Columns

Sustaining the momentum from recovery to growth

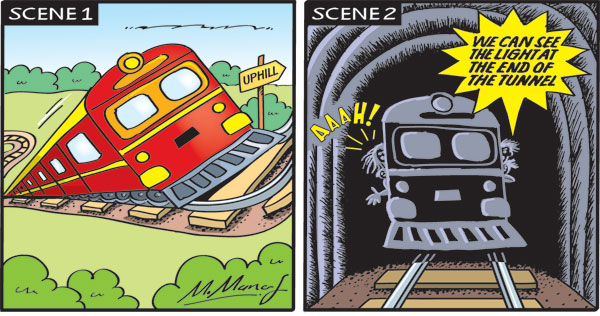

View(s):The economy has moved from a crisis to a recovery. Economic growth is expected to be 5 percent this year to reach the level of national output prior to the 2018-19 economic crisis. Sustaining this economic growth momentum is the national challenge.

Remarkable performance

The International Monetary Fund (IMF) has described this economic performance as “remarkable.” However, it has cautioned against complacency and neglect of reforms and the pursuit of policies to stabilise and promote growth.

Growth

The economy that regressed in the past few years has stabilised and grown to offset the decline after the economic crisis. This year’s expected 5 percent growth would enable the economy to reach the GDP level of 2018-19, from which it had declined.

Remarkable

The IMF has described this economic performance as “remarkable,” but warned of slippages if the reform agenda is not pursued. Whether this advice is followed may determine the economic future of the country.

Reforms

The implementation of reforms is difficult owing to political compulsions and ideological biases of the governing party. This is especially so in respect of privatising loss-making state-owned enterprises (SOEs).

The government has stated categorically that it will not privatise state-owned enterprises. This appeared to be a violation of the IMF conditions for its facility. However, there appears to be a change in IMF policy.

Policy change

In its latest statement, the IMF has said that the privatisation of SOEs is not mandatory if they could be run efficiently. This is an unexpected change in policy. Is it a challenge to the government or an IMF experiment?

IMF facility

The satisfaction of the IMF with the economic progress of the country and the implementation of reforms has resulted in the IMF Executive Board approving another tranche of the Extended Finance Facility (EFF)—about US$334 million from the total of about US$3 billion.

Foreign reserves

The country’s foreign reserves increased to US$ 6.1 billion at the end of February. Furthermore, the balance of payments was in surplus due to increased inward remittances, earnings from tourism, and higher ICT earnings.

Trade deficit

In contrast, the weakness in the balance of payments continues to be the trade balance that is persistently in deficit owing to merchandise imports surpassing export earnings. Consequently, the country continues with persistent trade deficits.

This fundamental weakness and vulnerability in Sri Lanka’s trade has to be addressed through comprehensive trade policy reforms as well as economic policies that make the country’s exports competitive in the international market.

Economic uncertainties

Sri Lanka’s economic recovery may face severe setbacks as a consequence of the emerging ‘international economic disorder.’ Trade restrictions and a global recession could affect our exports and tourist earnings adversely.

However, some exporters are of the view that higher tariffs will not apply to small countries and that the current tariff wars may in fact benefit the country, as they are directed at big countries and not at products.

Recapitulation

The IMF is of the view that the reforms adopted by Sri Lanka are bearing fruit and that the economic recovery has been remarkable. Inflation is low, revenue collection is improving, and foreign reserves have risen to US$ 6.1 billion. Economic growth averaged 4.3 percent since the third quarter of 2023, and by the end of last year (2024), real GDP is estimated to have recovered 40 percent of its loss incurred between 2018 and 2023. The economy is expected to grow by 5 percent in 2025.

Despite this “remarkable” growth, the IMF is of the view that the economy is still vulnerable and that it is critical to sustain the reform momentum to ensure macroeconomic stability, debt sustainability, and promote long-term inclusive growth.

Whether political compulsions and ideological factors would derail reforms is the critical issue.

Conclusion

The economy has turned around from a crisis mode to stability and growth. An economic growth of 5 percent is expected this year. This would raise the level of national output to what it was prior to the 2018-19 economic crisis. The IMF has described this economic performance of Sri Lanka as remarkable. However, the IMF has cautioned against neglect of reforms and complacency in pursuing policies to stabilise and promote growth.

The economy that regressed in the past few years has stabilised and grown to offset the decline after the economic crisis. The expected economic growth of 5 percent this year would enable the economy to reach the GDP level of 2018-19 from which it had declined. The IMF has described this economic performance as remarkable but warned of slippages if the reform agenda is not pursued. Whether this advice is followed may determine the economic future of the country.

The implementation of reforms is difficult owing to political compulsions and ideological biases. This is especially so in respect of privatising loss-making state-owned enterprises (SOEs). However, in a surprising turnaround, the IMF has said that the privatisation of state-owned SOEs is not essential. That their efficient management is what is needed. Can we achieve this?

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment