News

Medicine security for SL: Need for stronger state backing for local pharma

View(s):By Kumudini Hettiarachchi

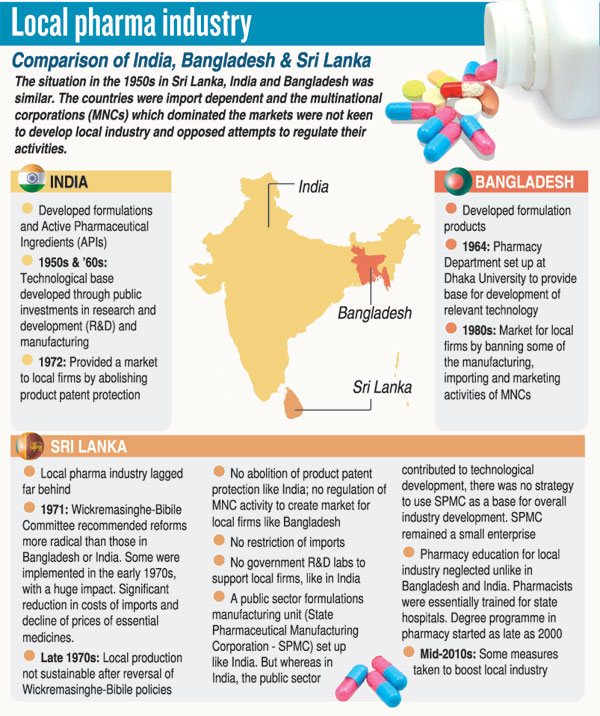

As a proposed strategy and recommendations to boost the local pharmaceutical industry are being drawn up, the need is to re-orient government policies including technological and other support to develop ‘medicine security’ and reduce the import burden.

This was the general consensus at the conclusion of the presentation of a ‘Situational Analysis of the Medical Products Industry in Sri Lanka’, on the request of the Sri Lankan government recently.

The analysis had been facilitated by the Asian Development Bank (ADB) and the World Health Organization (WHO) and funded by the ADB as part of the Economic Viability Study of Domestic Pharmaceutical Manufacturing in Sri Lanka. It had been conducted by local and international consultants including Prof. Asita de Silva and Prof. Sudip Chaudhuri.

The progressive pharmaceutical value chain that should be in place discussed at the exhaustive brainstorming session was:

Level 1: Imports – importing and distributing finished pharma products, produced under national or international GMP (Good Manufacturing Practice) standards in the country of manufacture.

Level 2: Packaging and labelling – importing in bulk finished pharma products manufactured in other countries following national or international GMP standards and packaging and labelling them here.

Level 3: Product manufacturing in

Sri Lanka – importing Active Pharmaceutical Ingredients (APIs) and excipients manufactured following national or international GMP standards and then formulation, development and manufacturing of finished products under the same standards.

Level 4: API manufacturing – producing APIs and excipients in Sri Lanka under national or international GMP standards.

Level 5: Research & Development (R&D) –conducting R&D for new formulations, processes and new chemical entities, which follow national or international GLP/GCP (Good Laboratory Practice/Good Clinical Practice) and ethical standards.

The vital need to develop human capital in science and technology to support the growth of the pharmaceutical sector, the establishment of science & technology incubators; the promotion of university enrolment in science & technology fields; support for pharmaceutical & biotechnology related industries and development of skilled workforce; and the introduction of pharmaceutical science in higher education was also put under the microscope.

A critical evaluation of government incentives and policies, meanwhile, had found that after passively accepting the reality of practically a non-existent local pharmaceutical industry, the government had initiated Buy-Back Agreements (BBAs).

The situational analysis had found that even though official announcements had been made to establish three Pharmaceutical Production Zones at Oyamaduwa, Anuradhapura; Horona, Millewa; and Arubokka, Hambantota, the last two are yet to start functioning. Under the Oyamaduwa project, land had been acquired and plots awarded to selected investors, but it has been embroiled in controversies and the zone is not yet ready for manufacturing.

However, the BBA programme launched in 2015 had seen the Medical Supplies Division (MSD) buying directly from local manufacturing firms without competitive bidding involving foreign suppliers. First purchasing products from members of the Sri Lanka Pharmaceutical Manufacturers Association (SLPMA), later the MSD had expanded to buying from joint venture companies set up with the State Pharmaceutical Manufacturing Corporation (SPMC).

“The quantities purchased are based on MSD requirements, with prices being decided by a Pricing Committees comprising officials from different government agencies. With the BBA programme creating a market for local firms, local production has expanded from about 5% of the market in the mid-2010s to 15% currently.The local firms are also manufacturing a diverse range of products for the MSD,” the analysis states.

It had also found that the improvement in the business environment due to BBAs has led to the entry of new players in manufacturing such as large importing and distributing companies who have taken steps to diversify into manufacturing.

Of the 66 products procured by MSD in 2023, the prices fixed by the Pricing Committee had been lower than that of the International Reference Prices for 45 products, higher for 19 products and the same for 2 products.

“Thus, on the whole, a majority of local firms did not take advantage of the BBA arrangement to charge excessive prices,” adds the analysis.

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!