News

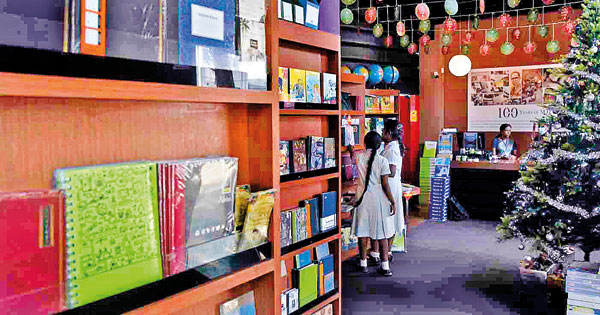

Axe the knowledge tax: Book industry pleads for VAT relief

View(s):By Senuka Jayakody

The levy will especially affect imported books, which are already “prohibitively” expensive. The impact on the education sector will also be significant, trade associations warned.

“This is taxation on knowledge,” said Miles Brohier, immediate past president of the Ceylon Booksellers, Importers and Exporters Association (CBIEA).

The International Publishers Association (IPA), which has members in 81 countries, and the European and International Booksellers Federation (EIBF)—which speaks on behalf of 25,000 booksellers worldwide, wrote to the International Monetary Fund (IMF) and the Sri Lankan Government this week opposing the tax.

“Tariffs should not be imposed on books, regardless of format, because of their key role in ensuring the success of education, literacy, and cultural development policies in all countries,” IPA President Karine Pansa said. “Books, whether for adults or children, provide the basis of reading skills, curiosity, comprehension and individual enterprise, all of which contribute to a country’s sustained socio-economic growth.”

The two trade bodies—which represent the Sri Lanka Book Publishers Association (SLBPA) and the CBIEA, respectively—also pointed out that the imposition of VAT on imported books violates the Agreement on the Importation of Educational, Scientific and Cultural Materials (the “Florence Agreement”) of which Sri Lanka is a signatory and state party.

“Replacing an exemption with a significant tariff on imported books will immediately cause Sri Lankan booksellers to reduce or cease imports of books,” said Fabian Paagman, EIBF Co-President. “Combined with the high prices of books due to the devaluation of the rupee, this can only have negative impacts by reducing access to books, increasing prices for consumers, and incentivising piracy to the detriment of domestic publishing.”

“The removal of books from the list of VAT exemptions seems entirely at odds with the country’s commitment under the Florence Agreement.,” a joint statement said, pointedly addressing the IMF.

“We are in the dark with regards to the VAT,” said CBIEA Secretary Pradeep Samaranayake, who is also the Director of Expographic Books. One of the issues they face is that small-time publishers who are below the VAT threshold will be able to retain the same prices, while larger bookshops will have to raise them, leading to a gaping price disparity and imbalance in the market.

The industry also lacks clarity concerning existing stocks, as there is no expiry date for books. “The government is not giving us a clear picture, and there are no guidelines on old stocks, which we do not differentiate when invoicing,” Mr. Samaranayake pointed out. Trade associations have “no idea” whom to consult regarding implementation matters.

Students using imported books for exams such as the International English Language Testing System (IELTS) will also be in a quandary. “There is no VAT on the provision of educational services, but there is a VAT on the books that go along with them, he said.

The impending price escalation has also raised serious concerns about pirated books—a violation of intellectual property rights—which are not caught in the taxation net.

“The Colombo International Book Fair at BMICH is known to draw the largest crowds to any exhibition in the country, but books would soon be unaffordable, impacting the overall reading habit in Sri Lanka,” warned Rajiv Gunasena, a director of M.D. Gunasena Bookshop. This will eventually affect education and “everything else down the line”.

Readers will have to pay one-fifth more on their books with the 18% VAT and 2.5% service charge, said Dinesh Kulatunga, SLBPA Secretary. The imposition of VAT on top of a devalued rupee will cause costs to rise to levels that neither publishers nor consumers will be able to bear.

“If the government is charging any tax, including VAT, we should pay it,” said Janaka Inimankada, the owner of Vidarshana Publishers. “But it should create an environment suitable for the local production of paper.” If this happens, books could be published at prices even lower than before the VAT imposition.

Industry associations are now contemplating whether a court case could be filed to delay the imposition of VAT for three months until issues related to it are resolved.

The government should not prioritise the “minuscule” revenue it will earn from taxing this sector over the knowledge books provide for the next generation, said Ariyadasa Weeraman, the Managing Director of the Samayawardhana Printers.

Students of international schools will also be hit, as they are predominantly dependent on imported books. Private and international schools cater to around 140,000 students who “are not children of the elite” and who do not pose a “burden to the state,” said Harsha Alles, Founder Chairman of the International Schools of Sri Lanka (TISSL) and Chairman of the Gateway Group. But because of the VAT on books, parents and students will struggle.

Prices of textbooks have already doubled owing to the weak rupee, and the VAT would be imposed on top of it, he said. There has also been an issue of piracy where “people photocopy the textbooks, bind them, and sell them”.

“I am not sure if this will bring in any additional revenue to the government,” Dr. Alles reflected.

Even though the VAT does not affect them directly, it has many indirect implications, including on books, All Island Professional Lecturers Association Chairman Ravindra Bandara said.

“As there are no books for Advanced Level students, we have to print our own,” he said, adding that this will now be more difficult in a situation where almost everything is affected by the VAT.

“One student told me that the bus ride to the class cost him more than the class fees,” Mr. Bandara reported, adding that most students attending tuition were from the middle class.

While attempts are being made to shift lessons online, the new VAT will now make electronic devices, such as mobile phones, too expensive to buy.

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!