Columns

Sri Lanka’s fragile economic recovery undermined by two wars disrupting global economic conditions

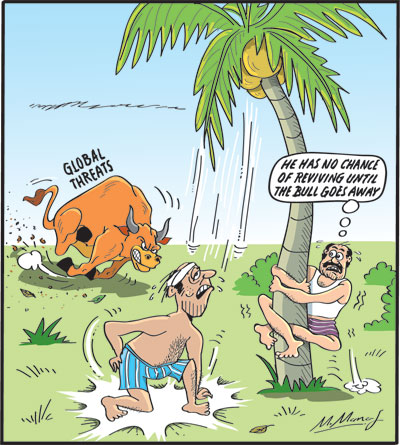

View(s):The Gaza war and the Ukraine war are serious setbacks to the Sri Lankan economy, which was striving to recover from the worst economic crisis that the nation has faced.

The war between Israel and Palestine that began on October 10th and the Russian-Ukrainian war of over a year have disrupted and destabilised the global economy.

The recessionary conditions caused by the Russian-Ukrainian conflict have been aggravated by the conflict in the Middle East.

Global impact

The global economy will be in severe turmoil if the two wars continue. The escalation of fuel, fertiliser, and food prices and shortages of these, if the wars drag on, would lead to a global recession.

Economic hardships

As much as the human tragedies of the wars are horrendous, the economic difficulties and hardships the world over would be severe.

Global economy

Apart from the destruction of buildings and infrastructure, the tragedy of thousands of lives lost and large numbers of people injured and displaced without housing, the ongoing Russian-Ukranian war of well over a year, and the hostilities that broke out between Israel and Palestinian Hamas, have thrown a dark cloud over the global economy.

International prices

Increases in fuel, food, and fertiliser prices, widespread inflation, and disruption of supply chains would retard economic growth, increase unemployment, and worsen poverty, hunger, and malnutrition in many parts of the world. Sri Lanka, too, would experience these in the months ahead.

Oil prices

Oil prices, which were increasing after the outbreak of the Russian invasion of Ukraine, have accelerated since the Middle East conflict. Oil prices are likely to exceed US$ 100 per barrel soon. This implies increases in the prices of fertiliser and fuel and shortages of these essentials.

Impact on Sri Lanka

These international developments will affect the Sri Lankan economy adversely in many ways. This is especially so as the country is an export-import economy and is dependent on inward remittances and tourism.

Economic recovery

There were signs of an economic recovery in Sri Lanka by the end of the year and an expectation of growth next year. These are now unlikely.

Hard times

In fact, hard times and economic deprivation are inevitable if the wars continue. Increased unemployment and poverty are inevitable.

Severe blow

These conditions will deal a severe blow to Sri Lanka’s economic recovery owing to the island‘s dependence on the international economy. The heavy dependence of the Sri Lankan economy on oil imports, export markets, inward remittances, and tourism, all of which could be adversely affected by the two wars, is indeed an economic catastrophe. A further escalation of the wars could impact heavily on the Sri Lankan economy, which was striving to achieve modest growth next year.

Hardships

The escalation of these two wars could bring severe hardships to the people, as the emerging conditions could be much more difficult than the crisis experienced earlier.

Economic contraction

The economy is likely to contract, prices will rise, and unemployment and poverty will increase. The external reserves will fall owing to an expanding trade deficit, and the prospect of lesser remittances and tourist earnings that were the bright lights of the economy may dim in the coming months.

Exports

Sri Lankan exports of manufactured goods have been declining owing to the recessionary conditions in Western countries. In the first eight months of this year, export income was lower compared to the same period last year. The demand for our manufactured goods, such as garments, ceramics, and rubber goods, has been depressed. This is likely to worsen with the global recession.

Imports

On the other hand, import expenditure is likely to increase owing to higher prices for fuel, fertiliser, and food.

While oil prices are likely to rise sharply, the disruption to transport may also result in a shortage of these essential items. Consequently, higher import expenditures are likely. This could be aggravated by shortages of these imports.

Trade deficit

In the first eight months, the trade deficit had widened to nearly US$ 3 billion. The lower export earnings of US$ 8 billion and higher import expenditure of almost US$ 11 billion have widened the trade deficit to US$3 billion. This trend is likely to expand and widen the trade deficit this year, owing to higher imports and lower exports. The higher trade deficit would strain the balance of payments.

External finances

While the country’s exports are likely to decrease, import expenditures will increase. The consequent increase in the trade deficit would strain the balance of payments, whose strengths—remittances and earnings from tourism—are also weakening.

Tourism and remittances

There is a cloud of uncertainty over the country’s earnings from tourism and even remittances. The insecure conditions in the Middle East may result in the repatriation of Sri Lankan workers and lower worker migration.

International travel, too, could be affected by the war in the Middle East. However, Chinese and Indian tourists may continue to be attracted to the island.

Balance of payment

In spite of the widening trade deficit, the balance of payments had a surplus of US$ 3.5 billion owing to increased inward remittances and higher earnings from tourism. Both these foreign earnings that were expected to increase in the last quarter of the year may face a reversal.

Foreign reserves

Foreign reserves that were expected to increase to above US$ 6 billion are at risk. The foreign reserves of US$ 3.5 billion at the end of September may decrease rather than continue their upward trend as expected earlier if remittances fall and tourism is endangered.

Summing up

The current two wars are enormous setbacks to Sri Lanka’s economic recovery. The economy is likely to contract, prices will rise, and unemployment and poverty will increase.

The external reserves will fall owing to an expanding trade deficit and lesser inward remittances and tourist earnings. While the country’s exports are likely to decrease, import expenditures will increase. The consequent expansion in the trade deficit would strain the balance of payments, whose strengths are also weakening. Earnings from tourism and remittances may decrease.

Concluding reflection

The tragedy of these two wars, as has been in most wars, is that there is little effort to find peace.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment