Sri Lanka’s savings rate is falling while the ageing segment of the population is increasing, according to economists and demography experts.

These numbers were raised by HNB Assurance Managing Director Manjula de Silva during a lively discussion on pensions at the Sunday Times Business Club (STBC) during its monthly meeting on June 28.

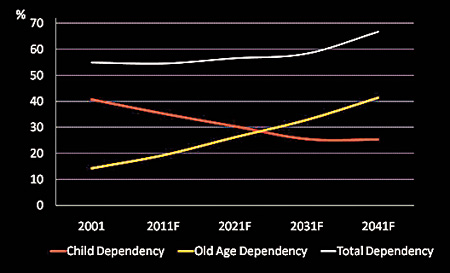

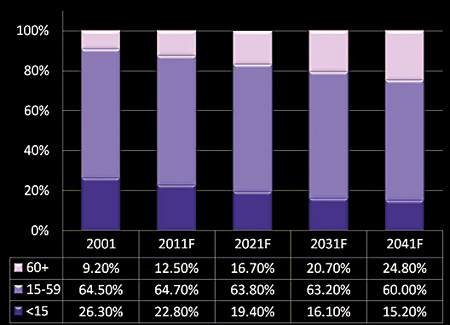

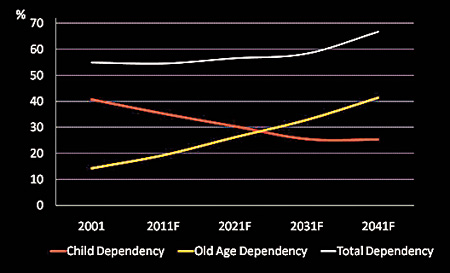

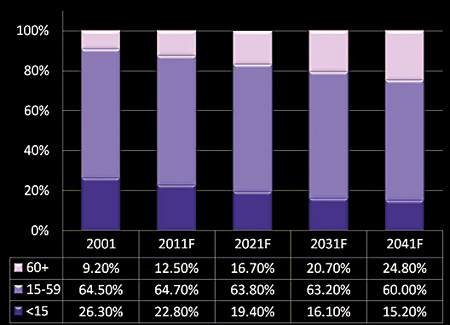

De Silva said Sri Lanka’s population is fast ageing where the 60+ age group in the population will double to 24.80% in 2041 from 12.50% now while in the ‘rising old age dependency’ category, the working population will be supporting 40% of those over 60 in 2041 compared to 10% now. He also showed another graph which reflected the “How we save” rate of an individual.

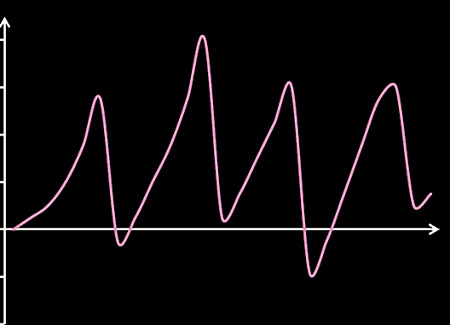

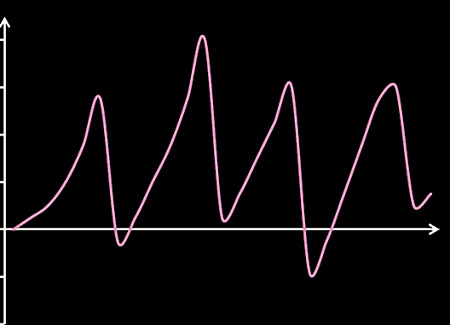

This shows a high savings rate, reaching a peak and then coming down (when that individual pulled out the savings to buy something), then goes up and comes down again. By the year 2041, the up-and-down graph shows the zero savings when one retires or nears retirement age. Another view that came up was that the savings rate is falling because there is little disposable income today owing to the high cost of living and other costs like tuition that middle-income families consider important.

The graphs show the ageing population, rising old age dependency and the way people save.

|