Columns

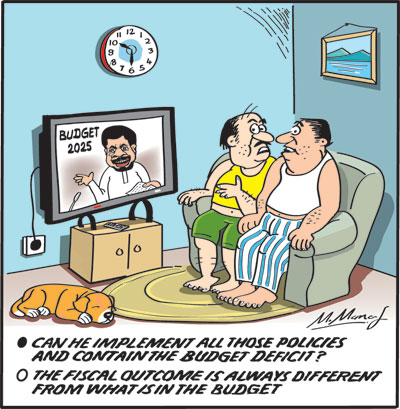

Budget 2025: Formidable challenge of containing the fiscal deficit while increasing expenditure

View(s):The 2025 budget presented by the president last Monday sought to give relief to lower-income earners and the poor, contain the fiscal deficit, achieve economic stability, and promote economic growth. Each of these objectives is difficult to achieve in the current financial bind; achieving all of them would be a formidable achievement.

Significance

The significance of the government’s maiden budget is that it discloses the new administration’s economic policy framework. It clarifies the government’s economic policies rather than the promises it made in its election manifesto and at the two elections. The opposition has criticised it for this reason. Nevertheless, the approach of the government is more pragmatic.

Relief

The budget gives relief to the lower-income earners, as promised in the JVP/NPP manifesto and election rallies. However, they are much less than expected and in phases as feasible in the current economic and financial bind.

Fiscal deficit

Containing the fiscal deficit to 4.3 percent of GDP to achieve economic stability and growth and increasing expenditure on salaries, pensions, health, education, social security, and subsidies are formidable economic challenges at the best of times. Curtailing government expenditure that is wasteful and increasing taxes on the affluent are expected to provide the fiscal space for the increased expenditure.

Outcome

As usual, the budget for 2025 was able to show a fiscal deficit of less than 5 percent of GDP by increasing revenue collection and lowering government expenditure in some areas while increasing expenditure on salary increases, health, education, social security, and poor relief. The higher expenditures have to be met with the fiscal deficit being contained within 5 percent of GDP as required by the IMF conditions for the Extended Finance Facility (EFF). In fact the primary fiscal deficit (excluding interest payments) is contained at 4.3 percent of GDP.

Critical issue

The critical issue is whether these fiscal outcomes would be realised. Expenditure overruns and revenue shortfalls have been regular features of our fiscal history. Nevertheless, we must hope that this year’s fiscal outturn will achieve the desired deficit of 5 percent of GDP or less. The government expects to usher in a just and equitable economy, contain the fiscal deficit to 4.3 percent of GDP, and achieve growth. Only time will tell whether these objectives will be realised.

Criticism

Opposition MPs have criticised the government for deviating from the policies in the JVP/NPP manifesto, especially the continuation of the IMF Extended Fund Facility. Economists and officials have pointed out that it was a pragmatic and even mandatory decision.

Budget deficit

The budget for 2025 was able to show a primary fiscal deficit (excluding interest payments) of less than 5 percent of GDP, as required by the IMF. by increased revenue collection and lower government expenditure in some areas, while increasing expenditure on health, education and poor relief and increasing public service salaries.

The higher expenditures have to be met with the fiscal deficit being contained within 5 percent (4.3 percent) of GDP, as required by the IMF conditions for the Extended Fund Facility (EFF). The critical issue is whether the required fiscal outcomes could be realised by the budget proposals.

Expenditure overruns and revenue shortfalls have been regular features of our fiscal history. There are many reasons to think that this year’s fiscal outturn will not achieve the desired deficit of 5 percent of GDP. Hopefully, the deficit will be contained below 5 percent of GDP.

Expenditure

On the expenditure side, the government is committed to increasing salaries, pensions, and social security payments; increasing subsidies for agriculture; and higher expenditure on education and health. These are desirable and necessary expenditures, but they are a severe strain on the public finances.

Revenue

On the revenue side, the government expects an increase in income taxes due to both higher taxes and improved compliance. The import of motor cars to a total import cost of US$ 1.2 billion is expected to increase revenue from import duties. The sale of state-owned luxury motor vehicles and some state properties are expected to rake in revenue. These are, however, uncertain.

Downside

On the other hand, loss-making state-owned enterprises (SOEs) will not be privatised, and income taxes and the VAT on many consumer items will be reduced. These are threats to fiscal stability.

Reduced expenditure

The curtailment of wasteful expenditure is expected to reduce government expenditure. However, the huge expenditure on the salaries and pensions of the highly bloated public service and the huge expenditure on the large defence forces remain an inflexible public expenditure. In addition, the losses in state enterprises could be a severe strain on the budget as they would require increased government expenditure.

Fiscal deficit

The containment of the fiscal deficit may prove to be the severest economic challenge for the government in 2025. The thrust of economic policies has been to increase government expenditure. In spite of pursuing a revenue-enhancing strategy, there have been some expenditure reduction efforts as well.

Election promises

The fulfilment of election promises to enhance government expenditure, as well as to provide tax reliefs and increase social security payments, is likely to widen the fiscal deficit. In addition, the damages caused by floods and the recent natural disasters and the enhanced fertiliser subsidy to farmers would increase government expenditure significantly.

Wasteful

The only signs of a curtailment in government expenditure have been the reduction of wasteful government expenditure, such as on ceremonies, perks to ministers, the upkeep and security of past presidents, and the reduction in overseas costs of foreign missions. While these are essential austerity measures, their impact on the reduction of government expenditure may not be significant enough to cause a dent in the public expenditure. A two-pronged strategy to increase revenue collection while reducing government expenditure is needed to achieve fiscal consolidation.

Conclusion

Resolving the country’s economic problems is a formidable task. The popular expectations are, however, high that there would be increased public expenditure that would benefit people, while reduced taxation would provide relief to workers and professionals. Such a prospect is unlikely in an economy that is struggling to achieve economic stability while facing serious international uncertainties and external challenges.

Final word

The popular understanding and expectations on public finances are based on two faulty pillars of inexhaustible and unlimited government finances and the government’s ability to distribute these in any manner. This mindset that is exploited by politicians is a serious threat to fiscal consolidation, economic stability and development.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment