News

CBSL salary controversy: Governing body wants to explain reasons to Parliament

View(s):The Central Bank’s Governing Board has made a formal request through President and Finance Minister Ranil Wickremesinghe that they be called before Parliament to answer questions on the recent controversy regarding salary increments.

“We want to maintain our accountability and transparency alongside the higher autonomy we got under the new Act,” CBSL Governor Nandalal Weerasinghe, who did not receive a raise, told the Sunday Times.

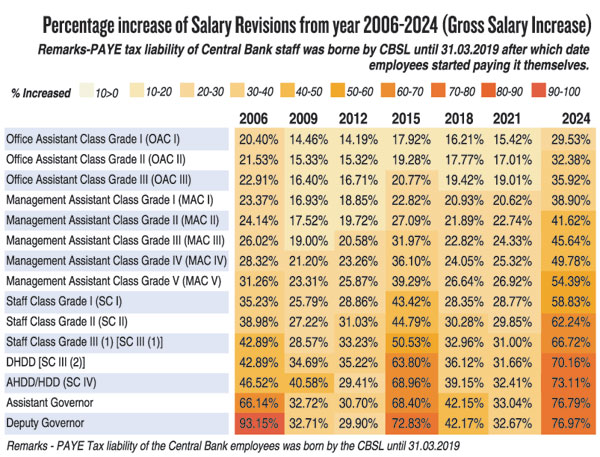

The CBSL this year raised the salaries of its staff by between 29.53% (most junior office assistants) and 76.97% (for its highest grade). But the increases were consequent to negotiations with seven employee unions based on collective agreements that require salaries to be revised every three years, the CBSL said. The new scales that came into effect last month will remain unchanged until December 2026.

“There will be no more salary increases for CBSL staff until 2027, whereas the Government can increase salaries whenever it receives higher tax income,” the Governor said.

The financial sector regulator came under fire in the media and in Parliament, where some MPs, including Minister Nimal Siripala de Silva and Chief Opposition Whip Lakshman Kiriella, claimed approval of the House should have been sought before such “exorbitant” salary hikes were granted.

It was also widely questioned why the Monetary Board of Sri Lanka (MBSL) approved such increments when citizens continued to face economic hardship. Critics said that in revenue-generating institutions, key officials such as customs officers, IRD assessors, and excise inspectors are drawing lower salaries than the CBSL’s office aides.

But Dr. Weerasinghe said that CBSL salaries were paid from its balance sheet, whether or not a profit was made. “If we make a profit, the law prescribes how profits are to be distributed to the Treasury after deduction of all expenditures and after making provisions for reserves,” he explained.

CBSL expenditure is not drawn from the Consolidated Fund—the government budget—and, therefore, salaries or increments have never needed Parliamentary approval as they have no direct impact on taxpayer money, he said. They are decided by the MBSL.

Official statistics show that the salary of a Deputy Governor has risen this year by 76.97% and an Assistant Governor by 76.79%. The revision for management assistants starts at 38.9% and staff classes at 58.83%. The total adjustments for 15 grades, including the most junior office assistants, have seen the CBSL’s monthly salary bill rise by 50 percent.

However, 24 percent of this is deducted and transferred to the Inland Revenue Department as pay-as-you-earn (PAYE) tax, the Governor said, adding that the previous revision in 2021 was made when inflation was projected to remain at five percent per annum (the scales were revised that year by between 15.42% and 32.67%). However, actual inflation skyrocketed to 70 percent in 2022.

Dr. Weerasinghe also pointed to high attrition among CBSL staff. In 2022-23, the regulator lost 99 professional staff out of 1,054 (excluding minor staff). This is around 10 percent. Many joined competitive jobs at foreign institutions, including the Bank of England and the Bank of Oman.

“Since CBSL operates with a limited number of officers and employees, such a loss of resources within a short period is a challenge to continuing its functions smoothly,” a CBSL source said.

“It also exerts extra pressure on the remaining staff. To manage the situation prudently and retain the required talent at the Bank, it was required to compensate them reasonably.”

CBSL salaries must be compared with the remuneration paid in financial institutions that come under its regulation and supervision and not with public sector scales, the Governor said. “This has long been the practice, not just in Sri Lanka but globally as well.”

For instance, while a CBSL Deputy Governor (there are three) is now paid around Rs. 1.7 million, a private sector bank CEO gets around three times more.

He denied published reports that the Ministry of Finance had requested CBSL not to increase salaries. There has also been no increase in the pensions of CBSL staff. “But we may have to give them some increase in the future as the Government has already raised pensions and salaries,” he said.

Official CBSL data show that, in 2006, there were salary revisions of between 20.40% (office assistant) and 93.15% (highest grade). The next highest increase was seen in 2015, between 17.92% and 72.83%.

At the time, however, CBSL paid income taxes on behalf of the staff. From 2019 onwards, employees meet this tax component themselves.

CBSL argues, therefore, that the effective increase this time (after tax) is much lower despite high inflation, compared to 2006 and 2015.

(Please see the infographic on our website sundaytimes.lk)

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!