29th July 2001

News/Comment|

Editorial/Opinion| Plus| Business|

Sports| Mirror Magazine

Tourism is booming in the Maldives,

probably at the expense of Sri Lanka.

Picture in the background shows blasted Airbus

- Mind your Business

- Tourism to recover despite shock

- Airline insurance premiums may rise after attacks

- Blasts and you! The Sunday Times invites comments from readers

- People's Bank technically insolvent but improving

- UK, US, Italy and Germany issue travel warnings

- Stagnant stockmarket stunned again

- The saga of the takeover of international oil companies

- News

- Features

Mind your Business

A taste of hell!

The bubble of tourism has burst at long last and to many in the trade, in no uncertain terms, what with a closed airport, adverse travel advisories and worldwide publicity for tourists in distress.Several charters have already been cancelled and the much-awaited 'season' is likely to be a big disappointment, so much so that hoteliers are swiftly taking rearguard action.

Already on the cards from several leading hotel chains are generous rate reductions for all and enticing 'packages' for locals. These chains have agreed on one thing, though: there will be no undercutting among themselves.

Hedging on bets

Terrorist attacks or not, the wars of politics go on and both camps are readying for battle, bracing for a snap general election.And the surest sign of that are the quiet demands for campaign funding from leading lights in the private sector.

And, with the outcome so uncertain, most are playing it safe with 'donations'

to both camps, they say.

Tourism to recover despite shock

Tourist Board PR exercise gets underway as damage-control measures

By Feizal Samath

Sri Lanka's economy suffered another crushing blow from last week's LTTE attacks on the airforce base at Katunayake and the Bandaranaike International Airport but most analysts believe the country's resilience to shocks would once again cushion the impact.Treasury Secretary, Dr. P.B. Jayasundara, told The Sunday Times Business Desk that the blasts were definitely a setback to the economic momentum.

"However, this is yet another event among many events this economy has gone through in the past," he said.

Others concurred. "The economy and tourism, in particular, will recover as has been the case in the past but by how fast is the question," said one private sector economist.

Apart from the tentative losses of more than US$ 300 million from the 13 aircraft – either destroyed or damaged in the strikes – the overall loss to the economy is yet to be quantified.

Tourism was the worst hit, much more than in the past as SriLankan Airlines planes were the targets this time. Dr. Jayasundara said the tourist industry has gone through this troubled phase from 1983 onwards with a major disaster occurring every year like the Central Bank bombing in 1996, the Dalada Maligawa attacks and the assassination attempt on the president in 1999, last year's fall of military camps and now the airport.

"Because of these events we have never been able to exploit the country's potential. What we are maintaining is a sub-optimal economic activity and growth path. That sub-optimal situation will continue," the treasury secretary said, adding that SriLankan Airlines have so far not sought financial help from the government to tide over the crisis.

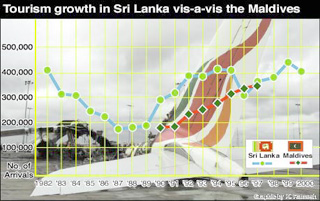

Other analysts believe the tourism industry would take longer to recover than in the past when it took similar hits. Miraculously no tourist was injured on Tuesday. Sri Lanka's loss is Maldives' gain as seen in the past. Tourist traffic to the Maldives has soared since 1983 and that country currently has a shortage of rooms to cater to the demand. (See graph).

Tourism, which has seen many ups and downs in the past but has been a resilient sector, was set to reach 440,000-450,000 arrivals this year against 400,000 in 2000. That now would be a difficult target to achieve, one analyst said.

He said there was a likelihood of some foreign airlines pulling out and tourists scheduled to visit Sri Lanka being diverted to other destinations in the next three to six months. "The tourism authorities would need a major public relations exercise to convince people that the country is safe for visitors and that is what has been planned," he added.

The latest blow to the economy comes at a time when exports, particularly garments, have slowed down and first quarter growth figures have shown a sharp fall from last year. Government economists and the Central Bank have, however, projected lower growth of 4.5 to 5 percent this year compared to six percent in 2000 in view of a global recession and a slowdown in Europe and the United States.

Dr. Jayasundara said the recession in the west is weaker than anticipated but this situation has some benefits for Sri Lanka. "The global slowdown has resulted in lower demand for oil which has trimmed crude prices," he added.

