Columns

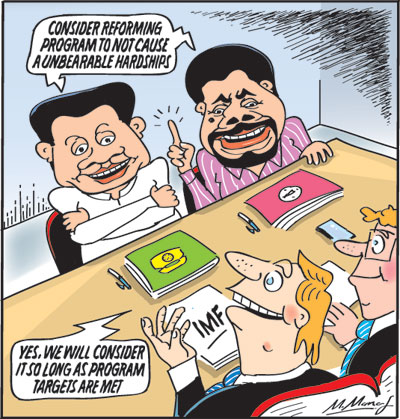

Will the IMF modify its ‘conditionalities’?

View(s):The presidential election on September 21 and the parliamentary elections thereafter are crucial for the country’s economic future. The economic policies of the new president and the new government would determine the economic future of the country, as perhaps never before.

Critical issue

The country is at a critical juncture in its economic journey. A key issue is whether the International Monetary Fund would agree to revising its ‘conditionalities’ or will the government abandon the IMF agreement.

Fiscal targets

In a nutshell, it depends on whether the opposition parties could come up with alternate policies that heap lesser burden on people and achieve the IMF programme’s targets. Most important would be the achievement of an acceptable low fiscal deficit by increased revenue and lower expenditure.

Issues

With the presidential election a little over five weeks away, the election campaign is narrowing on the issues of most concern for most people. These include the cost of living and the hardships people are bearing. Foremost concerns in the minds of people are the cost of living, inadequate wages, and the lowering of the tax threshold to Rs 100,000 a month. Recently, even President Ranil Wickremesinghe acknowledged these hardships and agreed to negotiate with the IMF.

Economy

Though the macroeconomic conditions and the availability of essentials have improved, the living conditions of most have deteriorated. An increase in wages or reduction in taxes and prices are necessary to improve living conditions.

Main parties

The two main opposition parties have vowed to change the most onerous conditions of the current agreement. These are the reduction of income taxes by increasing the threshold for income taxes and reducing indirect taxes to reduce the costs of living. They also want to change some other conditions of the IMF agreement, most notably the privatisation of state entities.

Onerous

Changing these conditions could be an onerous task in the context of the IMF’s most recent observations that tax revenues should be increased. The tough challenge is to find the means of increasing revenue while raising the threshold of income taxation and reducing some indirect taxes that have increased the costs of living. The threshold for income taxes may have to be raised to about Rs 2.4 or 3.6 million a year, but this will reduce tax revenue considerably.

Broader picture

Hopefully, the IMF would look at the broader picture of the social repercussions that its conditions have created and modify the programme so that the burdens on the poor are alleviated. They would have to look beyond the macroeconomic variables to what social and political impacts they have had. If this is not done, there is the prospect of this 17th IMF agreement going the way of the earlier 16.

Fiscal consolidation

Fiscal consolidation is imperative for economic stability and growth. However, the manner in which it is achieved should not place burdens on the poor and create social deprivation and unrest.

Privatisation

Privatisation of state enterprises is unpopular and lacks the political will of governments and political parties. How the parties opposed to privatisation could negotiate non-privatisation is difficult to envisage. Privatisation of SOES is also important to fiscal consolidation.

The above discussion should not be conceived as advocating the privatisation of all enterprises. Perhaps some enterprises could be reformed and retained as public enterprises. There could also be a justification for some state enterprises, such as the railways and the SLTB, remaining subsidised ventures. However, mechanisms to improve their efficiency would need to be devised. The management of these enterprises should be depoliticised and handed over to professionals. It would be prudent for the next government, whichever that be, to reorganise state enterprises in several different ways. This could be state-owned but privately managed enterprises, government-owned and privately owned enterprises, and enterprises where the majority of ownership is in private hands with a minority interest by the government.

Conclusion

All these factors considered, there may be some scope for modification and adaptation of the IMF’s conditions. However, these should be within a strategy of achieving fiscal consolidation pertaining to market-oriented policies and good governance. Achieving good governance and reducing corruption are Herculean tasks. It is only if the right policies are pursued that the country can aspire to be a developed and prosperous nation.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment