Columns

Remittances and tourism earnings continue to increase foreign reserves

View(s):The March 3rd column pointed out that meeting our foreign debt repayment obligations of US$ 6 billion this year was a formidable and challenging task, given our current state of foreign reserves.

Favourable developments

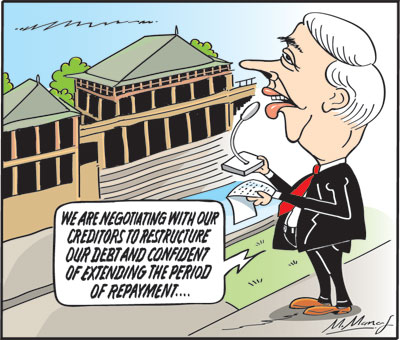

Since then, there have been two favourable developments. The government, with the assistance of the IMF, is negotiating with foreign creditors to extend the period of debt repayment, and the increasing trend in remittances and earnings from tourism is continuing.

Negotiations

The announcement that the government, with the assistance of the IMF, is negotiating for a revision of the debt repayment and is confident of a lower repayment this year would ease the repayment burden this year and later. A lower foreign debt repayment and an improvement in the balance of payments would make debt repayment less onerous.

Remittances and tourism

The other silver lining is that remittances and tourism earnings have continued to increase. If these continue, the balance of payments surplus would increase significantly, and the external reserves would be enhanced. On the other hand, the trade deficit is likely to expand.

The increasing trend in remittances and tourism earnings continued to strengthen the foreign reserves in January. There are indications that this was so in the second month, too. If the trend continues in the coming months, then the external reserves will swell.

Remittances

In January of this year, remittances amounted to US$ 483 million. If this trend continues, remittances for the year could be nearly US$ 6 billion compared to about US$ 5 billion last year, and there would be a significant improvement in the reserves.

Tourism

Tourism earnings of US$ 342 million in January this year were one of the highest in recent years. If this increasing trend continues throughout the year, tourism earnings could reach around US$ 4 billion. Tourism earnings are expected to increase in the latter months of the year, provided global and local conditions remain safe for tourists.

An inflow of US$ 10 billion from these sources would make the foreign debt repayment less onerous.

Lower debt repayment

Furthermore, if the newly negotiated debt repayment is reduced to US$ 4 billion or less, the country’s foreign reserves would be at an adequate level.

Risks

However, we must be mindful of several downside risks owing to the two wars that are continuing: the Gaza war and the Ukraine war. Remittances could dip sharply if the security situation in West Asia threatens our workers’ security. Tourism, too, could be disrupted if the ongoing wars make travel unsafe or costly. We must also ensure that the country is safe for tourists. This could be a challenging task in an election year.

Trade deficit

In contrast to the improvement in remittances and tourism earnings, the trade deficit widened in the first month to US$ 541 million. If this trend continues, as is likely, the trade deficit could be as high as US$ 6 billion, exceeding last year’s deficit of US$ 4.7 billion.

Improving trade

Improving the trade balance by increasing exports and reducing imports through import substitution, especially in food, is imperative. However, this is a long-term strategy.

An improvement in global conditions is needed to revive our manufactured exports, especially garments. This is unlikely to happen soon.

Reserves

At the end of February, the gross foreign reserves were US$ 4.7 billion. Of this, US$ 1.5 billion cannot be used to repay debts, as it is in Yuan.

Recapitulation

The repayment of US$ 6 billion this year is a challenging task. It is only through a continuing increase in remittances and earnings from tourism and financial assistance that the debt obligations can be met. Therefore, the successful completion of the ongoing negotiations is imperative to reduce this year’s debt repayment to about US$ 3.5 billion to US$ 4 billion. It is also imperative to enhance the reserves to above US$ 6 billion to repay the foreign debt obligations and sustain the trade deficit of above US$ 6 billion. Hopefully, the foreign debt repayment will be reduced to below US$ 6 billion this year.

The foreign reserves need to be strengthened during this year to enable the repayment of the foreign debt. A balance of payments surplus is possible through increased remittances and tourism earnings. It is vital that these two earnings are not disrupted by the ongoing wars.

The expanding war in West Asia could be a severe threat to workers’ remittances from West Asia. Tourism, too, could be disrupted if the wars make travel unsafe. Hopefully, these adversities will not occur.

The downside risks to inward remittances from Arab countries and threats to booming tourism owing to higher costs of air travel would incapacitate the country’s repayment of the foreign debt.

Risks and uncertainties

Furthermore, there are several risks and uncertainties in the balance of payments. While the trade balance is likely to widen, the strengths in the balance of payments are likely to weaken the foreign reserves.

Several global developments could affect the trade balance and balance of payments adversely this year.

Among them are the likelihood of a widening trade deficit and uncertainties in inward remittances from workers in insecure countries in West Asia. The tourist boom that the country is experiencing could also be affected if travel becomes insecure and the costs of travel rise sharply.

While we cannot control these global conditions, it is crucially important that the country remain safe for tourists in this election year. As in the past, there should not be any violence that would dissuade tourists from visiting the country.

Conclusion

The bottom line is that the repayment of foreign debt, which is a challenging task, would be easier if the repayment burden is reduced and the two strengths of the economy, remittances and tourism earnings, continue their uptrend.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment