Columns

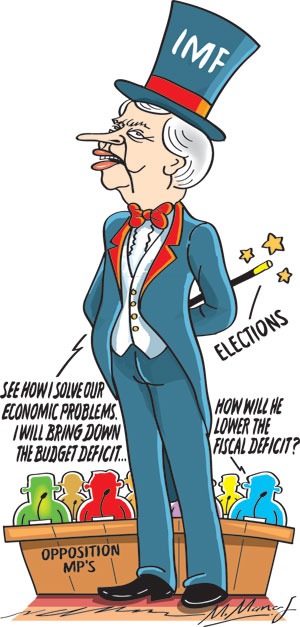

Will Budget 2024 achieve a lower deficit despite higher expenditure?

View(s): The underlying theme of President Ranil Wickremesinghe’s 2024 budget speech was that prudent management of public finances was imperative for the country’s financial stability, economic recovery and economic independence.

The underlying theme of President Ranil Wickremesinghe’s 2024 budget speech was that prudent management of public finances was imperative for the country’s financial stability, economic recovery and economic independence.

Lower deficit

Despite the much higher expenditure budgeted for 2024, the President expects the budget deficit to be reduced to below 10 percent of GDP by increased revenue.

Realisation

The pertinent question is whether the expected revenue would be realised and expenditure could be contained at the budgeted amount.

GDP growth

Furthermore, there is considerable uncertainty as to whether the economy will revive and grow at 5 percent next year. A lower GDP means a higher fiscal deficit.

No giveaways

The President claimed that this budget was a break from the past practice of giveaways based on borrowing and money creation that has put the country into a dire economic condition.

Election budget?

He countered the view that the budget was a pre-election budget and characterised it as a budget to put the derailed economy back on track to economic recovery and growth.

Containing deficit

The crucial question is whether he would be able to contain the fiscal deficit to 8 percent of GDP next year, as required by the IMF agreement.

The lower fiscal deficit is expected to be achieved in spite of an increase in government expenditure by 47.1 percent. While government expenditure is estimated to increase to Rs. 12 trillion, government revenue is only Rs. 9 trillion.

Taxation

The President did not disclose the taxation measures that would yield an increase in revenue by 47.1 percent to bridge the gap. These are expected to be announced in a separate bill on the new taxation measures next year.

Hints

However, there are hints of property and wealth taxes and higher levies on motor car licences and other fees.

A system of requiring an income tax file number on financial transactions is expected to reduce tax avoidance and tax evasion and increase tax revenues.

Expenditure

While many in Sri Lanka deserve some means of relief, whether the government can afford to provide more relief to a large segment of the bloated public sector is questionable.

Salaries and pensions

Budget 2024 will provide an additional Rs. 10,000 allowance to around 1.3 million state employees and Rs 2,500 a month to widows and orphans of former government employees.

These are essential, and, in fact, inadequate relief, but ill affordable in the current state of public finances.

Other expenditures

As has been the practice of finance ministers, President Wickremesinghe announced a plethora of projects. Some of these have been mentioned in previous budgets, but not implemented. Had such projects been implemented, the country would have been developed!

White elephants

The exception to this is the construction of several white elephants that are so well known that they require no mention. Interestingly these were speedily constructed at exorbitant costs.

Universities

The President announced the development of several universities and technical institutes. None can oppose these good intentions. Yet, how could we find the human resources for these when existing universities are facing a wave of depleting staff?

Revenue

As far as mobilising adequate revenue is concerned, there was an unusual lacuna in the budget. There were only a few proposals to increase revenue such as the increase in the Value Added Tax (VAT) to 18 percent.

New tax system

The main sources of revenue are to be disclosed in a separate bill on new taxes and a new tax system. There were a few hints such as increased property taxes, a wealth tax and increased motor car licence fees.

Privatisation

There was no mention of the amount of revenue to be obtained from privatisation of state enterprises that are an important reform that the government is committed to implement.

Banks

Although the need for privatisation was mentioned and the privatisation of 20 percent of shares of the two large state banks was announced, the sale proceeds of privatisation were not mentioned as a source of revenue in the budget speech. This was most probably to not stir a hornet’s nest and provide material to oppose the budget with an unpopular measure.

Privatisation

It is, however, certain that several key institutions will be privatised. This will, on the one hand, reduce government expenditure, and on the other hand, enhance the public coffers.

Important income

The proceeds from privatisation could be an important means of achieving a lower fiscal deficit of 8 percent of GDP.

Challenging task

The reduction of the fiscal deficit to 8 percent of the GDP is a challenging task, as the prospects of economic growth next year have many downside risks. The lower the economic growth, the more onerous the achievement of a low fiscal deficit as a percentage of GDP.

Financial discipline

All things considered, the budget has made an effort to have some financial discipline. However, this resolve of President Wickremesinghe has been mellowed by political compulsions.

Although the President took pains to say that this was not an election budget, the increases in wages, pensions and widows and orphans (W&OP) payments, the welfare expenditure, and land grants were no doubt politically motivated.

After all, the president knows fully well that politics is the art of the possible.

Economic issues

The budget has provoked several significant economic issues.

First: Will we be able to achieve the IMF condition of a fiscal deficit of 8 percent of GDP?

Second: Will there be a continuity of the fiscal policies under a different regime?

Third: Is there a viable alternate economic policy to ensure that the country does not fall into bankruptcy again?

Conclusion

Unfortunately, the budgetary outcome in 2024 is likely to be determined by narrow party politics rather than sound economic policies.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment