Columns

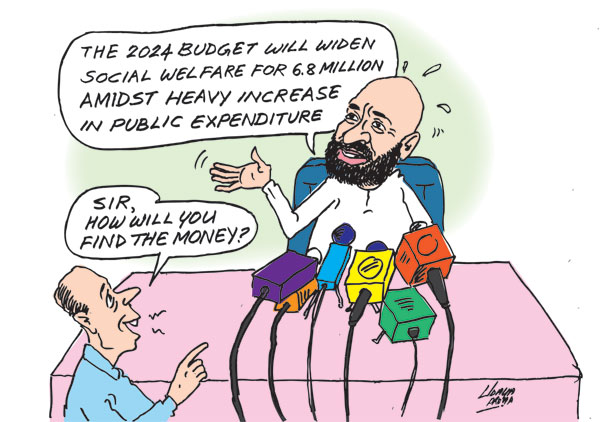

Promises and expectations of tomorrow’s pre-election budget for 2024

View(s):President Ranil Wickremesinghe, as Finance Minister, will present the budget for 2024 tomorrow. How will he keep to the promises of increasing wages, higher social welfare benefits, increased expenditure in defence, and interest payments while reducing the deficit to 10 percent of GDP?

This is the crucial issue, though public expectations are, as usual, the benefits of reduced taxes, increases in wages, and lower prices. ‘Giveaways’, as usually described.

Lower deficit?

Tomorrow’s budget is expected to disclose the ways and means by which the large expenditure will be met while containing the budget deficit to 10 percent of GDP from this year’s deficit, which is expected to be 15 percent of GDP.

Higher wages

The President has said the budget will be full of surprises. Similarly, the State Minister of Finance, Ranjith Siyambalapitiya, has promised higher wages to public servants and relief measures for the poor.

No surprise

Surprises are not surprising, especially as this is a pre-election budget. What would be surprising is if the budget deficit is contained at 10 percent of GDP. How this could be contrived into the budget would be intriguing. Achieving it is another matter that remains to be seen.

Promises

We have been told that Budget 2024 will be full of surprises. Pre-budget statements are full of promises, or what is often described as “seeni bola”. This is especially so in a pre-election year. How these promises would be financed without a large fiscal deficit is expected to be announced by the President.

The Sinhala saying “kathawanam katin, yana whenne kakul deken (talk is by the mouth, walking is by the two feet) is most appropriate.

Most budget estimates have not been achieved. Expenditure overruns and revenue shortfalls are common features of budgets.

Benefits without costs

We are a people who are accustomed to seeking and expecting benefits from budgets without bearing their costs as taxes. As the former Prime Minister of Singapore expressed in the 1950s, “Elections are an auction of unavailable resources.”

Budgets and ballots

So budgets and ballots are indeed inseparable. They are an “auction of unavailable resources.”

Expectations

Although an increase in wages, higher social welfare benefits, and other popular expenditures could be expected from tomorrow’s budget, the critical issue is how the consequent increase in the fiscal deficit could be financed.

Even without the added expenditures, the fiscal deficit is not likely to be reduced to 10 percent of GDP from this year’s (2023) estimate of a fiscal deficit of 15 percent of GDP. How then will the fiscal deficit be narrowed in spite of the higher expenditures?

Three ways

On the eve of the budget, one can only guess how the President would narrow the budget deficit to around 10 percent of GDP. There are three possibilities.

First, a large inflow of revenue would be estimated by the sale proceeds of state-owned enterprises. Second, the government expects to secure substantial foreign assistance as budgetary support. Third, tax revenues would be highly exaggerated or unrealistically high.

Certainty

The only certainty is that this being a pre-election budget, it would have its eye on gaining electoral popularity rather than fiscal consolidation. Narrowing the fiscal deficit will be the challenging task of the next government, whoever that may be.

There is no doubt that Budget 2024 will have many benefits of a customary pre-election budget. How these could be fulfilled without widening the fiscal deficit to over 10 percent remains to be unfolded tomorrow.

Underlying factors

There are at least three underlying factors for the nation’s state of public finances.

First, there is a lack of understanding of economics and public finances. Most people are unaware that a large fiscal deficit has a multiplicity of adverse economic consequences. They think the government has inexhaustible finances that could be distributed to people.

Consequently, there is a “culture of entitlements”. People think they are entitled to a multiplicity of benefits without having to bear the costs. They have this view because they think that the government has inexhaustible resources.

Third, to compound the problem, a political culture that exploits this to garner political support is a serious constraint. Party manifestos at elections are, therefore, a litany of generous promises of benefits.

All these are further aggravated by widespread corruption that results in inadequate revenue. That is why Sri Lanka has one of the lowest revenues, at 8 percent of GDP.

Economic catastrophe

As a consequence of these, we are on the brink of an economic crisis. The failure to contain the fiscal deficit to within 10 percent of GDP will derail the IMF programme, which is vital for an economic recovery. At a time of multiple external shocks, a global economy in recession, and prices of essential imports likely to escalate, the impending economic crisis is horrendous. Will 2024 be a year of economic catastrophe?

Concluding reflection

This budget is overshadowed by the serious global economic conditions that are likely to affect the Sri Lankan economy in 2024. A fall in government revenue and an increase in government expenditure would derail the process of fiscal consolidation. However, tomorrow’s budget will be based on current conditions and will show a reduced deficit. This will not be realised if the wars continue and global economic conditions deteriorate.

Only a cessation of war or massive foreign aid could prevent an economic crisis of huge proportions in 2024.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment