Columns

Restructuring foreign debt: Opportunity for economic resurrection and growth

View(s):The restructuring of foreign debt is an opportunity for economic resuscitation. The agreement with official bilateral creditors on reducing the external debt, the deferment of all bilateral loan installment payments until 2028, and the repayment of all loans on concessional terms, with an extended period until 2043, is undoubtedly an opportunity to strengthen the country’s external finances and achieve economic growth.

Facts

The facts of the foreign debt restructuring are unfortunately distorted by opposition parties for political gain. The undeniable fact is that without restructuring foreign debt repayment, the economy will be crippled. It would not be possible to move from the current economic recovery to economic growth and development. Unfortunately, the opposition parties’ positions are not based on economic facts and figures.

Facts and figures

The reduction of foreign debt by US$ 5.3 billion, or 13 percent, and the postponement of repayment instalments until 2028 are immense benefits to the country. It is a breathing space in which the country must strengthen its foreign reserves, stabilise the economy, and achieve higher economic growth. It allows the economy to enhance its reserves through an improvement in the balance of payments and obtain foreign assistance and foreign investment.

Better concessions

Whether we could have got better concessions, as the opposition leader claims, is unclear. The fact that we were a middle-income country, unlike Ghana, which is a low-income country, is a reason for the lesser concessions.

Repayment

Prior to the restructuring of foreign debt, this year’s debt repayment, which was estimated at about US$ 4 billion, was beyond the capacity of the country to repay as external reserves that were usable were only around US$ 4 billion.

Opportunity

The restructuring of the foreign debt by US$ 5.8 billion and the commencement of the repayment after a grace period till 2028 come as an immense relief and are an opportunity to stabilise the economy and achieve higher economic growth.

Opposition

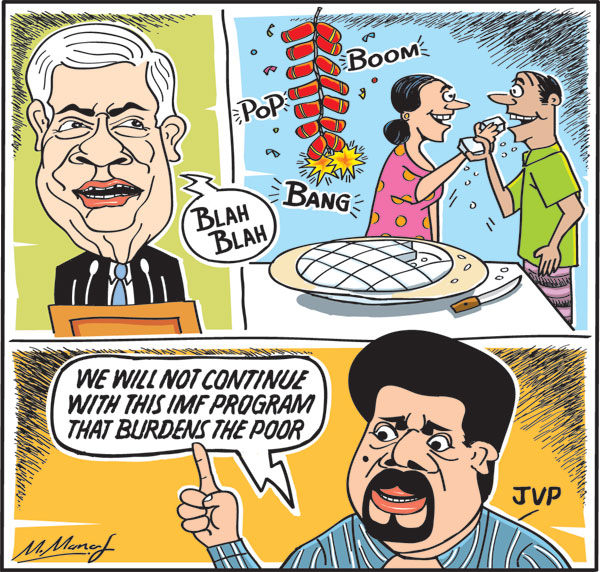

Opposition parties condemned the conditions attached to it as a truckling to IMF conditions that worsen the plight of the poor. The JVP even said it would discontinue the IMF agreement. The SJB vowed to change the conditions to be less burdensome for the poor.

Politicisation

Such politicisation that distorts economic issues is endemic in the country’s politics and a root cause of bad economic policies and underdevelopment. The economic facts of the restructuring presented earlier are distorted to gain popular support.

Unfortunately, this foreign debt restructuring has been heavily politicised by both the government and opposition parties. The government made the president’s announcement a cause for celebration with the lighting of crackers and fireworks and partaking in kiribath. It was perhaps the beginning of the president’s election campaign.

Alternative

The JVP, which says it will abandon the IMF programme, has not presented an alternate solution. Whether the SJB position of modifying IMF conditions could be achieved depends on whether such changes ensure fiscal consolidation and whether there is agreement on implementing economic and governance reforms.

Achievement

The government projected the foreign debt restructuring as a huge gain and achievement of the government, and the President made use of this to virtually launch his presidential election campaign. The SJB said the government failed to get concessions that other countries like Argentina and Ghana had obtained. The two main opposition contenders belittled it and focused on the mismanagement of the economy over the years that brought about the economic crisis and bankruptcy. The irony of this situation is that if either of these opposition parties were to come to power, their task of economic management would be made much easier by the debt restructuring.

Economy

The economic prospects in the near future depend on the economic policies that will be pursued after the elections. Last year’s economic growth of 2.3 percent is expected to increase to 4.5 percent this year. The availability of imported raw materials is expected to revive construction and industries.

Balance of payments

The balance of payments would register a surplus this year if the increasing trend in tourist earnings and inward remittances continues. There are downside risks in both. Remittances from West Asia could decrease if the security situation in the region deteriorates. We must ensure that law and order prevail and that conditions are safe during the upcoming election period for the continuous flow of tourists.

Foreign reserves

The foreign reserves are expected to be enhanced in the coming months with the resumption of foreign-aided projects that were abandoned, assistance from the World Bank, the Asian Development Bank, and foreign governments. Among those who have indicated their willingness to help are Japan, the United States, India and China. The expectation of foreign investments would, however, require a better investment climate.

Advantage

A significant advantage of foreign debt restructuring is the removal of constraints on the import of raw materials for industry and services. The ability to allow such intermediate imports could get the wheels of industry moving. The import of certain essential foods and medicines could reduce the cost of living.

Conditions

There are a host of other conditions that are needed for economic growth. Good governance and the effective implementation of pragmatic policies are crucial. Debt relief is an opportunity to get other conditions and reforms implemented to spur economic development.

Trade deficit

The trade deficit would widen this year. It would be beneficial if the trade deficit could be reduced. Although there has been an increase in exports in the first half of the year, imports are likely to increase. In fact, the easing of external finances would be a reason to liberalise imports, especially intermediate goods and raw materials, to enhance production and exports. This could weaken the trade balance and strain the balance of payments. This weakness in the short run could be an impetus for growth.

Conclusion

Despite several advantages to the economy owing to the foreign debt restructuring, the resuscitation of the economy remains an uphill task. Political culture, political developments, a stable government, and a work ethic are necessary conditions for resurrecting the economy. The country’s post-independence economic history is one of missed opportunities. Will the advantages of the foreign debt restructuring also be frittered away?

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment