Getting along with the neighbours

View(s):

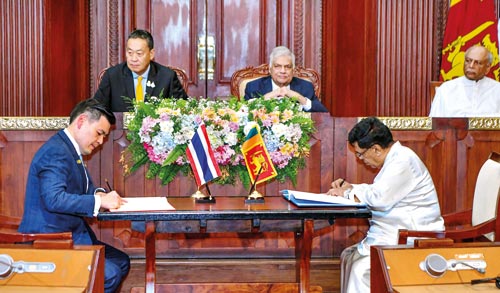

Signing an agreement during the Thai Prime Minister’s visit

Sri Lanka entered a bilateral Free Trade Agreement (FTA) with Thailand on February 3 which is scheduled to be effective from January 1, 2025. This is the second most comprehensive FTA that Sri Lanka signed after its FTA with Singapore (2018). However, the

Sri Lanka – Singapore FTA was on hold for five years without implementation.

As far as the potential trade benefits that Sri Lanka would have reaped from the FTAs are concerned, the period of five years was a loss to the country. If we count the number of years without any new FTA, this loss could be extended to 18 years. The last FTA that came into effect was the Sri Lanka – Pakistan FTA signed in 2005. Apparently, the loss has caused a further slowdown of

Sri Lanka’s export growth, contributing to the country’s foreign exchange crisis.

While the FTA with Thailand has concluded, Sri Lanka is now in the process of preparing for more bilateral FTAs with China, Malaysia, Vietnam and Indonesia. Apart from that Sri Lanka has also sent a Letter of Interest to join the Regional Comprehensive Economic Partnership (RCEP) agreement. RCEP is the association of the 10 ASEAN countries plus seven other countries in the Asia Pacific region, which is the world’s largest free trade area.

Apart from being a member of the ASEAN, Thailand has bilateral FTAs with Chile, India, Japan, Laos, Australia and New Zealand as well as now with Sri Lanka.

Thai economy

Thailand has an over 70-million population with a growing market demand led by the expanding middle class. Further impetus to the domestic demand has been added by about 40 million tourists arriving annually.

Although in the 1960s Thailand’s per capita income and merchandise exports were below those of Sri Lanka’s, the country’s policy reforms enabled the economy to grow and expand exports in the past few decades. Even though there were sporadic political unrests from time to time, investment expansion was kept insulated from political uncertainty. Accordingly, Thailand is also one of the Southeast Asian countries which attracts higher FDI inflows.

Over US$ 6,900 per capita GDP in Thailand in 2022 is more than double that of Sri Lanka. With an over $500 billion economy (compared to $75 billion in Sri Lanka), Thailand is the 9th largest economy in Asia and the 30th largest in the world. In 2022, Thailand recorded $287 billion exports, compared with just $13 billion in Sri Lanka. Thailand not only attracts FDI, but also now generates outbound FDI to other countries, surpassing even Malaysia.

Over US$ 6,900 per capita GDP in Thailand in 2022 is more than double that of Sri Lanka. With an over $500 billion economy (compared to $75 billion in Sri Lanka), Thailand is the 9th largest economy in Asia and the 30th largest in the world. In 2022, Thailand recorded $287 billion exports, compared with just $13 billion in Sri Lanka. Thailand not only attracts FDI, but also now generates outbound FDI to other countries, surpassing even Malaysia.

Thailand’s economy is freer than Sri Lanka, which has been important for its better trade performance and rapid economic growth. Its tariff rates are lower and there are no tariffs plus para-tariffs levied on import trade. Taxes on international trade are only three per cent of government revenue, whereas in Sri Lanka it is 24 per cent. These trade policy differences explain the differences in export performance between the two countries.

Comprehensiveness of FTA

Sri Lanka – Thailand FTA, which is also similar to the FTA with Singapore, covers trade in goods, trade in services, investment and economic and technology cooperation. Sri Lanka’s earlier FTAs with India (2000) and Pakistan (2005) both covered trade in goods only. Accordingly, they were quite primitive forms of the FTAs which need to be revised expanding their scope of operations.

Sri Lanka’s merchandise trade with Thailand is quite small and results in a trade deficit for

Sri Lanka. A common misconception is that unless it turns to be a trade surplus, entering a FTA is irrational. The same argument had been raised during the past 20 years against the Sri Lanka – India FTA too. Probably it will be the result of the FTA with Singapore as well as the one which is proposed with China too.

The purpose of a bilateral FTA is not about achieving bilateral trade surplus, expecting the FTA partner to bear the deficit. It is more about export promotion not just to the FTA partner country, but more to the global markets. Accordingly, what we must anticipate from the FTA is not covering Sri Lanka’s $200 million bilateral trade deficit with Thailand but accelerating the country’s stagnant export growth.

As per the tariff liberalisation schedule of the FTA, 50 per cent of imports from the partner country will be eliminated with immediate effect (by January 1, 2025), while 30 per cent will be phased out in three stages within 15 years. Out of the total import products, tariffs will be reduced for another five per cent, while the balance 15 per cent will be the sensitive imports that remain outside the FTA.

Service trade

Usually trade in services is subject to the regulatory barriers, while service trade is divided into four modes under the WTO classification: (a) Cross border trade assisted by ICT, (b) Consumption abroad under which the buyer crosses the border, (c) Commercial presence under which the supplier crosses the border and, (d) Presence of natural persons under which professionals can cross the border.

As per the service trade schedule, regulatory barriers will be relaxed providing market access in both countries for a list of services. The list includes business services, ICT, R&D, construction, distribution, tertiary education, environment, tourism and transport. Under the movement of experts, high-level professional categories linked to the investment will be relaxed.

Investment sector covers

Sri Lankan investment in Thailand and Thai investment in Sri Lanka as wholly owned or as joint ventures. Investment covers manufacturing sectors such as electrical and electronics, automobile components, food and beverages, apparel and pharmaceuticals, while investment in services cover tourism, IT and logistics. Economic and technology cooperation covers 11 sectors, as trade and investment, infrastructure, agriculture, fishery, gem and jewelry, tourism, SME, finance, packaging, ICT and TVET sectors.

The FTA also specifies rules of origin criteria for the eligibility of products under the FTA and to maximise domestic value addition from partner countries, limiting third party penetration. Rules of origin specified in the FTAs determine the weight ascribed to the domestic source of a product.

Challenges ahead

Entering FTAs is easier for the countries that have been following policy reforms. From the other angle, it is more challenging for the countries that have not followed policy reforms. In a country that has a crippling economic crisis, it is even more challenging. However, compared with the long-term benefits of entering the FTA, the circumstances do not present a good justification to postpone such decisions any longer.

In addition, reaping the benefits of FTAs requires the existence of a fairly open economic regime with an enabling environment for business. In that sense, new trade flows may be created, and new investment flows may be generated in order to capitalise on the opportunities that are available with the FTA.

This could be an important limitation that existed with

Sri Lanka’s bilateral FTA with India too. Although Sri Lanka had an early entry point to a big market with a growing economy and an expanding middle class, it is difficult to say that Sri Lanka could exploit that opportunity. The FTA did not derive its anticipated benefits with full effects, as the

Sri Lankan economy was characterised by a protective trade regime.

The unilateral policy reform process in the country needs to be accelerated along with entering the FTAs. Unlike in the East and Southeast Asian countries where we are aiming at entering FTAs, Sri Lanka has a unilateral reform agenda to expedite for implementation. The house needs to be tidy and in order, when we invite the neighbours.

(The writer is Emeritus Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk and follow on Twitter @SirimalAshoka).

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!