Columns

The prospects of adequate foreign reserves for repayment of debt

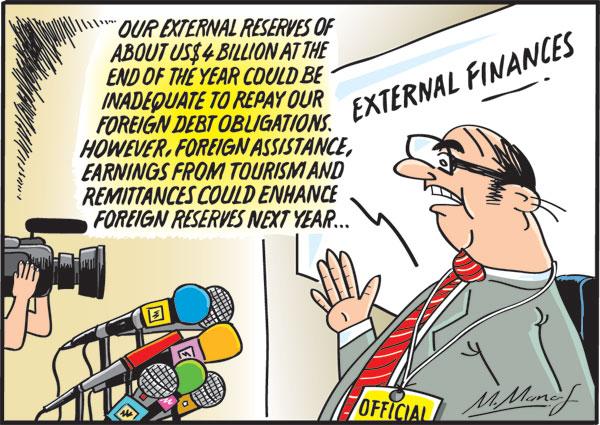

View(s):Will we have adequate foreign reserves to meet our foreign debt obligations next year? This is a critical issue facing the country next year.

Although the amounts and conditions of repayment of the restructured debt are still not known, even a repayment of US$ 3 to 4 billion next year could be a severe strain if foreign reserves dip in the next few months. There are prospects of increased foreign assistance, increased inward remittances and earnings from tourism. However, there are uncertainties and downside risks in these.

Trade deficit

Adverse trends in our external trade in recent months and the current global recessionary conditions do not augur well for the country’s trade next year. However, the good news is that we are likely to receive the second tranche of the IMF’s Extended Finance Facility (EFF) shortly. Although the second tranche is around a mere US$ 299 million, the international confidence it gives is vital for its external finances. There is also the prospect of receiving several project loans that would boost our reserves from time to time.

Foreign reserves

At the end of October, external reserves were US$ 3.6 billion. The reserves may reach about US$ 4 to 5 billion at the end of the year.

At best, reserves could reach around US$ 6 billion if there is increased foreign assistance and higher earnings from tourism in November and December. There was a tourist boom in November and indi-cations are it will continue this month, too.

Expectation

The expectation earlier this year was that external reserves at the end of the year would reach US$ 6.5 billion to 7 billion. This is likely only if inward remittances, earnings from tourism, and foreign assistance inflows increase.

Global recessionary conditions

A significant factor determining next year’s external finances is the global recessionary conditions and the impact of the wars in Ukraine and West Asia. More serious are the unfavorable developments that could unravel next year, if the Russia-Ukraine war continues and the West Asian war engulfs other countries in the region.

Recession

Then the global recession will deliver further setbacks to our trade balance. While demand for our manufactured exports would decline further, international fuel, fertiliser and food prices could increase our import expenditure.

Trade balance

In the first ten months of this year, the trade balance deteriorated owing to decreased exports and increased import expenditure. The decline in manufactured exports was due to recessionary conditions in Europe and North America—the main markets for our manufactured exports. Garments, which are our main export, dipped sharply. Agricultural exports also decreased due to inadequate export quantities of tea.

Garments

The biggest casualty of this depressed demand was the country’s main export of garments. Apart from the adverse impact on the trade balance, it has led to the closure of garment factories and severe unemployment. Increased taxation and higher costs of energy could aggravate the manufacturing down-turn.

The prospects of industrial exports increasing next year are bleak as there are no signs of an improvement in the recessionary conditions. It could worsen if production costs rise and demand declines.

Imports

The increase in imports this year was due to a partial relaxation of import restrictions to get the economy moving. The deterioration of the trade balance is likely to continue if import prices of essential raw materials and energy rise and export demand declines.

Remittances

Although the trade deficit widened to US$ 2.7 billion, remittances of US$ 4 billion in the 10 months wiped away the deficit. In addition, increased remittances of over US$ 5 billion this year and increased earnings from tourism, are likely to result in a balance of payments surplus of about US$ 4.5 to US$ 5 billion.

Whether the improvement in the balance of payments this year due to increased inward remittances and earnings from tourism would continue into next year is a critical uncertainty.

Debt repayment

Although the amounts and conditions of repayment of the restructured debt are still not known, even a repayment of US$ 3 to 4 billion could be a severe strain if reserves dip in the next few months. However, inward remittances and earnings from tourism are expected to increase.

Tourist earnings

Earnings from tourism are estimated at US$ 2.7 billion at the end of October and are expected to reach around US$ 4 billion by the end of the year. Remittances are expected to reach over US$ 5 billion.

External reserves

Consequently, the external reserves that were US$ 4 billion at the end of October could be expected to reach US$ 5 billion at the end of the year. The problem is whether this trend will be reversed next year owing to the deterioration of global economic conditions.

Uncertainty

As discussed in last Sunday’s column, there are considerable uncertainties and downside risks concerning the external finances next year. The trade deficit could widen further due to a further decrease in exports owing to continued recession in Western countries and increased prices of essential imports. Remittances could dip owing to insecurity in West Asia and the return of migrant workers and tourism could dip owing to both recessionary conditions in Western countries and travel risks. The continuation and expansion of the two wars could result in risks and fears of air travel.

Inward remittances

As workers flee home for safety. Also, out-migration to West Asian countries would dwindle, or even cease, till peace is restored in the region. Initially, remittances would not decrease owing to returnees bringing in their savings. It is only a matter of time before labour migration to West Asian countries dwindles and remittances decrease sharply.

Hope

We can only hope that the two wars will cease soon and the adverse impacts on the global and Sri Lankan economy will be eliminated.

Conclusion

The external reserves of the country must be adequate to be able to service the debt repayment that begins next year. Unfortunately, the trade deficit is likely to expand owing to decreased exports and increased costs of imports. There are also downside risks in inward remittances if security conditions in West Asia deteriorate. Tourist earnings that are also of significance for the balance of payments could fall with international travel becomes insecure. This is in addition to the impact of the recessionary conditions on travel.

We are entering a period of economic uncertainty owing to the global recession that could hamper the revival of the economy in several ways. A reduction in exports, increased costs of imports, lower earnings from tourism and lesser inward remittances could erode the country’s external reserves which are required to be adequate to meet debt repayment in 2024.

The continuation and expansion of the two wars would undermine the economy. The cessation of wars and the revival of the global economy is vital to enable the country to repay its debt obligations and revive the economy.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment