Columns

Sustaining improvement in external finances vital for economic growth

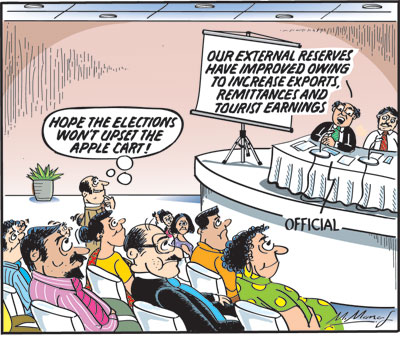

View(s):An increase in export revenue, inward remittances, and earnings from tourism resulted in an improvement in the balance of payments and an increase in gross external reserves to US$ 5.7 billion at the end of June.

These favourable developments continued to increase external reserves to over US$ 6 billion at the end of July. Sustaining and enhancing this improvement is of crucial importance to enable the repayment of foreign debt.

Preoccupation

This improvement in the external finances has been achieved in spite of the nation’s preoccupation with the presidential election.

External reserves

At the end of June, gross external reserves had risen to US$ 5.7 billion. Of this, about US$ 1.4 billion is in Yuan, which is only usable for Chinese imports.

Favourable factors

Increased export revenue, remittances, and earnings from tourism accounted for this balance of payments surplus at the end of June.

Exports

Exports of merchandise goods, as well as services, increased. Remittances and earnings from tourism have increased significantly. Consequently, foreign reserves that increased to US$ 5.7 billion at the end of June are likely to have increased to over US$ 6 billion at the end of July.

Merchandise exports

Merchandise exports have increased in tandem with increased exports of services, especially information and communication technology (ICT) services. However, due to an increase in imports from US$ 8.1 to 8.6 billion, the trade deficit widened from US$ 2.3 billion to US$ 2.5 billion by June 2024.

BOP

The balance of payments has improved due to the upward trend in remittances, and earnings from tourism have improved the balance of payments and increased foreign reserves.

Remittances and tourism

The two strengths of the external finances—remittances and tourism earnings—have shown further improvement and contributed significantly to the external finances.

Tourist earnings accounted for US$ 0.87 billion in the first half of 2023. They increased to US$ 1.5 billion in the first six months of this year. Remittances brought in US$ 2.8 billion in the first half of last year, and in the first six months of this year, they rose to US$ 3.1 billion.

External reserves

These improvements in the balance of payments have enhanced the external reserves to US$ 5.7 billion in the first half of this year. Both earnings from tourism and remittances from abroad have continued to increase in July and August.

Prospects

There is a prospect of foreign reserves rising further by the end of the year if there are no disruptions due to the elections and global conditions do not affect trade, tourism and remittances.

Trade

The most noteworthy achievement this year has been the resurgence in exports. In the first six months of 2024, merchandise exports increased from US$ 5-9 to 6.1 billion.

Reversal

The most noteworthy achievement is the reversal of the declining trend in exports of garments. Garment exports increased in the first six months, compared to the same period last year, perhaps due to the disruption of garment exports from Bangladesh.

Agriculture

Agricultural exports too increased. Tea exports that had declined earlier picked up and increased in the first six months compared to the same period last year. Other agricultural exports too increased.

Trade deficit

In spite of these performances in exports, the trade deficit increased to US$ 2.5 billion compared to a trade deficit of US$ 2.3 billion in the first six months of last year.

Balance of payments

The export revenue increase, higher earnings from tourism and increased remittances resulted in a balance of payments surplus to enhance the external reserves to US$ 5.7 billion.

Uncertain

Despite the improvements in the external finances, the prospect of a continuous improvement in the balance of payments is uncertain. There are several risks and uncertainties that could reverse the trends discussed earlier.

Remittance dependence

The high dependence on remittances and earnings from tourism are risk prone. The growing insecurity in West Asia could result in a repatriation of our workers there. This could affect about half of the remittances we receive. That would be a significant decrease in remittances that would make a dent in our external finances.

Tourism

Tourism earnings, which have been on an uptrend could also be affected by the elections this month. Both prior to the elections and after the elections, foreigners would be cautious about coming to the country. This will be compounded if there is a political crisis and social unrest once the results are known.

Merchandise exports

The escalation of the war between Russia and Ukraine could result in a setback to tourism if travel costs increase to depress tourist travel from western countries.

Exports

Garment exports and other industrial exports could be adversely affected if there is an increase in costs of shipping to western countries that account for about a quarter of our industrial exports.

Imports

Furthermore, there could be an escalation of import prices, particularly of fuel, fertiliser, and food. Such an escalation could increase the import bill substantially.

Risks

These downside risks would affect the balance of trade and balance of payments adversely. Moreover, political developments in the country after the presidential elections could have a bearing on foreign assistance and foreign investment.

Imports

It is, therefore, prudent to ensure that imports are not liberalised much and a greater amount of import substitution is achieved.

ICT services

In this unstable environment, increased earnings from ICT services could be invaluable. As the performances of these services have shown, there is much potential for increasing earnings from them.

Focus on elections

The nation’s preoccupation has been with the forthcoming presidential election rather than the economy that will matter whoever becomes the president. The extravagant promises made of conferring a host of benefits are dependent on a much better improvement in the economy.

While the country is focused on the presidential election on the 21st of this month, the growth of the economy is vital to fulfilling the expectations of the electorate.

The improvement in the country’s external finances is crucial but insufficient for this. Conversely, the consequences of giving the promised benefits could destabilise the economy.

In conclusion

Despite the nation’s preoccupation with the September 21st election, the country’s external finances have improved. It is vital that this improvement is enhanced by a climate conducive to economic growth. A further increase in exports is vital for this.

Promises

Once again, the elections have become a “truckling to the multitude,” “an auctioning of unavailable rresources, and the promise of prosperity like we have never had before.

Political leaders aspiring to be the next president of the republic are promising a transformation of the nation’s economy and political culture. This would indeed be more than a transformation; it would be a transfiguration of politics.

Final word

Good politics is bad economics, but bad economics is good politics in the short run. Good economics is good politics in the long run.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment