Easy choices and tough choices

View(s):George is not only a frequent visitor to Sri Lanka but also a matured intellectual who has knowledge about many areas of our political economy, covering the good, the bad, and the ugly all. When such a person has an intellectual perspective about our ‘state-of-affairs’, we can understand that it is an objective comprehension.

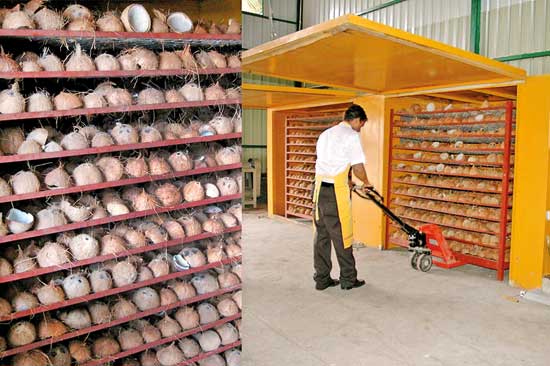

Sri Lanka needs to expand its exports. In the picture are coconut products for export.

A mind map

Sometimes he used to send me his comments on my writings in this column as well, while we have also met a couple of times. When he was here for the last time a couple of months ago, he gave me a simple “mind map” drawn on the computer.

A mind map is a study tool that can be used to understand a difficult concept or an issue, surrounded by a network of complex relationships. George’s mind map is about getting the Sri Lankan economy out of the crisis and keeping it on a progressive track.

It suggests that there are five critically important areas that require political and policy focus as the cornerstones for economic recovery and progress. And then, it shows the surrounding issues and relationships with boxes and arrows which would be resolved automatically, when the five key areas are being addressed directly with the priority.

The five key areas of the mind map are (a) increase exports, (b) reduce corruption, (c) finalise debt restructuring agreements, (d) improve taxation and, (e) cut down government spending. As we know now, the third key area, finalising debt restructuring is already completed, but the progress in all other four areas are yet to be seen in the coming years.

All five cornerstones are inter-connected among themselves and connected with other surrounding issues and relationships. Towards the end of our discussion today, we may be able to grasp the surrounding issues and complex relationships to the five key areas.

Third Review by IMF

I remembered George’s mind map and thought of making use of it for our discussion today, after I had the opportunity this week to read two important documents: The first is the President’s Policy Statement that he delivered at the opening day of the Parliament on November 21 and the second is the Press Release of the IMF mission after its Third Review under Sri Lanka’s Extended Fund Facility (EFF) arrangement on the following day, 22 November.

The “easiest choice” that the new government can make to achieve economic stability and debt sustainability is “to stay on track” despite pre-election rhetoric. In principle, the government seems to be committed to maintain the same track that had already been prepared during the past two years, while the President’s policy statement confirms this.

The “easiest choice” that the new government can make to achieve economic stability and debt sustainability is “to stay on track” despite pre-election rhetoric. In principle, the government seems to be committed to maintain the same track that had already been prepared during the past two years, while the President’s policy statement confirms this.

It is an important decision made by the new government rather than messing up the track with alternative experiments at least for two reasons: The first is that its difficult part is already completed by the previous regime which also had a political cost; the regime was overthrown at the elections.

The second is that the IMF-supported recovery programme, whatever its hardship that fell on the general public, has already been bearing fruits; fiscal consolidation has improved, inflation has subsided, exchange rate has stabilised, and economic contraction has come to an end.

The Press Release issued by the IMF, concluding the third review states that “IMF staff and the Sri Lankan authorities have reached staff-level agreement on economic policies to conclude the third review of

Sri Lanka’s economic reform programme supported by the IMF’s Extended Fund Facility (EFF)”. The policy statement issued by the President, while acknowledging the fact “…that even the smallest error could have significant repercussions due to the scale of the crisis”, clearly spells out the government’s commitment in moving forward with the IMF-supported programme.

Debt sustainability

One of the key problems of achieving debt sustainability as per the debt sustainability targets by 2032 has already been resolved; that is domestic and external debt restructuring. Its final step was the agreement that the government reached with the international sovereign bond (ISB) holders, which has also been acknowledged by the IMF.

The finalisation of debt restructuring in agreement with the lenders will improve

Sri Lanka’s financial stability and help in achieving fiscal consolidation. There are two sides for the fiscal consolidation as tax administration and expenditure management.

On the part of the expenditure side, the NPP government has been keen in cutting down expenditure on maintaining governmental and political apparatus which is considered to be excessive and wasteful. Although it may add a little relief to the government’s spending, the need for further expanding the social protection programme, Aswesuma, requires an increase in spending.

Fiscal challenge

On the revenue side, the need for increasing tax revenue through widened tax base remains a medium-term challenging task. Although the government has been able to increase tax revenue, a few hundred thousand income tax files for a 22-million population seem to be too small. And the IMF proposal of property tax doesn’t seem to be a viable revenue option for the government.

Apart from that the government is not keen in implementing the proposed state-owned enterprise (SOE) reforms either. While some of the reforms have already been either reversed or halted, the new plans for eliminating their fiscal burden, improving competitiveness and achieving operational efficiency are yet to be unveiled. If such unseen plans fail, the choices could be tough too.

IMF does not suggest policy options or impose conditionalities on SOE reforms, while how to entertain trade union pressure is totally up to the government. Since the IMF interest is more about the outcome, as long as the government “stays on track”, how the government maintains the track is not an issue for the IMF.

Exports and corruption

Fiscal consolidation is not yet completed, while its potential progress seems to have been challenged by the new developments. The government, which has been continuing to borrow from the domestic sources, was yet to reach its medium-term targets on gross financing needs on its path to fiscal consolidation and debt sustainability.

All that is achieved over the past two years were due to immense sacrifice of the general public who somehow tolerated two knockout punches: the economic crisis impact as well as the harsh policy response to the crisis. The achievement should be sustained, and the people’s hardship should be lifted only through export growth. And the irony is that, despite rhetoric we are still far from being there.

In the first place, Sri Lanka’s economic crisis is primarily a foreign exchange crisis due to the country’s inability to earn foreign exchange to maintain external finance balance and to meet maturing foreign debt obligations. Thus, export growth is fundamental to sustaining fiscal consolidation and debt sustainability. It is also fundamental to sustain long-term economic growth which has now turned to be positive due to unutilised capacity utilisation.

Fundamental reforms

As we have discussed on many occasions previously in this column, it requires nothing other than reforms in policies, regulations and institutions as well as investor confidence. This is the most challenging task for the government because it is naturally a difficult task due to both external and internal resistance to change on the one hand and due to complexity of the reform procedures on the other hand.

The government is, however, keen in addressing the issue of corruption and establishing a system of clean governance, as was raised in the IMF’s governance report as well. This is essentially a positive step towards building investor confidence, because corruption and governance issues were critically important obstacles to the country’s investment promotion and, thereby export growth in the past.

Accordingly, ‘staying on the track’ should be accompanied by not only a system of ‘clean governance’ but also a ‘bold reform’ programme, aimed at investment promotion and export growth.

(The writer is Emeritus Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk and

follow on Twitter @SirimalAshoka).

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!