Columns

Challenging task of strengthening external reserves to meet foreign debt obligations

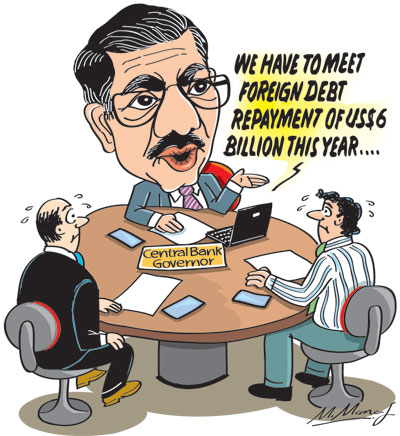

View(s):Although the details of the repayment of the restructured foreign debt obligations are yet unknown, the Central Bank has indicated that this year’s foreign debt repayment obligations will be in the region of US$ 6 billion.

Repayment of such a large debt is indeed difficult, as our current reserves are much lower. It is, therefore, imperative that the external reserves are strengthened this year. At the end of last year, the usable foreign reserves were only US$ 3.5 billion, as US$ 1.5 billion was in Yuan.

Improvement in BOP

Therefore, there has to be a significant improvement in the balance of payments (BOP) this year. Last year’s increasing trend in remittances and earnings from tourism must continue to enhance the external reserves to repay the debt obligations.

Inauspicious

The current global conditions are hardly conducive to an improvement in the balance of payments. Hopefully, remittances and earnings from tourism will continue to increase.

Challenging

The repayment of about US$ 6 billion of foreign debt this year is a challenging task. Inadequate foreign reserves, a widening of the trade deficit, downside risks to inward remittances from West Asian countries, and threats to tourism owing to the higher costs of air travel could impair foreign earnings.

Risks

The trade balance and balance of payments are facing several downside risks. Exports could decrease, import expenditures could rise, and workers’ remittances and earnings from tourism—the country’s main sources of foreign earnings—could dip if global conditions are unfavourable. Consequently, meeting foreign debt obligations could be onerous.

External reserves

At the end of 2023, foreign reserves were estimated at around US$ 5 billion (US$ 4.96). This includes a currency swap arrangement of US$ 1.5 billion from China that cannot be used for debt repayment. The usable reserves are therefore only US$ 3.5 billion. Strengthening external reserves by over US$ 2.5 billion is imperative to meet debt repayment obligations this year.

Imperative

The strengthening of the external reserves is imperative to meet foreign debt obligations of about US$ 6 billion this year, as the current reserves of US$ 5 billion, of which only US$ 3.5 billion could be used, are quite inadequate. In addition, there are other essential requirements for imports.

Risks and uncertainties

There are several risks and uncertainties in the balance of payments. While the trade balance is likely to widen, the strengths in the balance of payments could face downside risks.

Global

Several global developments could affect the trade balance and balance of payments adversely this year. Among them are the likelihood of a widening trade deficit and uncertainties in inward remittances from workers in insecure countries in West Asia. The tourist boom that the country is experiencing could also be affected if travel becomes insecure and the costs of travel rise sharply.

Trade balance

The trade balance, which widened last year to US$ 4.7 billion owing to a fall in exports and an increase in imports, is likely to widen further this year. An increase in shipping costs could affect exports as well as imports.

Shipping

Our exports and imports could be adversely affected by steep increases in freight rates on west-bound routes spread to the east as ships and containers are delayed while passing around Africa to avoid Houthi attacks in the Red Sea.

The sailing time of exports from Colombo to the EU and the USA’s east coast has increased by around 12 to 14 days as ships bypass the Suez Canal. Rates at some European ports have increased by as much as US$ 2000 to 3,000 per 20-foot container, which has resulted in a doubling of freight costs in some cases.

Import containers from East Asia have not gone up as much so far. However, as ships are strung along around Africa, it will take longer for them to turn around and return to East Asia, reducing ship calls and also containers, which will remain at sea for longer.

Trade deficit

This year’s trade deficit is likely to widen owing to a further fall in manufactured exports, especially garments. The demand for our exports, which was adversely affected by the recession in Western countries, is likely to continue and be further weakened by the disruptions in transport.

The trade deficit that widened to US$ 4.7 billion last year, mainly owing to a decrease in export earnings and an increase in import expenditure, is likely to widen further owing to the continuing global recession, difficulties, and higher costs of shipping and disruption of supply chains.

Imports

On the other hand, import expenditures are likely to increase owing to the higher costs of shipping and insurance. The liberalisation of some imports last year may have to be revoked to somewhat reduce import expenditure.

Two strengths

The two strengths of the balance of payments last year were inward remittances and earnings from tourism. These two brought in nearly US$ 7 billion and wiped away the widened trade deficit of about US$ 4.7 billion. Consequently, the external reserves increased to about US$ 5 billion.

Remittances

Over one-half or more of inward remittances are from migrant workers in the region vulnerable to war due to the likely expansion of the Gaza war. Workers from Israel and Lebanon are returning. Such fleeing for security could affect inward remittances adversely.

The other half of remittances from such countries as South Korea, Japan, and Western countries are not likely to be affected. Yet a decrease of about US$ 2.5 billion would be a severe strain on the balance of payments at a time when the trade deficit is expected to widen.

Tourism

Tourism, the other source of strength for external finances, could be affected by threats to air safety and higher costs of air travel. Earnings of nearly US$ 3 billion last year signalled a revival of tourism that had setbacks from COVID and inhospitable conditions. The threats to tourism could be from dangers in air traffic through the war zone and increased air fares owing to higher fuel prices.

On the other hand, people fleeing from Russia and Ukraine and rich Arabs seeking security could boost tourism. Furthermore. A substantial number of tourists are from India and East Asia. They could bring steady tourist income to the country.

Ways and means

In this economic context, ways and means must be found to strengthen the country’s external reserves. International assistance would undoubtedly be needed to tide over the current international setbacks. Increased project loans could enhance reserves.

The pertinent question in the current global conditions is whether these sources of external finances would be affected by the current insecurity in West Asia.

Conclusion

Strengthening external reserves is imperative to meet debt repayment obligations of about US$ 6 billion, as the current usable reserves are only US$ 3.5 billion. The risks and uncertainties are many. While the trade balance is likely to widen, the strengths in the balance of payments could weaken. Increased remittances and earnings from touristm are critically important.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment