Sunday Times 2

Transparency and accountability of provincial, municipal & urban Councils

View(s):By Dominic L. J. Seneviratne

These councils’ annual revenue and expenses are around Rs. 160 billion. The revenue includes annual grants recommended by the Finance Commission and paid as reduced by the Treasury. Financial accountability of these councils to their ratepayers must be strengthened. There was hardly any in the past and even now and would be for the future unless the system is changed.

For commission and bribe detection, there are control mechanisms. For misuse of council funds, the present mechanism, including their Annual Financial Statements (AFS) prepared for audit, the Auditor General’s report, and the councils’ reply to it, is inadequate.

In the past, we have seen some publicity for the misuse of ratepayers’ funds and central government allocations. Examples are all council members going to China ostensibly to learn its good governance and the construction of large, luxurious, furnished, air-conditioned buildings for the councils. The 10-floor Western Provincial Council building in Battaramulla and the District Office near Lanka Hospitals are two of many throughout the country. There may be more such projects after the local government elections.

In contrast to these, many requirements in local authorities are ignored or given low priority. They are the infrastructure development, e.g., construction and improvements of minor roads, stormwater drainage, street lighting, garbage collection and disposal, public parks, cycling paths, pedestrian walkways, and low-cost housing for the poor, all referred to by councils as development work. The provincial councils must each year decide on such projects in consultation with the respective urban or municipal council.

The websites are a useful means of implementing transparency and accountability. All councils have websites. Their potential must be used fully. Most people are computer literate. All provincial, municipal, and urban councils must be required to publish specified data on their websites. At present, very little important information is readily available to the public.

This culture must change so that reviews of administrators’ works must be currently—not in retrospect—available to the people who should propose constructive—not destructive—change for the better where needed. This will encourage the public to participate and help administrators improve the performance. After an initial period of apathy, the administrators will see the benefit of such coordination. Several countries do this.

As of now, only the Western Provincial Council has posted its 2023 Annual Financial Statement (AFS) and item 3 below on its website in both Sinhala and English, the official link language. Almost all of the other 60 do not have items 1 to 11 below. The omission by almost all is a disastrous failure in transparency and accountability. In recent years, there has been no excuse for failing to make available the required data online. All councils have computer systems. Most public servants in the provincial, municipal, and urban councils are computer literate, and some are trained in designing websites. Moreover, assistance from the Department of State Accounts is available.

Sample check of council websites in November 2024

Sample checks of council websites were done in November 2024 by me for seven municipal councils, three urban councils, and six provincial councils. Over 95% of them do not have the important information listed below.

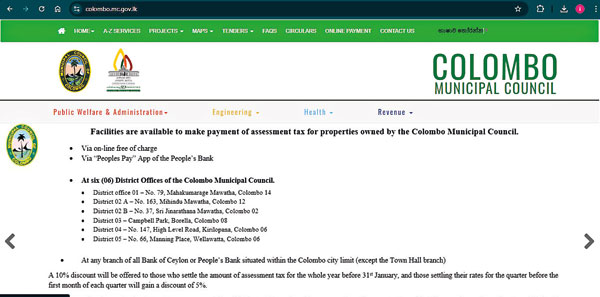

The Western Provincial Council was the best. The Colombo Municipal Council had not posted its Annual Financial Statements (AFS), but what it had been attempting to do was to publish a computer printout of its accounting records. In February 2025, it put on its website a 15-page abridged version of 2023 AFS with access to relevant details. It was developed by me for no fee. Hopefully it will continue. Responses from the Public Administration Ministry’s Home Affairs Division gave the impression that the Right to Information law was adequate to get the required information. It is like using a rickshaw when a passenger liner is available—both are needed.

The implementation of these recommendations will need directives. As these are devolved subjects, the central government cannot give them. The Public Administration Ministry will have to find a way to do it. ‘Advice’ from the President to the nine governors may be the answer. The ministry must take early action.

Recommended information

to be on websites

1) Amounts spent on new development projects such as new roads, cemeteries, incinerators, parks, medical dispensaries, low-cost housing, waste removal, etc.

2) Expenditure on overseas travel, new office buildings, vehicles, and other facilities that are for the exclusive benefit of council members and employees. These are costs that are likely to be abused, as seen in the past.

3) The receipts from rates, rents, etc., and the arrears of these. Arrears are to disclose the efficiency of their collection.

4) A quarterly report should be on the website, in Rs. ‘000s of fixed deposits in banks, arrears of rates, and this as a % (to disclose efficiency of collection of arrears) of total rates; similarly for all licence fees. Expenses & income as in 1, 2, and 3 above, the number separately of casual and permanent employees are all to be for the quarter and to date. These are easily accessible from computers. Description of contracts awarded with total value of each. Description of contracts where they are in arrears for over one year. The impact on readers would be more when they are in table form. This report should be on the web before the end of the month following. These reports must be obligatory and audited by the Auditor General.

5) The names and functions of the several departments (e.g., engineering, personnel, administration, finance, etc.) responsible for each of the different activities of the council. Of the head of each department, the name, designation, telephone extension number for the office, direct line numbers where a secretary will respond, and the postal address and telephone numbers of the council.

6) Names, telephone numbers, and the wards of elected members.

7) Budgets for proposed new development projects and continuing projects for the year and fixed deposits in banks. The WPC had Rs 40 million in fixed deposits in the bank on 31/12/24, instead of being used for development projects in local government areas.

8) The latest Annual Financial Statements (AFS), which are for January to December and available by March/April of the year following, the Auditor General’s report, and the reply. The Treasury’s State Accounts Department confirmed to me that the AFS may have information as decided by each Provincial Council because this is a devolved subject and is not administered by the central government, but it would give assistance if requested.

9) When the website is ready for public viewing, its path should be informed to the ratepayers by a notice in prominent locations in council buildings. It should also be included in the annual rating assessment notices sent in December of each year.

10) Names and phone numbers of Information and Designated Officers for Right to Information letters.

11) When available, how to use the facility for online payments and obtaining application forms prescribed for licences, etc.

A manager who is responsible for promptly updating this data should be appointed. Every day the website must be visited to see whether it is active and immediate action taken when needed.

Substantial amounts are collected at 2% stamp duty on transfers of land. This money is to be used by local authorities to undertake ‘development work.’ At present there is much delay and cumbersome requirements in local authorities receiving the stamp duty. They have to visit several Registrar of Lands offices, examine the land registrations, if any, in its territory, and thereafter claim the refund from the W P Revenue Division Commissioner. A much faster route is available, but only the local authorities want the system changed, and there are no others to take the initiative and do it.

Funds are invested in fixed deposits in banks earning interest. For the WPC, deposits at year-end increased from Rs. 25 million in 2022 to Rs. 40 million in 2024. This money should be used exclusively for development work in local councils as prioritised in consultation with their council members and not left idling in a bank.

Need for a team

There are many areas where system changes in the government sector are long overdue. A team of volunteers who are committed to this task and have experience in administration in both the government and private sectors must be set up. They would have to lobby for the implementation of recommendations and would find a knowledge of Word, Gmail, Sinhala, and a second language useful.

(The writer is a chartered accountant. He can be contacted at admsystemschange@gmail.com.)