Columns

Two-pronged strategy for fiscal consolidation: Up the revenue and bring down Govt. expenditure

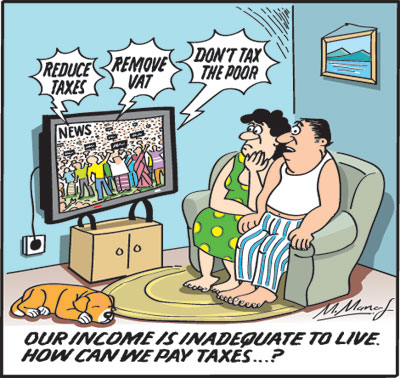

View(s):The government’s recent taxation measures have led to widespread protests, strikes, social unrest, and public resentment. This public discontent could prove to be an important factor in the elections this year.

Fiscal consolidation must be achieved through a two-pronged strategy of increasing revenue and reducing government expenditure. Reducing tax avoidance and tax evasion is vital for increasing revenue.

Political protests

The past few weeks have seen a wave of protests and strikes. Workers are protesting against the new tax regime and the imposition of an 18 percent value-added tax (VAT) on a large number of goods and services. They are demanding an increase in salaries to offset their reduced incomes and higher costs of living.

The problem is further compounded by the government agreeing to give an additional allowance to some professionals. This has led to a demand for a similar allowance for other employees. Consequently, several essential services, especially health services, have been crippled.

Equitable?

These protests, which are likely to continue, raise the question as to whether the increase in taxes is equitable and whether the needed revenue could have been gathered by taxes that were more equitable and effective.

Taxation

Government revenue must be increased by taxing the rich, who are evading and avoiding taxes, and by reducing wasteful government expenditure. Frugality in government expenditure would not only reduce the deficit but would also make increased tax measures more acceptable to people.

Imperative

Reducing the fiscal deficit is imperative for economic stability and growth. Increasing government revenue from its current low level and curtailing government expenditure are needed to achieve a reduced fiscal deficit.

Two-pronged strategy

The reduction in the fiscal deficit or fiscal consolidation must be achieved by both a reduction in government expenditure and an increase in revenue. The current strategy is mostly, if not entirely, a revenue-based strategy that is based on the premise that revenue collection is woefully low at about 8 percent of GDP, while expenditure is at an acceptable level of 19 percent of GDP.

IMF advice

The IMF has probably advised the government to adopt a revenue-based strategy on the basis of revenue and expenditure to GDP ratios.

Such an approach has not taken into account the sources of revenue, the inequitable nature of the taxation measures, or the efficacy of such an approach.

Expenditure

While keeping expenditure at its current level is undoubtedly necessary, the allocation of expenditure requires meaningful changes. For instance, defence expenditures should be pruned down, while expenditures on health, education, and social security should be enhanced.

Expenditure on unnecessary foreign missions in countries such as the Seychelles should be closed, and excessive and incompetent staff at foreign missions reduced.

Discontent

Public discontent caused by wasteful expenditures on parliamentarians, international travel, embassies, defence, and ceremonies has made increased taxes unacceptable. Had there been a visible curtailment of government expenditure, the increased taxation would not have been opposed as bitterly as it is.

Fiscal deficit

There can be no doubt that reducing the fiscal deficit to 10 percent of GDP is vital for economic stability and growth. The current collection of only 8 percent of GDP is one of the lowest revenue-to-GDP ratios in the world. Countries with our level of per capita income collect about 12 percent of GDP in revenue.

Sri Lanka too must achieve such a target, irrespective of the requirement to comply with IMF conditions.

Equitable taxes

The government must, however, adopt equitable and pragmatic tax measures to increase revenue and reduce the fiscal deficit. Increased taxes must also be complemented by reduced government expenditure.

Increasing revenue

In the past, it has been a near-impossible challenge to increase government revenue to the required levels. Revenue shortfalls and expenditure overruns are annual features of the fiscal outturn. On the one hand, increased taxes have proved inadequate to raise revenue to 10 percent of GDP, and on the other, professionals protest that the higher tax rates are inequitable.

Fiscal deficit

Reducing the fiscal deficit from the current 15 percent of GDP to around 10 percent of GDP is a necessary, though insufficient, condition of the IMF’s Extended Finance Facility (EFF). The implementation of economic reforms is a prerequisite for good governance. So are the other conditions of the IMF. These conditions are politically unpopular, and the current conditions in the country are far from conducive to implementing them.

Opposition

Even professionals have opposed the higher income taxes. Professionals, especially doctors and university academics, have been at the forefront of such opposition.

Inadequate incomes

Professionals contend that their incomes are inadequate to meet the escalating prices of food, petrol, gas, electricity, and other essentials. This is no doubt the reason for a large number of professionals to leave the country, paralysing essential services, especially health and university education.

Dilemma

The government is no doubt in a serious dilemma. On the one hand, the taxation measures are not yielding adequate revenue; on the other hand, there are crippling protests. Inadequate collection of taxes from the rich is the reason for this.

This column has, therefore, advocated high taxes on the expenditure of the rich, who avoid taxes.

Tax evasion

The reason for the revenue shortfall is widespread tax avoidance, tax evasion, corruption, and an inefficient tax administration. These have been pointed out in the recent IMF Governance Diagnostic Review. Therefore, this is a long-term challenge. The realistic option is to introduce a system that imposes heavy taxes on the expenditures of the affluent.

Summary and conclusion

The reduction of the fiscal deficit, or fiscal consolidation, is imperative for economic stability and growth. Increasing government revenue from its current low level and curtailing government expenditure are essential to achieving a reduced fiscal deficit.

However, the government has adopted a revenue-based strategy on the premise that revenue collection is woefully low while expenditure is at an acceptable level of 19 percent of GDP.

The new taxation measures have led to widespread protests, strikes, social unrest, and public resentment. The government should adopt a more equitable and pragmatic tax strategy to increase revenue and reduce the fiscal deficit. Increased taxation must be complemented with reduced government expenditure.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment