The dominant current economic concern is the adverse impacts of the global recession on the Sri Lankan economy. The downturn of the Sri Lankan economy however preceded the Wall Street collapse and the US recession. The external shocks faced by the economy since 2007, the effects of rising oil and food prices and a high rate of inflation and the lack of countervailing policies to mitigate their adverse impacts had already begun a slide in the economy. The continuing high fiscal deficits caused by public spending had been the underlying factor in the high rate of inflation that in turn affected both production and export competitiveness.

The import-export dependence of the Sri Lankan economy makes it particularly vulnerable to external shocks. Even before the recession got into gear the Sri Lankan economy was facing severe difficulties owing to the sharp rises in oil prices and the hike in international food prices. Consequently the economy faced high rates of inflation, a large trade deficit and a strain on the balance of payments. The latter effect was staved off by heavy foreign borrowing and consequently the depreciation of the currency did not occur. Consequently export industries faced difficulties and the decline in export growth was the inevitable result. These issues have been discussed in this columns many times. What about the impact of the US recession that has grown into a global recession?

|

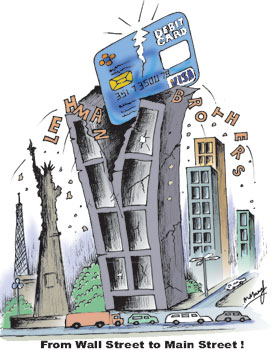

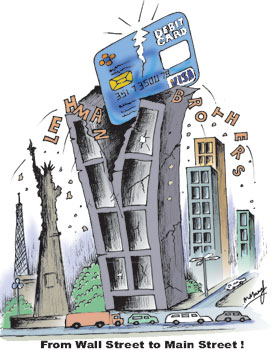

The diagnosis of economists is that the US recession is here to stay. Some economists have indicated a period of around a minimum of 5 to 7 years before an upturn. The meltdown in the US economy began with the lack of prudent management of the financial sector that resulted in several large finance houses facing bankruptcy. It is unimaginable that a financially developed country with its powerful Federal Reserve Bank did not regulate the financial system adequately. This is no doubt largely a consequence of the laissez faire doctrine that permeates much of economic policies in the US that did little to curb the greed of finance houses to make money without prudential practices. Consequently the entire financial system collapsed. It is ironical that a country that often pontificates about the need to regulate and supervise financial institutions through international organisations did not heed their own advice. What is most pertinent is that the bubble that burst in the mortgage market is having repercussions not on Wall Street alone but in Main Street and flowing across to the rest of the world. The Sri Lankan economy is especially vulnerable owing to the US market being of considerable significance to our industrial exports in particular. Therefore it is important to understand how the recession in the US will affect the Sri Lankan economy in the foreseeable future.

The collapse of the mortgage market means that people’s net wealth is reduced as well as their disposable income. Many of those caught up in the crisis will no longer have access to credit. The effect of this is that people will be spending less on consumer products. Already retail sales have dropped by 1.2 percent last month. They will travel less, not buy new cars, will be unable to spend on the purchase of new clothes and on non essential items. The American economy is characterised as a society of high spenders whose expenditure is not limited by the amount of current incomes. The US is a highly indebted country where credit card spending is a conspicuous feature. Expenditure is not governed by current incomes but the money or credit they think they can get hold of. It is because of this feature that economists have come up with several theories on consumption that explains consumption in terms of the net worth and the permanent income of households. The permanent income hypothesis of Milton Friedman postulated that people’s spending is governed not by the current income but the income they expect to obtain all through their lifetime. The financial system is geared to this mode of consumer behaviour, both in the housing market as well as in the other durable goods market and in consumer products. This is the background in which we must look at the looming crisis for the Sri Lankan economy.

The consequences of the depressing economic conditions in the US on Sri Lanka are both direct and indirect. Directly, the reduction in consumer spending means that several items that we export to the US will face curtailed demand. This is particularly significant with respect to garment exports. US consumers are likely to restrain their consumption of garment purchases as this is of little impact on their livelihoods. They will use their clothes longer and resist unnecessary purchase of clothes. This is of considerable significance for several reasons. The US is our main export market for garments together with the European Union countries. And garments are our main export accounting for a little over one half of our total exports and about two thirds of our industrial exports. Admittedly these are gross export values and since garment manufacture has significant import contents, the net export significance is relatively less in comparison with agricultural exports. Further, this setback comes in the wake of increasing export competitiveness owing to our high rate of inflation and a stable exchange rate value. Our competitors are less disadvantaged owing to their lesser rate of inflation.

Indirectly the overall economic depression is likely to snowball and its adverse effects are likely to have a long term effect. Further the US depression is affecting other countries, especially Europe. Consequently the demand for our industrial exports from European Union countries is also likely to decline. In addition to this there is a looming fear that the EU countries would withdraw the GSP Plus concession. This would compound the problem as our competitiveness would be further eroded. Although the US economy is not as dominant in the world economy, there can be little doubt that its economic downturn would have ripple effects on the global economy and be of serious consequences to our industrial exports. Among the other exports that would be adversely affected are rubber goods that are also subject to the same demand factors discussed. In fact the country has experienced previously a reduction in rubber goods demand when a recession occurred.

The global impact of the US recession is all-encompassing. The demand for goods and services would decline from all parts of the world. This is already evident. Tourism already affected adversely by the security situation will worsen with diminished demand from most countries. While the fall in oil prices is a boom to the economy and especially the trade balance and the balance of payments, the prices for rubber will decline both owing to the lower costs of production of synthetic rubber and the lesser demand for rubber products, especially tyres. The diminished incomes of oil producing countries may reduce demand for tea. However on balance the drop in oil prices is likely to benefit the country although the plantations may be less remunerative. Food import costs are also likely to fall. This would benefit the import side of the trade balance.

The plain truth is that in a globalised world no country is an island unto itself. It is more so for a small trade dependent economy such as ours that is vulnerable to reduced demand for our exports in as much as we are dependent on essential imports. There is a danger that the seriousness of the global recession would be underplayed and the appropriate policies to curb its impact not put in place. Further we may as usual blame the international shocks for the economic crisis within and not admit the bad policies, such as the rising fiscal deficit, that is a key factor in the current crisis. The current international recession requires a strong policy response to ease its impact on economic growth. |