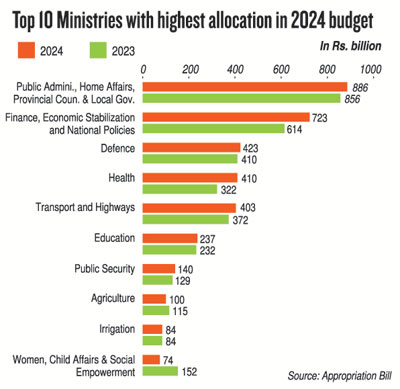

Meanwhile, all government ministries including the Defence Ministry will be instructed to engage in large scale cost-cutting measures. This includes cutting down on unnecessary expenditure such as renting buildings and obtaining vehicles on lease, purchasing furniture and equipment as well limiting expenditure for functions.

The ban on importing personal vehicles will remain in place next year as well.

A key focus of Budget 2024 is on increasing the country’s foreign reserves from the present USD 3.8 billion to USD 6 billion, sources said. This is especially vital given that the International Monetary Fund (IMF) has already noted that Sri Lanka has failed to make enough progress in tax collection and the potential delay in the second tranche of its bailout package.

The government will fully implement the Revenue Administration Management Information System (RAMIS) next year. One objective of RAMIS is to increase the number of Large Taxpayer Units, who pay the largest amount of tax. New laws are also due to be introduced to further increase the tax net and increase penalties for those who continue to flout paying their taxes. The Inland Revenue Department is currently owed some Rs. 400 billion in unpaid taxes, according to officials.

More allocations will be made towards tourism in the upcoming Budget with the hope of raising tourism earning to USD 1 billion.

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!