Columns

Increased government expenditure threat to fiscal stability and economic growth

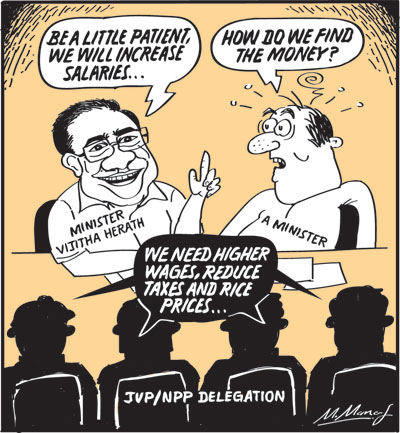

View(s):The promise of increasing salaries, welfare payments, flood relief, and fertiliser subsidies, while reducing taxes, is likely to widen the already high fiscal deficit, pose a threat to financial stability, and retard economic growth.

Election promises of giving unavailable resources have been a foremost cause for high fiscal deficits that have destabilised the economy. Once again, we need to stress that fulfilling election promises could increase the fiscal deficit, destabilise the economy, and retard economic growth. In addition, the government has to incur unforeseen expenditures due to floods in most parts of the island.

Breaking promise

Paradoxically, the government’s promise of a rich and beautiful country for all could be undermined by fulfilling election promises. Hopefully, there will be a way to avoid this.

Public finances

The government’s finances would be drained by the enormous costs of increasing the wages of public sector employees, including doctors, teachers, and other professionals.

These expenditures, together with increased poor relief by the expansion of the aswesuma, compensation for farmers who suffered crop damage, and the fertiliser subsidy, are likely to widen the fiscal deficit. The widened fiscal deficit would in turn destabilise the economy.

The economic stability could be undermined if the government fulfils extravagant election promises and incurs additional expenditure due to flood damage, subsidies, and poor relief. Consequently, these measures could breach the conditions of the IMF agreement and threaten its continuance.

Discontent

Amidst this economic bind, high prices and shortages of essential foods are leading to popular discontent with the new government. If corrective measures are not taken, the escalation of prices and shortages of essentials could even lead to mass discontent and political upheavals.

Economic stability

While economic stability could be threatened by increased government expenditure to fulfil extravagant election promises, increased expenditure due to the recent floods and natural disasters, as discussed in last Sunday’s column, would increase the fiscal deficit and destabilise the economy.

The increased expenditure the government has to spend due to the unforeseen flood crisis, and the increases in wages and social security while reducing income taxes, VAT, and other indirect taxes, will undoubtedly expand the fiscal deficit.

IMF agreement

The IMF’s Extended Fund Facility (EFF) could be at risk of being discontinued if these additional expenditures widen the fiscal deficit. This would have far-reaching adverse consequences for the economy.

IMF conditions

How will the government comply with the IMF’s condition of reducing the fiscal deficit? Will the IMF be sensitive to these difficulties and readjust and modify its conditions for continuing the Extended Fund Facility (EFF)?

Aid

Foreign assistance to meet the expenditure due to the floods, poverty alleviation, and food needs could reduce the fiscal deficit. There are some indications that such assistance is forthcoming. They are invaluable in the current context of containing the fiscal deficit.

Savings

The expected savings from wasteful government expenditure are not likely to be sufficient to offset the increase in expenditure.

Long-term

The government has plans and policies for fiscal consolidation. On the expenditure side, it expects to reduce expenditure by curtailing wasteful expenditure. For instance, it intends to close down some diplomatic missions that serve no useful national service. The embassy in the Seychelles is one such closure. There would be a downsizing of other embassies too.

Defence

Similarly, government expenditure on defence, MPs’ privileges, or perquisites (perks) would be curtailed. Unproductive infrastructure projects that have been white elephants would be used productively or sold. The recent announcement to use state-owned residences or other amenities for productive purposes is a good example of this. These would, however, take time to materialise.

Fiscal deficit

The fiscal deficit that was expected to be contained at around 5 percent of GDP is likely to increase due to increases in wages, salaries, pensions, and enhancement of social expenditure. In addition, the unexpected expenditure on assistance to families affected by the floods and reconstruction would increase expenditure.

Consequently, the continuation of the IMF agreement is in doubt. The discontinuance of the IMF relationship would make economic stabilisation onerous, if not impossible.

Concluding reflection

Amidst popular discontent owing to the high prices of rice and coconuts, the escalation of prices and shortages of essentials are causing severe difficulties for people. The government’s policies of intervention in the rice market could aggravate the problem. Price controls could create shortages and further price increases. The political, social, and economic implications of this will unfold in due course.

Increased expenditure

More significant than this turbulence in prices is the destabilisation of the economy owing to the increase in government expenditure.

The fiscal deficit that was expected to be contained at around 5 percent of GDP is likely to increase in the Budget for 2025 owing to increases in public sector salaries, pensions, and social expenditures. In addition, the unexpected expenditure on assistance to families affected by the floods and reconstruction would increase the financial burden.

The expected savings from wasteful government expenditure are not likely to be sufficient to offset the increase in expenditure. Consequently, the continuation of the IMF agreement is in doubt. The discontinuance of the IMF relationship would make economic stabilisation onerous, if not impossible.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment