Columns

The rude awakening to 2024 in the Lankan year of the VAT

View(s):As the people waited with great trepidation for new year dawn to break, not even the tremendous crack and dazzle of the midnight hour’s fireworks could exorcise their mounting dread as they shuddered to face Lank’s year of the VAT.

Like condemned men, prisoners of a lost economic war, lined up to face the morning firing squad, they faced the certainty of waking up to meet an economic death after their commanding officers had been found guilty of negligence and desertion by an international court martial conducted by a Washington based monetary tribunal.

The sins of the wayward shepherds had visited the flock, and now, godforsaken, they stood, the innocent sacrificial scapegoats, to be slaughtered at dawn.

The prospects of surviving the newly dawned year were indeed grim. If the broken spirit of a nation sought an inspirational streak from the symbolic rising of a new year sun, they found only the depressing reality of risen costs brought starkly home to their doorstep. Never before in recent memory had the people met such a rude new year awakening with a blanket eighteen percent tax arbitrarily placed upon almost all consumer goods and services. And this was only for starters.

For who could say what each new day might bring to nail them harder to the cross, to lower them deeper into their economic graves, and banish hope further beyond their ken, with the same fatalistic dirge mournfully sung at the solemn funeral mass. They had been assailed by taxes after taxes in the old year only to be walloped in the dawn of a new. In the mist of the morn, they could hear the new VAT toll the distant death knell.

Of course, it had been exquisitely eulogised, as the penance that had to be paid to atone the original sin, and artfully explained why the Lankan public had to be exiled from their welfare paradise and branded with the mark of VAT on their foreheads. The new crucibles the people had to endure while waiting redemption with the advent of a new prophet who, contrary to expectation and harboured hope, might preach an even gloomier message. If the present seemed dim, the future seemed bleakest.

The entire exercise, it was claimed, had been undertaken to discharge a binding obligation to the IMF for its 2.9 billion dollar bailout loan. One of the conditions imposed is that the deficit between government income and government expenditure is drastically reduced.

The 18 percent VAT on almost the entire gamut of goods and services, has been necessitated, they say, by a shortfall in the revenue estimated in the 2023 budget.

It’s hardly surprising if fancy expectations fall far short of estimated revenues as a result of the laws of demand and supply, as envisioned by Treasury mandarins in air-conditioned comfort in their echelon offices, fail to hold good in the market, where price is the dominating factor.

The gross failure of the government to crack down on corruption, the failure to eliminate wastage in the public sector, the tolerance shown towards the continued extravagant spending spree by ministers and high-ranking public servants; the continued maintenance at a stupendous cost the world’s 18th largest army as needed to defend the territorial borders of this tiny bankrupt island, as if it could defy ‘a whiff of grapeshot’ by an international or regional superpower; all these ill-affordable indulgences signify, we are suicidally bent on living beyond our means.

And most shocking of all failure, is the total apathy shown toward recovering the stolen billions alleged to have been stashed abroad by corrupt past leaders. Three months ago, the Justice Minister told Parliament that a total of 56 billion US dollars have been parked abroad by powerful people in the past two years. This year alone a sum of 9 billion dollars had been stashed abroad’.

Are these little snippets revealed at certain intervals in parliament, uttered to merely humour us? To tickle our sensitive soles? To amuse us?

The minister further added: ‘It will be possible to settle all debts which Sri Lanka owes other nations if these parked funds are brought back.’

If so, why is the government, while sitting on a stolen 56 billion dollar treasure chest, taking such a laidback attitude and, instead, flaying the skins of the people with taxes? Why isn’t it making a concerted effort to marshal the combined resources of international government agencies specifically assigned to monitor and track the movement of black money? Or rather than ruffle certain political feathers, had it preferred to take the easy route and seek the assistance of the IMF for a bailout loan, and tax the hapless citizens endless to meet its stringent conditions?

This is not only the year of the VAT but it’s also the Lankan year of elections. Change is in the air, but it must be emphasised it is not the time for a revolutionary change, not the time to tinker nor to experiment. It’s not the time to test the untested nor to try the untried, nor to vest faith in the self-proclaimed uncorrupt, eagerly waiting their own turn to willingly fall prey to the seductive temptations of high office.

If the people make the wrong choice and board the wrong crest of the many political waves now dashing to the shore, then they will commit the same unforgivable folly they naively committed five years ago, and once again have none to blame but their own foolish selves alone.

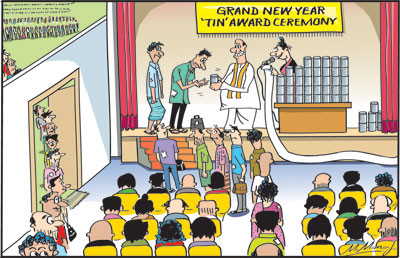

| Govt’s mandatory New Year gift: A brand new TIN for all above 18After imposing a crippling 18 percent tax on almost all goods and services to further burden the people in the new year, who says the government doesn’t have a heart? In a bid to assuage the people’s hardship and grant them a reed of relief and show it cares, the government on new year’s day proclaimed its philanthropic decision to grant each and every one of the country’s citizens above 18, a bespoke complimentary gift of a brand new TIN, each one exclusively engraved with the owner’s name and special identification number to prevent theft and unauthorized use. Furthermore, it was subtlety conveyed that, as an additional precaution to make it even more secure, the Government would use expensive state-of-the-art, cutting-edge technology and tag each TIN with an encrypted QR Code to track its current location and live status. Once upon a time not so long ago, it had been a status symbol only the privileged rich could afford to own. The ultimate accolade one could aspire to gain. The highest honour the state could bestow in recognition of one’s accumulated riches.

Oft such high honour came accompanied with dark rumour spread by the envious, that it had been obtained through the influence of political office, or by pulling the strings of nepotism or through the simple expediency of outright graft and corruption. Now no more. In this enlightened age of the common man and woman, the government has in one bold swoop, made TIN the common lot of all. In one profound inspirational flash of genius, the government abolished the hitherto privilege and preserve of the rich by offering free TINS to all above 18. By this one act alone, equalising the richest man in the country with the lowest of the lowly in the most poverty stricken hamlet in the island, the government balanced the social scales, thereby transcending the divisions of race, caste, religion, creed or wealth. The rich, the poor, the young, the old, the clergy, the laity, the employed, the jobless, the single, the married, the divorced, the separated, the heterosexual, the gay, the transgender, the straight, the judge, the serial rapist, the remandee, the lifer, the free, the jailed, the good, the bad, the honest, the corrupt, the thrifty, the spendthrift, the sick or the healthy, to cut the long list short, all citizens from every diverse walk of life, from all diverse social strata, irrespective of rank, station or office occupied, no matter their born pedigree or class, were made equal – though not at birth – at their coming of age before the watchful eye of the omnipotent, omniscient Big Brother at the State’s Inland Revenue Department by simply accepting the government’s compulsory free gift of a brand new exclusive TIN. And just in the remote event, some stubbornly refuse to accept this gratuitous honour – like Bernard Shaw once did when he declined to accept his king’s kind offer to bestow on him the honour of a knighthood, tersely replying, ‘Being Bernard Shaw is sufficient honour’ – the thoughtful government had even planned to endow them, in lieu of the free TIN honour, a cash gift of 50,000 bucks with no questions asked. Perhaps, Finance Ministry officials, too, realised that the 50,000 buck ‘incentive’ was carrying philanthropy a bridge too far and announced on Wednesday they were temporarily withdrawing the attractive offer. Bad news, maybe, for get-rich-quick opportunists but all above 18, including schoolchildren, Samurdhi recipients, Ping Padi beneficiaries and even beggars, will still retain the untrammelled right to flaunt their exclusive TINS when opening bank accounts or buying new SUVs or buying new houses. It will be the gateway passport to a brave new financial world where once, only the rich were permitted entry, the visa card that will compel one – as an old American VISA card slogan put it – to ‘never leave home without it’. But wherever there’s game, there’s always the spoilsport to queer the pitch. No sooner had the Government announced its laudable offer of a free TIN for everyone, a retired Deputy Commissioner General of the Inland Revenue Department, N.M.M. Mifly swiftly declared, in an article published in the Daily FT on Wednesday, that the Government lacked the legal clout to give away free TINS on the basis of age. He stated that, neither the Inland Revenue Department nor the Finance Ministry is legally empowered to grant TINS to all above 18. Age is not the legal criterion for selection. According to section 102 of the relevant Act, ‘Every person who is liable to furnish a return of income for a year of assessment, shall register with the Commissioner General’. Furthermore, under section 126 of the Act, ‘Every person chargeable with income tax under this Act shall furnish a tax return.’ Therefore, only those with annual incomes above Rs. 1,200,000 are legally liable to furnish returns of income. Social observers noted with dismay that there was something rather odd, somewhat cruel, something surreal that somehow sounded like a sick joke, in asking millions beggared by the nation’s economic collapse to compulsorily queue up to receive their free TINS. They pointed out that to ask these unfortunate people who, perforce, have been condemned to live a hand to mouth existence, who know not where their next meal will come from nor when it will appear, who have nothing to claim as their own but their tears and toil and nothing to declare but their hunger and woe, whose mountainous liabilities far exceed the combined total of their annual incomes, is to perversely mock the wretched fate of millions of Lankans below the poverty belt. They cynically asked whether these countless, faceless millions who had been largely ignored and left to wallow in the squalor of poverty, who had so far applied in person for nothing more than Samurdhi or Ping Padi membership, could be expected to own or have access to fancy laptops or smartphones and fill out complicated inland revenue applications and register online, which even defies the learned who hire tax specialists to fill and file for them? They asked if the entire exercise was an attempt by the government to court their vote in this election year with the implied promise of raising their financial status and granting them the badge of affluence? But some political commentators hailed the government decision to give away free TINS as the most laudable, pragmatic and ideal decision taken in living memory. At long last the government has finally realised what the people require most to survive. It has cut through the fog of deception and – instead of giving them bland tinsel gift like free internet, cellphones and gold chains – has begun the long due implantation of an admirable policy devised to meet the exigencies of time. A policy that will fire the entrepreneurial spirit in every soul to rise, and make them move away from being dependent on the welfare state to live another day. A policy that will arm them with the capital tool to make them all self-sufficient: the symbolic yet practical tool, the indispensable tin to beg for their supper. | |

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment