Energising the energy supply

View(s):It is only a matter of few days more for the opening of Initial Public Offering (IPO) of the LTL Holdings to transform it to a public limited company. With over Rs.125 billion asset base, LTL Holdings is set to be one of the largest

Sri Lankan companies ever listed on the Colombo Stock Exchange (CSE).

LTL Holdings specialises in the power sector, offering a wide range of services, including manufacturing, heavy engineering, power generation, and engineering services. It also has its outbound investments in Bangladesh, India and Nepal, while its manufactured products and services are exported to over 30 countries worldwide. Accordingly, over half of the annaul income of the LTL Holdings originates from abroad in foreign exchange.

The establishment of the LTL Holdings Company is one of the innovative and timely steps taken by the Ceylon Electricity Board (CEB) some 40 years ago. Today, it is the holding company of many power plants built and operated in

Sri Lanka as its subsidiaries and sub-subsidiries.

It was just two weeks ago that the LTL Holdings entered an MOU with the Petronet LNG India to supply natural gas to the Sobadhanavi LNG plant. With 60 per cent plant factor, Sobadhanavi needs 40 containers of natural gas supply each day for its operations, while it has the gas storage capacity for three days of electricity generation.

Power crisis

It was in 2022 that Sri Lanka faced its worst power crisis as part of the counry’s economic crisis. Daily power cuts were extended for more than half of the day. About 35 – 40 coal ships, each one carrying about 60 metric tonnes, should arrive in Puttalam every year, avoiding rough-sea season. Then, coal should be unloaded and stored for electricity generation from the Norochchlai Coal Power Plant.

While the country’s foreign exchange earnings were plummeting and the Central Bank’s foreign reserves were depleting, the CEB also faced a dwindling cash flow. It didn’t have enough rupee income from electricity supply to buy dollars and, neither had the banks earned enough foreign exchange to meet customer demand. As credit rating had gone down, the suppliers of coal, fuel, and gas were demanding on-the-spot payments for unloading the shipments.

While the country’s foreign exchange earnings were plummeting and the Central Bank’s foreign reserves were depleting, the CEB also faced a dwindling cash flow. It didn’t have enough rupee income from electricity supply to buy dollars and, neither had the banks earned enough foreign exchange to meet customer demand. As credit rating had gone down, the suppliers of coal, fuel, and gas were demanding on-the-spot payments for unloading the shipments.

What had gone wrong? Among other things, typically electricity prices were determined by political decisions rather than the economic principles. Electricity tariffs to the customers, reduced by 25 per cent in 2014, continued to be less than its costs incurring accumulated losses in billions of rupees.

The CEB’s piled up debt to the banks was about Rs. 320 billion (endangering the banks too), and to the Ceylon Petroleum Corporations (CPC) about Rs. 136 billion for fuel purchases to generate electricity. In addition, it had not paid the dues for months to the independent power suppliers, including the subsidiaries of the LTL Holdings, West Coast Power Company, and other small-scale power producers. And many of them too had already defaulted their debt obligations to the banks and had faced with the problem of surviving their businesses.

Recovery and progress

In the midst of Sri Lanka’s economic crisis, the CEB had to be rescued. If not, it would not be the only one to collapse, but also the other businesses that it had driven into the risks – the banks, the CPC, independent power suppliers. Neither would the destruction end there.

It was at this point that the electricity tariffs were raised on average by 75 per cent enabling it to restructure its own debt portfolio and to rescue its suppliers. It was the tariff revision and the financial restructuring that reversed the country’s energy crisis.

It was at this point that the electricity tariffs were raised on average by 75 per cent enabling it to restructure its own debt portfolio and to rescue its suppliers. It was the tariff revision and the financial restructuring that reversed the country’s energy crisis.

By June 2024, the initial reforms at the CEB have been bearing the fruits. The CEB loss Rs. 14.02 from every electricity unit (KWh) in 2022, turned to be a profit of Rs. 4.33 in 2023 and in the first half of 2024. Accordingly, the CEB made Rs. 61 billion profits in 2023, and Rs. 119 billion during Jan-Jun 2024. This has enabled the CPC to settle its dues to the power suppliers and to reduce its overdue loan repayments.

However, the energy sector reforms need to be continued in order to guarantee the future demand-driven energy supply efficiently and effectively. The world has been changing rapidly in terms of energy supply through reforms aimed at establishing new models that are innovative and competitive. Accordingly, in Sri Lanka reforms in the energy sector have only begun now.

Long way forward

Basically, electricity is a ‘non-tradable’ commodity in the

Sri Lankan context in a sense that its generation, transmission and distribution take place only within the local market. Nevertheless, all around the world, it is a ‘tradable’ commodity, ensuring competitive tariffs, cost advantage, quality maintanace and efficient delivery.

It is quite common that electricity is traded internationally across the borders deriving mutual benefits to partner countries. In terms of energy supply and demand,

Sri Lanka has a long way to go with reforms enabling it to be a competitive tradable commodity.

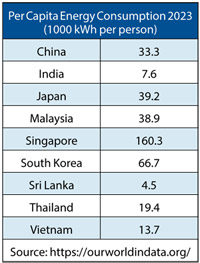

Sri Lanka’s energy consumption is one of the lowest in Asia: Per capita energy consumption in 2023 was 4,500 kWh in Sri Lanka, compared with 7,600 in India, 19,000 in Thailand, 33,300 in China, 38,900 in Malaysia, and 66,700 in South Korea. Singapore has the highest energy consumption in Asia at 160,300 kWh per person.

Lower energy consumption figures indicate the lack of commercialisation and industrialisation on the one hand, and keeping “the cities and roads in dark in the night” on the other hand.

Peak demand for electricity in Sri Lanka occurs in the evening, officially from 6:30pm to 10:30pm. It is commonly understood that this is due to the increase in residential electricity consumption to its peak level. Nevertheless, this is an indicator of the underdeveloped nature of the economy. In many other countries in the region with developed commercial and industrial sectors, the peak demand for electricity begin to rise in the morning rather than in the evening.

Future challenges

Accessability, affordability, availability, and reliability are often considered to be the foundational pillars of energy sector development. It is clear that all of these principles are equally important for achieving both efficiency and equity in energy supply.

Nevertheless, problems arise as there is room for “compromise” guided by non-economic motives through political interference and corrupt practices, which lead to a distortion of a balanced approach.

While Sri Lanka has ensured

100 per cent accessibility, many countries in the world other than in the African region, have already reached this level. Given the environmental concerns and climate change, the world is advancing in the direction of clean energy and renewable energy, reducing the use of fossil fuel as a source of energy. In adhering to the international conventions and protocols,

Sri Lanka has also declaired its commitment in the same direction.

In conclusion, it is apt to outline Sri Lanka’s future challenges in electricity generation. The country needs to be ready with new regulations and new approaches to meet the growing demand for electricity. Obviously, this requirement is subject to the country’s ability and capacity to ensure its long-term economic progress during this post-crisis era.

With already commited stringent limits on government spending and borrowing requirements, the country must rely more on “out of the box” models for investment in energy production and energy trading. In this respect, the reform process should not distort; it is necessary to enhance further the achievements of non-political reforms balancing the principles of energy supply and ensuring transition to cleaner and renewable energy sources.

By the way, after all these are times in which there is “competitive bidding for non-existent resources”. If there is any election promise to revise the electricity tariffs, I hope that it does not mean “reversing the progress” achieved so far.

(The writer is Emeritus Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk and follow on Twitter @SirimalAshoka).

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!