26th November 2000

News/Comment|

Editorial/Opinion| Plus| Business|

Sports| Sports Plus| Mirror Magazine

SEC draft act under broker fire

By Dinali Goonewardene

Stock brokers are up in arms over provisions in the Securities and Exchange Commission's (SEC) draft Act 2000.Brokers have collectively taken offence about a provision arming the SEC with powers to enter offices, "at all reasonable hours of day" to search for and take copies of documents they want. Broking houses, public companies and unit trust all fall into the category of offices which may be searched.

"The line has to be drawn at this draconian legislation. There is a tremendous lack of interest in the market and it is impossible to get companies to list. The thought of the SEC being able to walk in at any time is only going to frighten them further and prove a hindrance to market development," the CEO of a leading brokerage said.

"The proposed Act brings the SEC in line with regulators around the world and only confers on it, the powers available to other bodies such as the Central Bank, Inland Revenue and Bribery Commission," Senior Manager Legal, Kithsiri Gunawardena told The Sunday Times Business.

Stock brokers are quick to protest that market conditions in these highly regulated markets are quite different to those in Sri Lanka where sentiment is at a low ebb at present. However they concede that the regulation may be introduced when market conditions are more conducive. " Companies can not fold up in a day anyway, the onus should be placed on auditing standards to highlight deviations," said a leading broker.

SEC officials believe the proposed legislation enhances its investigative powers which were sometimes described as impotent. The SEC may presently call for information but can not go in search of it. This has resulted in long investigations which are unhealthy for the market, Gunawardena said. At present the SEC can refer its cases to the police or Criminal Investigations Department subsequent to getting the Attorney General's approval. "However mechanisms such as the SEC are more in tune with corporates than the police and have been set up to deal with them," Gunawardena said.

The SEC's initial 1997 draft amending the SEC Act met with a howl of

protest when it was circulated among market players. It gave the SEC district

court powers enabling it to impose fines and issue penalties. These provisions

have been removed from the current draft. The SEC has called for feedback

on the draft which may be accessed at the SEC web site www.

sec.lk

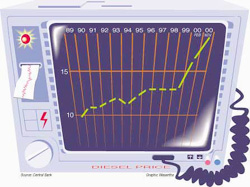

Holiday season heart attack

How will the recent diesel price hike affect the consumer? Will they end up getting a heart attack this holiday season? Analysts say that seasonal price increases and the recent diesel price hike might prove too heavy a burden for consumers this holiday season.However, hope still lingers. In a recent interview, Treasury Secretary P. B. Jayasundera said that a possible alternative to bring down the price of domestic fuel was to reduce duties on fuel imports and thereby reduce the cost of fuel.

But, will such action come too late. Historically, when fuel prices go up they stay there, and in many instances so does costs.

PBJ's comments follow the recent and the second upward revision of diesel prices this year after February's Rs. 4 price increase. He added that the government would not lose revenue as a result of the reduction of duty. According to analyst reports, the plan would pan out only if the demand for fuel increases as a result of the reduction in price. Central Bank statistics state that the demand for diesel is rapidly rising, while the demand for petrol is inching its way up.

The Treasury secretary added that despite high fuel prices to the consumer, the government was still subsidizing diesel at Rs. 7 to Rs. 8 per litre and kerosene at Rs. 8 to Rs. 9 per litre while making a Rs. 10 to Rs. 12 profit on petrol. This in terms of recent trends in fuel consumption would mean that the government would make a substantial loss.

Meanwhile, back in 1998 when world oil prices came down, the CPC did not revise its selling price of fuel. But, that decision later helped it absorb a part of the loss it incurred during the latter part of 1999. Subsequently, the CPC raised the price of diesel and kerosene, to partially offset the loss it was making as a result of increasing oil prices.

In an interview in February 2000 the CPC said that even at the previous prices, they could only operate at break even level only if the average crude oil price remained at around US$ 20 per barrel. However, as we all have seen world oil prices have been hovering above the US$ 30 mark.

So, should the CPC bring down local prices if the duty and world oil prices come down? Officials in the industry not willing to be identified said that no immediate reduction would be made, as the CPC was making a loss at present. "They would like to recover some of their losses if the prices do come down. However, we then have the 1998 scenario. If they had brought down fuel prices locally fuel when world oil prices came down, 1998 they would have had to increase prices much before February 2000. Since the world oil prices are volatile, they might not make a substantial downward revision."

In the rest of the world

Effective October 31, OPEC allowed its members to increase crude oil production by 500,000 barrels per day (bbl/d), in addition to the 800,000 bbl/d increased allowed by the October 1 quotas. This decision was made after the average price for OPEC oil - "the OPEC basket price" - continued above OPEC's target range or price band for 20 consecutive trading days after the previous quotas took effect. OPEC noted that "the decision is in line with an agreement reached by OPEC oil ministers aimed at stabilizing market prices".

As a result of these continued production increases, officials feel that OPEC's efforts to bring down crude oil prices will be successful, and that the OPEC basket price will decline to around US$ 25 by the end of the year. However, they believe that OPEC will need to cut back its production below its August 2000 levels by the second quarter of 2001 in order to avoid risking a price collapse. Even with such a cutback, world oil prices are expected to decline by an additional US$ 6 per barrel to the bottom of OPEC's target range by the end of 2001.

Mind Your Business

Booze too

With some people calling the recent price hikes- diesel, auto gas, cigarettes-a mini-budget the only price increase that was not announced was on liquor.But don't count your blessings too soon because booze too might be dearer shortly, the boys in the treasury say.

Excise duties will be raised soon- before the budget early next year- to get some additional revenue to the state coffers which are rather empty these days, they say...

Bankers budge

Remember the two big banks, which fought a bitter, battle not so long ago, with one accusing the other of a hostile take-over?Now it seems, some intermediaries who feel that a cease-fire would be better for the entire banking system has broached the issue of a settlement with both parties.

And the response has been encouraging though by no means conclusive enough to warrant a complete truce, those trying to negotiate say.

Hill hits the bill

The recent incidents in the hill country were not by any measure helpful to the tourist industry but star class hotels in the estate sector have been hit badly.Of course, the tension has disappeared from the region and all is calm but tourists and their travel agents don't seem to have understood that.

So much so that some hoteliers in the region are planning to ask the

state for some concessions this year...

'Rates will stabilise' P.B. Jayasundera

By Feizal Samath

A petroleum crisis, higher defence spending and a shortfall in privatization proceeds has put pressure on Sri Lankan interest rates, Treasury Secretary, P. B. Jayasundera said. "We need to borrow something like Rs. 45 billion rupees from the commercial market and that is putting pressure on interest rates," he told the Sunday Times Business in an interview.Interest rates have soared in the past few months mainly due to high government borrowings.

Last week, 12-month treasury bills were traded at 17 1/4 per cent compared to 12 per cent in May this year. The government's budget has gone off the rails due to higher spending on the war and costly petroleum imports, which has forced the government to raise local fuel prices.

Commercial banks have also raised interest rates on deposits to be competitive 15 percent last week from 11 percent three months ago.

Jayasundera said the government was compelled to raise fuel prices last week, by 10 percent, due to the global fuel price scenario where prices of crude oil rose to $35 per barrel in September from around $25 in January 2000. Fuel prices have now risen locally by about 50 percent this year.

"In my view the pressure on interest rates would be temporary and would stabilize by around February or March because defence spending won't be repeated at such an intensive level and hopefully our privatization programme could be revived," he added. The government is presenting a vote on account next month - to cover four months of spending - in lieu of the annual budget as officials were preoccupied with the October parliamentary poll. The calendar 2001 budget is expected to be presented in February or March next year.

Dula Weeratunga, Treasury Head at Commercial Bank, said there was pressure on interest rates because of a liquidity shortfall of some Rs. 20 billion rupees in the domestic market right now. "There is demand for imports and exports plus we are going into the festival season - Ramazan and Christmas. So demand for rupees is rising and putting pressure on interest rates," he said, adding that high government borrowings was only part of the problem. While the country's economic growth is seen at five percent this year, Sri Lanka has been hit by a series of external and internal shocks. War spending, projected at Rs. 52 billion for calendar 2000, was raised to Rs. 70 billion rupees in April after heavy fighting broke out in the northern sector. The military suffered several losses and to counter the balance launched an expensive spending programme to purchase new planes, ships and other armaments. The April war crisis also forced the government to delay the sale of Sri Lankan Telecom (SLT) from which $300 to $400 million was expected from an overseas listing. "We really got hit by the war and petroleum prices. On one hand war spending rose while we could not market the SLT issue as investors were taking a negative look at Sri Lanka," Jayasundera said. "The transaction can go through but at a heavily discounted price. The question is should we wait for market sentiment to improve or sell Telecom at a discount. That is something policy makers would have to decide," he added.

He said the international telecommunication markets were also disappointing which was another reason for delaying the issue but the market was expected to improve in the next couple of months. Other Finance Ministry officials said government expenditure has risen this year from projected Rs.330 billion rupees to Rs.341 billion rupees due to increased defence costs, salary increases in the public sector and other additional spending. But part of the additional spending is coming from cutbacks in capital expenditure and better management of financial resources.

Jayasundera said the budget deficit was expected to rise to Rs.108 billion rupees or 8.6 percent of gross domestic product (GDP) this year from 96 billion rupees or 7.6 percent of GDP last year. Officials said government borrowing requirements this year is Rs.87 billion rupees, up from projected Rs.44 billion rupees for 2000 but only slightly higher than actual borrowing figures of 75 billion rupees in calendar 1999. Defence spending is expected to remain at 70 billion rupees next year, which is a reduction in real terms and would represent 5.5 percent of GDP compared to 6 percent this year, Jayasundera said.

The Treasury Secretary said that despite high fuel prices to the consumer,

the government was still subsidizing diesel at Rs.7 to 8 per litre and

kerosene at Rs.8-9 rupees per litre while making a Rs.10-12 profit on petrol.

"What we are planning to do is to reduce import duties on fuel imports

and thereby reduce the cost of fuel. We won't lose revenue as a result

of this," he added.

A new buzz at SLCTB

By Dinali Goonewardene

The Sri Lanka Central Transport Board (CTB) has radically improved its performance post clusterisation in 1997. Eighty two depots made a profit before depreciation in August 2000 compared to nine in August 1997, CTB officials said.A Rs. 44.3 mn loss before depreciation in August 1997 turned to a profit of Rs.47.4 mn in August 2000. Centralising spare part imports to a national level to cut costs and reactivating provincial workshops are next on the agenda, officials said.

Clusterisation in 1997 saw the depots being brought under the administration of eleven Regional Transport Companies (RTC's) and the depots, which previously operated on a fragmented basis, benefited from economies of scale.

These included economies of scale in buying spare parts and marketing season tickets. While the CTB has engaged in cost cutting exercises, the de-escalation in competitive practices in scheduling between depots also helped, officials said.

Although the fleet consisted 8887 buses in 2000 only 5474 buses operated. Bus time tables took a hit when the buses kept to only 72% of schedule but even this compares favorably with its record of meeting 58% of its schedule in 1997. During this period 4400 of the 7900 strong fleet was operational. However a host of problems continue to dog the CTB. Only 24 of the 94 depots recorded profits after depreciation in August 2000.

Unserviced routes and buses which lie around awaiting repairs are a trade mark of this transport giant which services the majority of the country's population. Meanwhile CTB officials complain of unfair competition from private sector, buses which do not run night buses and are not forced to run to schedule without differentiating between peak and lean periods. Although salary increases have been subsidised by the government bus fare increases have failed to make a dent in losses incurred.

The absence of a bulk discount on fuel purchases from the Ceylon Petroleum Corporation monopoly is another cause for grouse.

While LTTE activities and a restricted bus timetable in the East hamper

activities for the New Eastern Bus Company, rainy days and election times

also cause profits to dip.

Rupee takes centre stage

By Chamath Ariyadasa

Even total exports worth over US$ 4 bn this year showing 21% growth for the first 9 months has not helped the sliding rupee this year.With year end drawing to a close, exports is one of the few positives; many other indicators seem to have suffered due to a mixture of external shock, increased spending and bad management.

Key interest rates were hiked again on Tuesday in an attempt apparently to defend the slipping currency.

An official explanation wasn't deemed necessary by financial authorities but left dealers reeling as repo and reverse repo rates were raised by 2% each to 17% and 20% respectively. These are the key rates at which market players lend and borrow money from the Central Bank.

At present the market has borrowed over Rs 20 billion from the overnight reverse repo window showing the extent of the liquidity shortage.

Reasons for the shortage are cited mainly as increased defence spending, the external oil shock, delayed telecom privatisation and the apparent holding onto of dollars by exporters. Government borrowing has thus increased leaving the banking system of short. Interest payments on foreign debt also can contribute to the problem even though there is a large percentage of concessional loans.

While exports picked up by 21% this year, imports have increased by 22.5% to US$ 4.9 bn. This figure also does not include Airbus imports during the first half of the year which would add around US$ 300 mn more.

Analysts however feel the situation can ease next year if there are lower payments on oil and defence.

The rupee traded against the dollar at 78.68 and 81.22 last week and

is up from 71.99 last year. Bank rate also was raised from 20% to 25% last

week.

Muddy thoughts on paddy

The government appears to have a very unrealistic view of the country's paddy production. Both the President and the Minister of Agriculture have such a rosy picture of the situation that they are dreaming of exporting rice. They may be even having dreams of Sri Lanka becoming the granary of the East as in the dim glorious past.The government's assessment of the paddy production situation may in fact result in wrong directions in policy. This would be to the detriment of the rice economy, as well as the overall economic conditions in the economy.

The President in her Address to Parliament said : " We have now reached self sufficiency in rice production. In such a situation,the farmer is faced with a downward trend in prices due to seasonal excess in production. The solution to this is to develop export markets for the excess rice and thereby bring about stability of prices in the local market. " The fact is that the country has not reached self sufficiency in rice. There is a "surplus" only because we imported a larger amount of rice than necessary last year. Apart from this factual inexactitude, there are several fallacies and serious implications underlying this statement, which we wish to comment on.

First, it is worth repeating that we have not reached self-sufficiency in rice. It is a case of counting the chicks before they are hatched, or even before the eggs are laid.

The depressed paddy prices in the market should not be interpreted as an indication of local paddy production exceeding consumption needs. The crisis which farmers faced in selling their produce was due to high imports of rice in 1999, and the failure of the marketing mechanisms for paddy in a situation of a glut caused by increased imports of rice. In 1998 we imported 168,000 metric tons of rice. In 1999 we increased our imports of rice to 214,000 metric tons. The Maha paddy harvest this year was good.

Therin lies the fundamental reason for the depressed prices .

The other connected issue is that the country has been increasing the imports of wheat. In 1990, we imported 577,000 metric tons of wheat. In 1999 we imported 659,000 metric tons of wheat. People are substituting imported wheat for locally produced rice. Therefore an important explanation for the present collapse of the rice market is the increased imports of wheat, rather than the increased production of rice alone. One can certainly achieve a kind of " self-sufficiency" in rice by importing wheat flour and other substitutes.

The third issue, which does not appear to have crossed the minds of the government, is to whom do we export rice and at what price. It is well known that most varieties of rice produced in the country do not have an international market. Further international rice prices have been coming down and even if we have an exportable surplus our rice exports would require an export subsidy !.

These issues raise a fundamental question far beyond the issue of paddy production and rice exports.

Is it that the government is being ill advised by its officials?

Is it that the government is not listening to those who know about these issues?

Is it that those who should know about these,in fact do not know?

Or is it that the government is not listening to those who know? The answers to these questions would be most revealing of the state of the government's processes of decision making.

The directions in the government's thinking on rice production should be very different. There should be no euphoria about the country's rice production. In fact the rice economy is in crisis. Paddy farming is no longer considered a viable financial proportion or an adequate source of household incomes. This is due to a cost-price squeeze that has been occurring for many years. The cost of inputs, including labour, has been increasing, while farm gate prices have not increased commensurately.

Research has not produced a new higher yielding variety for the last 15 years and has therefore not provided a means for increased productivity on rice fields. Extension services are extremely poor and in disarray. The marketing of paddy remains exceedingly unsatisfactory. The paddy farmer remains neglected . These are the issues which the government must address in order to make paddy farming sustainable.

The government must make a studied decision regarding its wheat price policy as much as the issue of imports of rice into the country. Instead of looking to export rice,the government policy must first attempt to change the equation with respect to the relative prices of wheat flour and rice,so as to provide a remunerative price for locally grown price. Stable and remunerative prices for paddy must be a foundation for a viable paddy farming, system,which is the backbone of our food security.

Let us hope that the government begins a dialogue with those who know

the actual rice production situation and formulates realistic policies

for the future. The mistakes the President made in the Address to Paliament

may be a good reason to start taking a fresh view of paddy production.

Far from exporting rice ,we may be importing large quantities of rice and

wheat next year,if the fundamental problems of the rice economy are not

addressed

Leading businesses adopt the "Balanced Scorecard"

From balance sheet to score sheet

By Manilka Fernando

What is this new technique? The Balanced Scorecard was originally announced through the Harvard Business review in 1992 - authored by Robert Kaplan and David Norton. Professor Kaplan visited Sri Lanka in late 1998, and many leading members of our business community attended the lectures and presentations he gave during that visit. The Balanced Scorecard is a management tool and technique, which focuses on establishing a set of business measures and targets directly linked to the overall strategy of the organisation.The Scorecard concept has been hugely successful in leading western economies. According to recent surveys, 60% of the Fortune -1000 companies use this technique, and in W. Europe, the take-up rate for medium and large businesses is now 40%. It is very widely employed in the USA, UK and Europe - and increasingly in other parts of the world including Australia and South Africa. It is very encouraging that some major local businesses in Sri Lanka have now introduced the Scorecard technique of business management.

The Scorecard concept is the leading "international best practice" for business planning and performance measurement: it focuses on a number of key themes:

* Setting business goals, which are clear and measurable. An organisation should know whether it has set clear, measurable goals, but all too often (in businesses not using the Scorecard) these goals are described in rather meaningless general terms. The resultant danger is that everyone concerned - even top management- interpret these so called goals in different ways. The problem here is obvious. Without a clear understanding of its intended destination, a business is unlikely to be competitively successful - it's unlikely to reach that destination.

* Setting clear measurable business strategies to achieve those goals. The Scorecard approach helps management to establish and articulate clear strategies, and to avoid the dangers of unrealistic wishful thinking, rather than stretching but coherent routes towards the business goals. The Scorecard approach requires management to set measures that describe the strategic themes. It also encourages proper communication of those goals / strategies to help everyone - however junior - to focus their actions towards the company objectives.

* Understanding and measuring the main drivers of success. What factors are necessary for the success of an organisation? For many, issues such as innovation, staff skills, competitive process quality / efficiency are crucial to success. The Scorecard requires management to set down a clear understanding of these performance drivers and to measure and target the ones that really matter.

* Aligning people and resources throughout the organisation - towards the achievement of corporate goals and strategies. In most Scorecard applications, there are local divisional / departmental / unit Scorecards which allow the careful alignment of local activities and priorities to the achievement of overall corporate goals.

* Regular monitoring of actual business performance (typically monthly). Through the Scorecard process, management receives regular monitoring reports. The onus on management is then to ensure effective use of that information - especially in taking remedial action where below-target performance is identified. Monitoring provides management with regular valuable feedback on two principal issues:

ù Is our strategy working?

ù Are we on track to achieve our overall business goals?

The Balanced Scorecard is usually designed (in accordance with the original Kaplan & Norton model) to have 4 boxes or "perspectives" which give a structured format and sequence to the measures, though many practical applications adapt this model and do not restrict themselves to the standard 4-box approach.

Typically there are around 15 - 20 measures in each Scorecard (i.e. 4 or 5 measures for each perspective) the aim being to provide management focus on to what really matters.

The standard design - shown below - sets out the 4 perspectives and the natural business sequence:

Business planning

People & Learning

Internal Processes

Customer

Finance

Business sequence:

"Cause & effect"

A fundamentally important aspect of the Scorecard is to establish an understanding of the "cause and effect" between different measures. For example, in the Internal Process section, the underlying question is:

"What processes must we excel at in order to achieve our customer and financial targets?"

All businesses - even small ones - have many processes within their overall activities. The Scorecard asks management to consider which are the important processes, and what level of measurable performance is required in order to help the organisation to achieve its final goals.

For most well run businesses, the Scorecard concept builds upon the existing planning and measurement systems. But it creates a management attention to overall strategy in a way which older planning/measurement models did not achieve. Also the Scorecard puts emphasis on the "softer" aspects of business (for example staff skills, leadership, innovation), which previously have usually been left off the management agenda.

The Balanced Scorecard can be summarised as helping management to create the "strategy focused organisation".

In Sri Lanka, the concept of the Balanced Scorecard has been introduced to several companies by a UK based management consultant, Alan Fell, in association with a local firm of consultants, Prime Consulting (Pvt) Limited. Alan Fell, a former senior executive with a major UK bank, is a specialist in implementing the Balanced Scorecard in Europe, Asia and Africa, now visits Sri Lanka regularly. He comments:

"I always enjoy my visits to Colombo: the people I meet and work with are highly professional, pleasant and charming - I am always made to feel welcome, so important when you are 5000 miles from home. In Sri Lanka, there is a business culture that is clearly attracted to the concept of effective planning and business measurement, which has a direct link to the Balanced Scorecard."

The following questions will enable readers to make a self-assessment of whether their firms need a Balanced Scorecard:

1. Are the firm's business goals clear and measurable?

2. Are clear, realistic and measurable business strategies set to achieve those goals?

3. Are the main drivers of success understood and measured?

4. Is there an alignment of people and resources throughout the organisation - towards the achievement of corporate goals and strate gies?

5.Is there a culture of achieving results - not of excuses?

6.Is there a regular monitoring of actual performance (not justfinancial results) giving management feedback on whether the strategy is working?

![]()

Front Page| News/Comment| Editorial/Opinion| Plus| Business| Sports| Sports Plus| Mirror Magazine

Please send your comments and suggestions on this web site to