News

Tourist visa holders doing business in Sri Lanka: SLTDA

View(s):By Namini Wijedasa

The Sri Lanka Tourism Development Authority (SLTDA) this week admitted there was a problem with unauthorised foreigner-run businesses and that “all agencies have been rather complacent” during the last two years.

Now that the discussion has opened up, however, the SLTDA will see “how best” it can work with the Department of Immigration and Emigration and the police to identify these businesses while also taking steps to promote lawful investments, said Chairman Priantha Fernando.

“There is an issue,” he said, “and it hasn’t been handled in the manner it should have been over the last couple of years. All agencies have been rather complacent.”

Advertisements for parties with foreign DJs, many of them in Sri Lanka on tourist visas.

Separately, tourism industry operators this week proposed wide-ranging solutions to meet the challenge in a manner that could attract and regularise foreign investment into tourism — without driving well-meaning entrepreneurs away.

There was consensus that, given how unlicensed foreigner-operated informal sector businesses are flourishing, ignoring them was no longer an option.

SLTDA puts its foot down

“We really cannot go ahead with unauthorised establishments or people without the right visas — for instance, tourist visa holders — doing business,” Mr. Fernando reiterated. “We will have to really come down hard.”

Like other observers, he apportioned some of the blame on Sri Lankans who lease their properties to foreigners who then market rooms to tourists. One school of thought is that clamping down will cause local communities to lose earnings.

“However, there is a formal way to do this,” Mr. Fernando insisted. “They have to fall in line. We are not against foreigners doing business because that will discourage investment. But if it is a large-scale operation, they must get approval from the Board of Investment and employ Sri Lankans, etc.”

“If they are a small and medium enterprise, they can hold up to 49 percent shares in a joint venture where the locals have 51 percent. They can then seek SLTDA approval.”

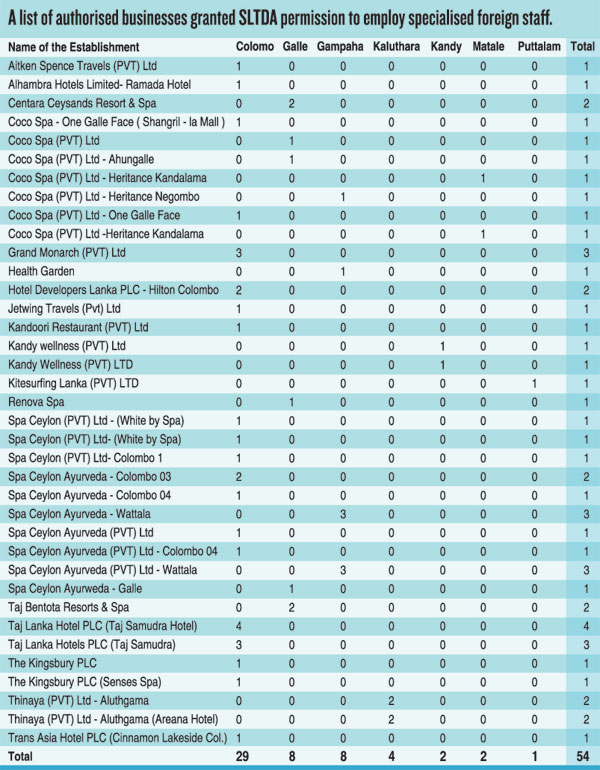

Under such an arrangement, the SLTDA recommends visas for foreign staff with specialised skills. At present, there are only 51 establishments for which the SLTDA has issued such letters. This means that the countless small businesses that “employ” foreigners run on the fringes of the law.

As part of a recent pilot effort, SLTDA officers visited seven places reported to be unlicensed. Of them, five had collaborations with locals who were running their businesses while the foreigners had residence visas.

“Even if they were not registered with us — which was their only fault — they had some sort of registration and business licence. So this is going to be a major operation. ”

No enforcement unit

The SLTDA’s enforcement unit was disbanded nearly two years ago and government procurement procedures have slowed down its reactivation. They are looking to expedite the recruitment of new staff for it. “With the informal sector mushrooming, the number of permanent staff is not enough to carry on even our normal work,” Mr. Fernando said.

The severe backlog has forced officers to work weekends. An experiment with handing out temporary SLTDA licences at the provincial level had to be shelved because the quality and standard of those businesses that received them varied so much (“some were like cattle sheds”).

It is now the off-season in Eastern Province, so most tourists are concentrated in the South. “In a matter of three to four months, it will all shift to the East — Arugam Bay, Pasikudah, Batticaloa,” he remarked. “So we will try to bring in some control in those areas before the season opens up.”

| A plethora of problems, including lost revenue Industry operators offered some well-considered solutions to the sector’s main problems — including the reality that “a staggering 90 percent or more” of tourist establishments (foreigner and local-run) do not have liquor licences. Dealing with Excise Department was a cautionary tale where “obtaining any form of licence often necessitates bribes over due process”. Applying requires multiple stops and physical pickup of forms, driving people to resort to shortcuts rather than “endure the months or years needed for proper procedures”. On the East Coast, local businesses face trouble registering with the SLTDA as their properties were classified as “permit lands” reserved for farming. So they operate outside the tax net. Separately, many Southern beachside properties lack building permits or certificates of conformity required for SLTDA registration or trade licenses. They either never got them or lost them in the tsunami. The industry operators proposed seasonal alcohol licenses for businesses in tourist areas as well as relaxation of trade licence requirements. This will benefit tourism; create a big taxable revenue base; be implementable with minimal capital investment; and will eliminate bribery and time wastage in the application process. A typical tourist town has 40-50 establishments selling alcohol with daily liquor sales ranging from Rs. 50,000 to Rs. 100,000 and DJ parties (held in a few large establishments every week) generating over Rs. 1,000,000 per event. These translate into an average of over Rs. 100mn. Unlicensed businesses pay Excise officials monthly bribes ranging from Rs. 50,000 to Rs. 100,000, the operators also said. Meanwhile, unregistered foreign-owned businesses undermine legitimate local enterprises through unfair competitive advantages. They also divert revenue abroad. The operators recommended three measures including a one-time amnesty for all foreign-owned businesses to register and obtain a tax identification number. “Thereafter, businesses lacking proper licenses, tax identification numbers and permits will face seizure, while foreign workers and owners without documentation will be deported,” they proposed. They suggested a high-skills visa programme — short-term visas for qualified foreigners who want to set up small businesses or work for tourism-related ventures. Minimum salary requirements will be stipulated to attract highly skilled workers and curb exploitation of illegal immigrant labour. They proposed linking the number of foreign visas a company can have to the revenue it generates. This would limit businesses from overstaffing with foreign workers. Loopholes that allowed companies with proxy Sri Lankan directors — but owned by foreign interests — to grab freehold land and price out residents must be closed. “Many foreign-owned businesses exploit this grey area by acquiring large swathes of freehold land, developing them, and selling them outside the tax net,” the operator said. Any exercise undertaken must make it easier for locals and foreigners to generate jobs; boost tax revenue; and prevent crowding out of local businesses by foreign nationals illicitly running businesses on tourist visas. The operators suggested different slabs of investment visas. For example, it could be US$ 100,000 for a coffee shop, US$ 200,000 for a travel business and so on. “This would ensure only serious investment that will have a meaningful impact flows in, as opposed to a tourist setting up a cafe for US$ 20,000 that he or she can self-operate, meaning that no local job opportunities are created,” they explained. Skilled visas can be issued for businesses to employ experts, including sommeliers, baristas, mixologists, chefs, etc. (notwithstanding expertise available locally). “Not all chefs or mixologists are equal and businesses should be able to differentiate by importing exceptional talent,” they said. It was vital to introduce a clear, easily navigable incorporation process (company incorporation and registration for taxes, employee pension schemes, etc.). It must be through digital forms allowing digital signatures. There must be a clear, easily navigable online tax payment process. “This makes it easier to monitor and collect taxes while making it easier for businesses to stay compliant,” they emphasised. Excise laws must be reformed so that the provision of licences is not a subjective exercise. If a restaurant, cafe, bar, or hotel meets the criteria, it should be given a licence. All non-compliant establishments on the South and East Coasts must be visited and given a grace period to register, retrospectively apply for investment visas and pay back-taxes and surcharges. Law enforcement needs strengthening. The tourist police must be a proper, separate division with adequate training in languages, in the rights of tourists and locals, how to deal with sexual assault victims, and so on. It should also handle complaints by businesses against cartels like the tuk-tuk mafia. A secondary objective should be to learn from similar markets such as Goa and Bali, taking measures to prevent turf wars and violence among different nationalities as well as between local groups and tourists. These are only some of the proposals the industry came up with. There is little evidence, however, of the government listening at the highest levels. | |

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!