Columns

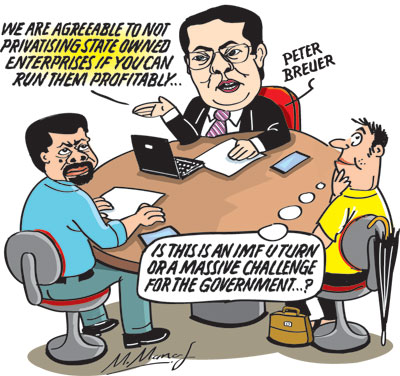

IMF’s nod for non-privatisation of SOEs: Tough challenge for Govt. to run them efficiently

View(s):In a surprising policy change, the International Monetary Fund (IMF) has agreed to drop its requirement for the privatisation of loss-making state-owned enterprises as a condition for continuing its Extended Fund Facility (EFF).

The focus will now be on how the government will run these enterprises without incurring losses that burden the public finances. This is a massive challenge when considering the SOE’s long history of loss-making and inefficient management. Reducing their losses is imperative to contain the fiscal deficit.

Change

The IMF’s Sri Lanka mission chief, Peter Breuer, said the Fund had agreed to allow Sri Lanka’s state-owned enterprises (SOEs) to remain either state-owned or be privatised, as the government resisted the restructuring of several loss-making SOEs.

He said, “It is crucial that SOEs are managed in a prudent manner to avoid the accumulation of losses or debts that would eventually need to be paid by taxpayers.”

Restructuring

Breuer also observed that “SOEs can be managed prudently while remaining state-owned, or they can be divested, partially or completely. The authorities have emphasised their commitment to ensuring that these enterprises do not become a burden for the budget or government debt.”

Background

The JVP/NPP’s election manifesto was clear that they would not privatise the SOEs. On the other hand, one of the important conditions for the continuation of the IMF’s Extended Fund Facility (EFF) has been the privatisation of lossmaking SOEs.

Reversal

The IMF condition of privatising lossmaking SOEs was considered inviolable. While commentators were waiting to see how this stalemate would be resolved, the surprising news was that the IMF had agreed to the government’s decision to not privatise state enterprises.

Speculation

One can only speculate why the IMF dropped one of its most important conditions attached to the EFF. Was it a realisation that if the IMF insists on it, the EFF arrangement would be abrogated and the IMF would be considered a failure? Or was the IMF convinced that the new administration would be able to run the SOEs without incurring losses?

Transformation

Is the IMF coming to terms with the view that the country will achieve a social and political transformation that will, in turn, enable an efficient running of SOEs? Or is it a fear that the discontinuance of the IMF agreement would push the dependence of the government elsewhere?

Achievement

Whatever the reasons, the privatisation of SOEs is not on the cards. It is certainly a huge achievement for the government. Had the government begun a privatisation programme, its popularity would have eroded.

Challenge

Nevertheless, now the government has a huge challenge of ensuring that the SOEs are run efficiently. This is no easy task, as the reasons for their lossmaking are many and difficult to rectify.

Incompetence

At the helm of many of these SOEs are incompetent and corrupt heads. Their removal and replacement by honest and competent persons are vital. This is the easiest of tasks. It only requires the good intent of the party leadership. Already there are some good appointments as heads of state entities. However, it may not be as easy as it seems, as there would be political compulsions that are not easily ignored.

Management

These enterprises must be managed by boards of directors who must ensure that they are run efficiently and responsibly, as is the case in the private sector. Will the government entrust these enterprises to such competent and responsible, business-minded technocrats?

Overcrowding

Another precondition that is far more difficult to achieve is the reduction of excessive staff. State corporations have been the repository of a large number of incompetent workers. They have been job banks for ministers and MPs over many years. How will the government downsize these and make their workforce competent, efficient, and hard-working?

Non-profit

There are good reasons for certain SOEs to be run not for profit but for the public good and social welfare. For instance, there are good reasons why both rail and bus transport should not be run at a profit. Their services benefit low-income passengers, especially those in remote areas.

Buses

For instance, private buses will not serve remote areas at an operational loss. However, it is important that people in such areas are provided with transport facilities. This is especially so in respect of schoolchildren.

Railway

Similarly, there is a large workforce that travels to Colombo daily by train. They travel from distant places. They are able to travel to Colombo owing to the subsidised season tickets.

Electricity

The pricing of electricity too should be done on the basis of national interest and social welfare. The criteria for efficient operation of the Ceylon Electricity Board (CEB) should not be profit. Electricity pricing should be on the basis of economic benefits, social needs, and welfare. Efficiency could be judged on the criteria of the cost of generation.

Economic criteria

There is a compelling rationale to charge a low tariff on electricity for industrial purposes. The price of electricity for industry is high compared to those in other countries. There should be a subsidised price for export industries to make our exports more competitive as well as to attract foreign and local investment in exports.

Similarly, the pricing of electricity for domestic use should be progressive. Homes consuming low electricity should be charged a low price, while high domestic consumers should be on a high tariff. This may have an additional benefit of conserving electricity consumption.

Private partnerships

The decision to not privatise should not preclude public-private partnerships that could infuse fresh capital as well as more efficient management of public enterprises.

Fiscal deficit

Irrespective of the IMF condition of reducing the fiscal deficit, it is imperative for economic stability. The decision to not privatise should not result in an increase in public expenditure that derails fiscal consolidation. As the reduction of losses in public enterprises cannot be achieved immediately, there is a need to reduce other expenditures as well as increase revenue.

Conclusion

The decision to not privatise SOEs bestows a huge responsibility and enormous challenge to transform them into efficient enterprises. The success or failure will have significant financial implications for the economy.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment