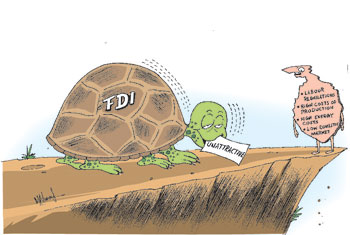

The slow and inadequate foreign investment inflow into the country is a disappointment. Much was expected by way of foreign investment after the end of the war and terrorism in May 2009. The tardy inflow of foreign direct investment (FDI) was featured at the recent interview with the IMF Resident Representative, Mr. Koshy Mathai who observed that: “FDI has been very slow. And even now our projections have FDI going from about $375 million in 2010, growing to $725 million in 2011. That's a near doubling, but $725 million for an economy of Sri Lanka's size is still quite a low figure.”

Significance of foreign investment

Foreign investment is a significant driver of economic development. It fills the savings-investment gap and contributes towards a country being able to supplement its savings with foreign savings and enhance its capacity for investment and thereby increase economic growth. While the quantum of foreign investment is important in determining the country’s economic growth, the nature and type of such foreign investment determines the long term development of the country. FDI contributes to improving work ethics, discipline, skills and knowledge of workers. It is an important means of technology transfer and transmission of management practices. FDIs also bring with them international markets.

It is the realisation of these economic benefits that has made former communist countries like China and Vietnam, and the formerly inward looking Indian economy to actively seek foreign investment. These three countries attract a large amount of foreign investment with China leading the world as the largest recipient of foreign investment.

Foreign investment inflows

The inflow of foreign investment to Sri Lanka is particularly low when compared to what other countries have been able to attract. Mathai pointed out: “Look at countries like Vietnam, where FDI is many times what it is in Sri Lanka. Clearly there is a lot of room to grow, and I think that's why the government has been focusing so much on all these things like the softer factors, improving the business environment, and why we also think that keeping the macroeconomic environment stable to attract those investors is going to be a key thing.”

The reasons for foreign investment not increasing after the war ended is not at all clear. The modest level of foreign investment during the period of terrorism and war was understandable. With the conclusion of the war it was widely expected that therewould be large inflows of foreign investment.

In fact many investors arrived in the country and expressed their satisfaction about the conditions in the country and articulated the view that Sri Lanka was now a good location for investment. These intentions have not materialized. “Hopefully”, Mr. Mathai said, “the tax reforms will play a role.”

In the one and a half year period after that there has not been evidence of higher foreign direct investment, in fact foreign direct investment has declined rather than increased. This poses the question as to why this is so. Foreign direct investment is estimated at US$ 375 million in 2010. The IMF expects FDI to double this year while the Board of Investment is as usual more optimistic in expecting it to reach 1 billion US dollars. Even these targets would be a modest achievement in comparison to other countries in the region. This amount is quite inadequate to raise the country’s economic growth to the expected higher trajectory.

There are signs that increased investment in hotels may achieve this. However the types of foreign investment too raise several pertinent issues. FDI is much needed in high technology manufactures and service industries. Such investments would contribute more towards technology transfer and domestic manufacturing capacity. Investments in casinos are hardly likely to achieve this, while proliferating social problems such as gambling, alcoholism and prostitution.

Factors deterring foreign investment

The explanations for this low level of foreign investment are conjectural, but the discussion of what appears to be the reasons may be valuable. Foreign investment is influenced by political and economic stability, tax and other incentives, labour regulations, work ethics, social and economic infrastructure, costs of production, potential domestic market and an overall assessment of political and economic conditions. Some investments are deterred by perceptions of corruption; others accept such costs as worthwhile incurring for favours granted. For one or more of these reasons, the international investment community does not appear to consider Sri Lanka a favourable destination for investment.

The political situation is stable in the sense that the President and government are secure to rule for at least another five year period and have a huge majority in parliament. However, international assessments may be considering other features in the polity as destabilising.

The imprisonment of former General Sarath Fonseka and continuous protests and violence; issues in press freedom that are highlighted around the world; perception of corruption and need to bribe officials to get investment approvals are unfavourable features. Yet many investors do not worry about these as witnessed by the large investments in dictatorial states. Investors are primarily concerned about the safety of, and return to, investment. Therefore these factors are not an adequate explanation though they may influence some investors’ decisions.

Despite the IMF and World Bank giving favourable assessments of the economy, investor assessments may be different. The high fiscal deficits, a large foreign debt of US$ 17 billion, debt servicing costs that absorb more than the revenue, external debt servicing cost of 20 per cent of export earnings, potential inflation and instability in currency value, among other macroeconomic indicators may be dissuading investment.

There is still a degree of uncertainty regarding government policies on foreign private investment. The experiences with respect to Apollo Hospital, Shell, Sri Lankan Airlines, and LIOC are not conducive to developing confidence among foreign investors. Labour legislation is another area where investors find the lack of freedom to hire and fire an inflexibility. While the rate of inflation has been brought down to single digit last year, there are fears that it may rise again owing to the weaknesses in economic fundamentals. While the foreign reserves are high, the large trade deficit and foreign borrowing leaves some doubts about the external finances of the country.

Costs of production play an important role in investor determination of investment locations. Sri Lanka is no longer a cheap labour country. There are other countries such as Vietnam and Bangladesh where labour is probably cheaper. Labour regulations in the country also affect investment. Sri Lanka is perceived as a country where labour regulations do not permit labour discontinuance either owing to changing market conditions or on disciplinary grounds. Several production costs too are high; this is especially so with respect to energy costs that is deemed one of the highest. These factors make it rather unattractive to foreigners to invest here.

Further the possibility of selling in the domestic market is limited. Large countries like India and China offer good prospects of local sales. This is why countries such as India and China are where reputed manufacturers of cars such as Benz and others have manufacturing plants. Since Sri Lanka is a location for export manufacture, the recession in western countries offers poor prospects for exports. The exception to this trend of low foreign investment is the recent purchase of land in prime property areas for construction of large international hotels.

Conclusion

Factors determining foreign investment are many. Whatever be the precise reasons for tardy foreign investment, the government must look into the reasons and provide a climate for enhanced foreign direct investment. Without a larger inflow of foreign investment, sustained economic growth of 8 per cent or more is unrealistic.

|