Columns

Prospects of negotiating a change or modification of IMF conditions

View(s):Last Sunday’s column discussed the importance of continuing with the IMF’s Extended Finance Facility (EFF) as well as the difficulties of negotiating with foreign bondholders for a restructuring of the international debt. An equally significant issue is whether the opposition parties would comply with the IMF conditions, were they to come to power.

Opposition

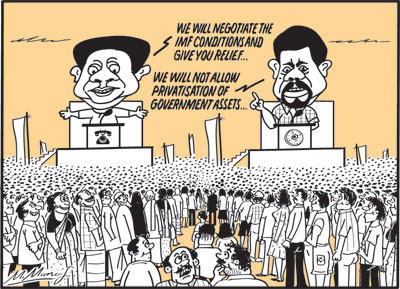

The main opposition parties have said they would negotiate with the IMF to modify and even change some of the conditions. The two main opposition parties, the SJB and the JVP-led NPP, have once again reiterated that they want the IMF conditions to be modified. What are the prospects of such modifications? Will their demands endanger the continuity of the IMF arrangement?

May Day

May Day rallies this year were, as expected, with an eye on the upcoming elections. Both main opposition parties were confident of victory and promised better conditions for the people and working classes. They were rich in promises and low on economic policies to achieve economic growth.

Renegotiating the conditions imposed by the IMF was a key promise. How feasible would this be?

Recent policy shift

The opposition parties’ recent pronouncements indicate a shift in their policies towards the IMF agreement. They appear to have changed their position from abandoning the IMF arrangement to one of modifying or changing what they consider to be harsh conditions and unacceptable policies. They have once again reiterated that they want the IMF conditions to be modified. What are the prospects for such modifications?

SLPP

The Sri Lanka Podujana Peramuna (SLPP), though the backbone of the government, has opposed the privatisation of state enterprises. The party has openly said it is against several important provisions of the agreement, especially the privatisation of state enterprises. Nevertheless, the SLPP continues to support the implementation of the IMF programme.

Party positions

The JVP and the SLPP have openly said that they are opposed to the privatisation of state-owned enterprises (SOEs). The SJB appears to be more selective in privatising SOEs.

Pragmatism

Such a selective divestment of state enterprises may be a more pragmatic strategy. However, at present, the SJB’s precise policy on privatisation is not clear. It has openly stated that it is opposed to several important provisions of the agreement.

Unpopularity of IMF

One of the underlying reasons for this opposition to the IMF conditions is that, over a long period, the IMF has been portrayed to people as an American or imperialist organisation that is undermining our economy. In addition, the increase in prices due to the imposition of an 18 percent Value-Added Tax (VAT) and a low threshold for income taxes have made the IMF unpopular. Both the JVP and the SJB have vowed to change these.

Popular

The opposition to the IMF proposals is a popular vote-catching position. That is why even the SLPP, despite extending its support to the government to implement the IMF programme, has taken the paradoxical position of opposing key IMF policies.

What are the conditions that could be modified?

Fiscal deficit

An IMF condition that cannot be compromised or altered is the need to reduce the fiscal deficit to a much lower level of 5 or 6 percent of GDP. The reduction of the fiscal deficit, or fiscal consolidation, is imperative for economic stability and growth.

A large fiscal deficit is akin to diabetes, which affects all organs of the body. Large fiscal deficits have over time incapacitated the economy and destabilised it in many ways.

However, while bringing down the deficit is neither negotiable nor desirable, there could be many ways in which the fiscal deficit could be reduced. The party that comes to power could suggest alternate ways of increasing revenue and reducing expenditure.

Privatisation

The privatisation of SOEs is another main condition of the IMF. Both the SLPP and the NPP are opposed to the privatisation of SOEs. This is further reinforced by the popular perception that privatisation of state assets is like giving away family silver.

Several decades

The opposition to privatisation has been there for several decades, especially in the run-up to elections. Consequently, in spite of state enterprises incurring huge losses, they have continued to operate as government enterprises.

Political benefits

Furthermore, SOEs confer large political benefits and financial rewards on government politicians. They provide opportunities for politicians, especially ministers, to give employment to their supporters. In fact, overstaffing is one of the reasons for losses in SOEs. Sometimes a state enterprise might have twice or three times the number required.

Unpopular

For these several reasons, privatisation is unpopular and lacks the political will of governments and political parties. How the parties that are opposed to privatisation could negotiate this key IMF condition is difficult to envisage. Privatisation of SOEs is also a prerequisite to fiscal consolidation.

Reform

The above discussion should not be conceived as advocating the privatisation of all enterprises. Perhaps some enterprises could be reformed and retained as public enterprises. There could also be a justification for some state enterprises, such as the railways and the SLTB, remaining subsidised ventures. However, mechanisms to improve their efficiency would need to be devised. The management of these enterprises should be depoliticised, with management being handed over to professionals.

Reorganise

It would be prudent for the next government, whichever party that be, to re-organise state enterprises in several ways. These could be state-owned but privately managed enterprises; government-and-privately owned enterprises; or enterprises where the majority of ownership is in private hands with a minority interest by the government.

Conclusion

With all these factors considered, there may be some scope for modification and adaptation of the IMF’s conditions. However, these should be within a strategy for achieving fiscal consolidation, market-oriented policies, and good governance.

Achieving good governance and reducing corruption are Herculean tasks. Is there a prospect of a government with good governance?

It is only if the right policies are pursued and implemented that the country can aspire to be a developed and prosperous nation by 2048.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment