News

Online loans trap borrowers in cycle of unregulated debt

View(s):By Mimi Alphonsus and Dilushi Wijesinghe

When 32-year-old teacher Sajeewanie (name changed) borrowed Rs. 5,000 from an online quick loan agency for her wedding, she did not expect it to destroy her life.

A mere week after she took the loan, she owed the agency Rs. 6,900 (with interest). To pay them back, she started taking out more loans from other online agencies at exorbitant interest rates. When she couldn’t cover the entire amount she owed, these companies started calling her friends and family.

“They have access to all my contacts through their app they made me download,” she said. “They even called my students’ parents and published my pictures.” Following the consistent harassment, Sajeewanie wound up in hospital twice after attempting suicide, and her husband is now filing for divorce due to the “humiliation.”

Vimukthi Kaldera - Convener of ‘Rata Samaga Api Ekata’

Online loan platforms such as Siyarata Assets, Camelship, Cash Avatar and Roserloan have been on the rise. According to their country manager, fino.lk and monigo.lk, two online lending sites alone provide around 400 loans each day.

Many platforms, however, resort to harassment like what Sajeewanie faced, to recover their money. A Facebook group with people who were trapped by online loans has over 11,000 members. Vimukthi Kaldera, the moderator of the group and advocate against online loans says there are thousands of victims all around the country.

To take a loan, usually a borrower must download an app that contains software which accesses all their phone data, explained an official at the Sri Lanka Computer Emergency Readiness Team (SLCERT), who requested anonymity. They behave like modern “poli mudalalis”, he said. Companies then threaten to publish photographs, contact employers and take criminal legal proceedings.

The Sunday Times learned of customers who were called by people alleging to be from the courts or the police, complete with police sirens in the background. In some instances, people who were listed as guarantors without their knowledge are harassed with calls and pressured to pay the sum on behalf of the borrower.

The large number of victims is due to the incredibly easy access and difficulty of repaying in full. Most online lenders do not require proof of income. As one service, FastRupee, advertises, “Only valid ID required. No collateral, no pay slips or proofs of billing.” They also do not conduct basic “know your customer” due diligence to ensure that the person applying for the loan is indeed who they say they are. The privacy policy of one service, LoanMe, explicitly acknowledges the possibility that people may be using their service “on behalf” of someone else and only asks that the borrower confirm that they received this third party’s consent when doing so. The Sunday Times found at least one instance of a child borrowing money using their parents’ NIC number.

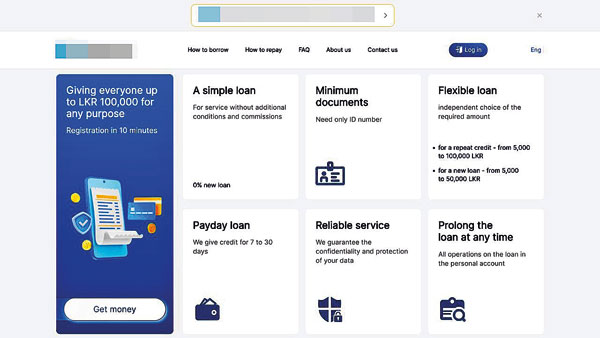

Homepage of an online quick loan agency

The companies are for-profit and advertise themselves for being quick, easy “10-minute” loan providers. They actively encourage people to take loans, and do not assess the reasons for doing so. The Sunday Times registered with one such company but stopped short of taking out a loan. Within a span of three days, we received twenty calls from different numbers promoting the loans and offering discount interest rates.

Repeated text messages offer customers loans even for internet packages, and advertising shows people enjoying shopping or partying thanks to the loan service. Indeed, while some victims have taken out payday loans for legitimate expenses or medical emergencies, many have done so for weddings or other non-essential expenses due to the easy access. No safeguards are in place to ensure that loans are not taken to fuel gambling or alcohol addictions.

Loans are given at excessive per-day interest rates and usually mature within 30-120 days. In a year, the amount due is double, even triple, the principal, further exacerbated by “late fees.” According to one letter of demand from attorney’s representing an online lending company, a woman who borrowed Rs. 50,000 owed them Rs. 105,500 in under 10 months.

These companies operate in a “grey area.” Some online loan platforms do not appear to be registered as companies at all. Many are registered in Sri Lanka while having a foreign parent company. fino.lk and monigo.lk belong to Latvian parent company, Sun Finance. oncredit.lk belongs to Ukrainian company SpaceCrew Finance. StarVIP–which was raided by the Computer Crimes Investigation Division last year–was headed by a Chinese national. Several platforms are owned by the same company, meaning that people like Sajeewanie who borrow money to pay others back are in effect borrowing again and again from the same people.

Latvian SF Group (Fino.lk and Monigo.lk) maintain that they are legitimate businesses filling a glaring gap in the market. “There is a very huge need. Since the beginning we have been growing very fast. People need the money for businesses or for hospital, tuition or utility payments,” said Artjoms Borcovs, country manager of SF Group. He says that traditional bank loans require a lengthy process while their service provides smaller loans quickly.

Justifying the high interest rate, Mr. Borcovs said that it is essential to make up for the high risk of default. He says the reason they have many defaulters is because some people take advantage of the system knowing there are few legal reprisals the company can take, and because companies like his do not have access to the Central Bank of Sri Lanka’s credit scoring information to identify regular defaulters. Mr. Borcovs denied allegations that they were involved in harassing their clients and said they only remind customers of their due payments via phone calls and SMS.

Mr. Borcovs says he is in favour of regulation as it provides credibility to companies like his and institutes legal measures to address defaulters. “It will bring the price of loans down,” he added. Currently fino.lk charges 1-2.5% interest per day. Their Latvian parent company, Sun Finance, has faced trouble in other countries. According to international media, in Vietnam, a Latvian employee of Sun Finance was sentenced to prison for operating a loan shark ring under Vietnamese law that prohibits predatory interest rate lending.

| A grey zone that needs regulation Currently no laws govern the operation of online lending. As a result there is a grey area. The Cyber Crimes Investigation Division (CCID) does sometimes take action in instances where illegally acquired personal information is used for blackmail, however, when Sajeewanie approached them they told her to pay back the loan. When she pushed them to take action about the company abusing her contact list and photographs she claims they simply told her to “change her sim.” Despite multiple efforts to contact them, CCID did not respond. Officials at the Central Bank of Sri Lanka who requested anonymity said that they used to have interest rate caps on microfinancing. “It used to be at 35% per year but then even the government treasury bonds interest rate surpassed 30% in 2022 so we had to remove the cap,” said the official. Even so, such caps are only applicable to the four microfinance companies currently registered with the Central Bank and the 49 microfinance nonprofits registered with the NGO secretariat, both under the Microfinance Act of 2016. The Microfinance Act of 2016 is limited in scope and excludes a wide range of microfinance institutions. The official said they would consider re-imposing interest rate caps; however, the priority is to pass a new law first to bring all microfinance institutions under a regulatory framework. Regulation efforts are ongoing. In 2023 the Micro Finance and Credit Regulatory Authority Bill, which included the regulation of online lenders, was introduced but promptly withdrawn after petitions against it in the Supreme Court. Some petitioners were large banks who argued that they were being doubly regulated as their financial practices fall under the banking act. Other petitioners argued that the bill would impose insurmountable limitations on non-profit, community-based lending–such as through death donation societies. A working group headed by the NGO Secretariat has been suggesting amendments to the bill and the proposals are currently with the steering committee, Director General of the Department of Development Finance, Manjula Hettiarachchi revealed. He said that following cabinet approval, the bill will be presented to parliament soon.

| |

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!