He said oil was now between US $ 24-25 per barrel compared to US $ 28 per barrel, which is a positive sign. "The bottomline is that moderate or lower export growth and stable oil prices are much better than high oil prices and more exports. Even if exports grew by 12 percent we are talking of earnings in the region of US $ 100 million whereas the savings on crude at current prices would be about US $ 200 million."

Garment industrialists said this was a time when dozens of buyers from Europe and the US arrive in the country to discuss shipments for the spring season.

"All these schedules are affected in addition to courier services which

are required for sending documents and samples," said Lyn Fernando, a top

garment exporter.

Airline insurance premiums may rise after attacks

There is a "very real" possibility of SriLankan Airlines' insurers demanding a large risk premium in the future after the LTTE's devastating attack on the airline fleet.SriLankan Airlines CEO, Peter Hill, indicated that the airline may ask the government to bear a part of the premium, if it is high. "The possibility of insurers demanding a higher premium will depend on the future security situation in the country," he told a crowded press conference on Friday.

The LTTE attack on the Bandaranaike International Airport left one Airbus A340 and two A330's completely destroyed while three more aircraft, including one A330 and two A320's, were damaged. Hill said all affected aircraft have been bought on lease from international banks.

The entire fleet is fully insured and the airline expects the entire leased value of the three destroyed aircraft to be recovered from the insurers. Foreign insurance loss adjusters are currently at Katunayake assessing the damage of the other aircraft. The primary insurer of the fleet is Sri Lanka Insurance Corporation but more than 99 percent of the value has been re-insured with leading global insurers.

Hill also said that the airline would not immediately obtain any new aircraft to strengthen its fleet until a more definite indication of demand for flights is known. "It is too early to give demand projections. We don't know how soon people will start flying us again," he said.

SriLankan's schedules have been cut by almost 50 percent to all destinations. "We are concentrating on destinations where the demand is highest. We may not service some destinations and to others we may reduce the frequency," Hill said.

"The effect on the bottom line caused by reduced revenues and costs as a result of fewer flights, cannot be forecast until the dust settles," he added.

The week before the crisis, SriLankan Airlines flew 50,000 passengers

in its network, which is an all-time record for the national carrier.

Blasts and you! The Sunday Times invites comments from readers

Sri Lanka's economy is facing one of its worst crises. It had taken many shocks in the past 18 years hurting growth but this time on top of LTTE attacks is a major political drama in which President Chandrika Kumaratunga and her government are fighting for survival. Whichever government in power would have a crisis on its hands. There's no escape from that.All around us, companies are collapsing due to high interest rates, competition and other problems. Cash flows are tightening. Simply said – the economy and law and order are collapsing while political parties are more interested in their survival than in the nation's future. Add to this the lethargy of the business community.

There is a belief that the business community is not doing enough to persuade political parties from all sides of the fence to come together and jointly tackle what must be regarded as a national problem. Some business leaders believe the business community should "take to the streets" and join religious leaders, NGOs and other peace-loving groups to demand change. Others say this is too harsh a step and are horrified by the suggestion.

What do you think?

How should the business community react to the current serious state of the country? Does this call for more radical action - than issuing statements appealing for calm which politicians rarely pay heed to? We are proud of a resilient economy and bounce back from setbacks.…

Would this be one of the problems – in the sense that if we hit rock bottom, the politicians and the rest of society must or would be compelled to move into action unlike today when people take crises in their stride and move on?

The Sunday Times Business Desk would like your views on this and invites

comments on these issues from our readers. Contributions, not exceeding

200-300 words could be sent to the Business Editor on e-mail: btimes@wijeya.lk

or c/o, The Sunday Times, 8, Hunupitiya Cross Road, Colombo 2 or fax: 423258.

People's Bank technically insolvent but improving

By Chanakya Dissanayake

The People's Bank, Sri Lanka's second largest state bank, has reported a loss of Rs. 8.54 billion for the year 1999 in its latest financial statement - a copy of which was obtained by The Sunday Times Business Desk- compared to a net profit of Rs 311.9 million in the previous year.The bank's auditors, Ford, Rhodes, Thornton and Company have noted that total liabilities exceeded total assets during the year 1999 resulting in a negative net asset position of Rs. 4.47 billion.

This is as a result of the Board of Directors of People's Bank making full provision for all non-performing loans as at 31st December 1999. According to the financial statement, People's Bank says it is unable to meet the minimum capital adequacy rate prescribed by the Central Bank, which analysts say in technical parlance means being insolvent.

However, the government as the owner of the bank has issued a "Letter of Support" guaranteeing the underlying business of the bank and confirming financial assistance to the extent not exceeding the deficiency in net assets.

The bank's total income dropped to Rs. 3.74 billion in 1999 from Rs.

6.73 billion in 1998. Bank officials were not immediately available for

comment but Treasury officials said the People's Bank was seeing major

improvements in its position this year. "I think the plan is to break even

this year," said Treasury Secretary, Dr. P.B. Jayasundara.

UK, US, Italy and Germany issue travel warnings

Last Tuesday's attack on the Katunayake airport and the airforce base is a severe blow to the economy, particularly tourism and foreign investment.The Sunday Times Business reporters Hiran Seneviratne and Diana Mathews spoke to a cross-section in the tourism industry and general businesses on the impact of the twin attacks. Also included are comments from the stockmarket.

Hiran Cooray, Managing Director, Jetwing Hotel Ltd, said this is a tremendous setback for the tourist industry and it will take some time to bounce back.

He said the industry was working together with the Tourist Board to enlighten other countries via the Internet and embassies on damage-control measures being taken to boost confidence.

Mr. Cooray, also vice president of the Tourist Hotels Association, said countries like the US, UK and Germany have warned their travellers that Sri Lanka is not a safe place to travel, which is a deterrent to promoting this industry in the present scenario.

Prema Cooray, Director, Aitken Spence Hotel Management (Pvt) Ltd, said it is unlikely that Sri Lanka could reach the 450,000 arrivals expected this year given this situation as there are many cancellations.

"This causes irreparable damage to the industry," he said, adding that efforts should be made at the highest government level, along with the Ceylon Tourist Board, to counter the bad publicity overseas from this incident.

Eraj Abeywardena, president of the Colombo City Tourist Hotels Association, said the worst part of the crisis was the negative picture of Sri Lanka portrayed by the international media.

"If the government cannot provide security at Sri Lanka's only international airport how can we ensure the safety of tourists?" he queried.

Bazier Cassim, General Manager, Mount Lavinia Hotel, said they were doing their utmost to make tourists as comfortable as possible. He said Italy and Germany have issued a warning saying their citizens should be vigilant when going to Sri Lanka.

Kumar Mallimarachchi, Managing Director of Associated Hotels Company Ltd, believes that although this is a big blow, the industry would bounce back in three months time.

He urged SriLankan Airlines to work together with the rest of the travel industry to save tourism from the present chaos. Mr. Mallimar-achchi, also president of the Tourist Hotels Association, said discussions with the diplomatic community were positive in this connection but noted that some countries including the UK have recommended travel to Sri Lanka only after the August 21 referendum.

Nauzab Fareed, Director, MMBL Phillips Securities, commenting on the impact in the stockmarket, said he couldn't see any movement in the market unless there are developments politically or economically.

"The platform has changed the way we think. We thought we could defend ourselves (from these attacks) but we couldn't. Investors have totally lost confidence."

He said on the economic front, money is needed to replace the damaged planes and defence expenditure would now rise while on the other hand winter tourist arrivals will see sharp falls. "We need reserves and they are not there. We are in a fix," he added.

Dushyanth Wijayasingha, Head of Research at Asia Securities, said the incidents would hurt business confidence and in the short term have a direct impact on tourism.

"Tourism accounts for four percent of GDP. Therefore it will not have a major effect on economic growth in the medium term. More worrying will be the impact on foreign direct investment," he added.

"It is fundamental to have political and economic stability and predictability. It is very difficult for us," noted CSE Chief, Ajit Gunewa-rdene, speaking of the difficulties in reviving a stockmarket, which has hit rock bottom.

Political uncertainty has created a double blow. Poor economic conditions with rising interest rates had reduced turnover at the Colombo Stock Exchange last year, Director General, Colombo Stock Exchange, Hiran Mendis said. He and Gunewardene made these comments at a Central Bank-organised seminar last Thursday.

"The recent attack at the BIA (airport) has definitely affected all businesses," laments Felix Yahampath, vice president of the National Chamber of Exporters. A serious crisis of confidence has developed in the minds of investors, he said.

"The BIA is inextricably linked with the Sri Lankan economy since it is the country's only link with the outside world and thus plays a major contributory role towards international trade," he said.

Investors especially from countries like Japan would be worried about the timely delivery of goods. "They fear that the goods would not be delivered on time and in this sense business confidence has been affected," Mr. Yahampath said.

"The industry as a whole is paralysed and economic growth has been halted," complained another industry source. "The Sri Lankan business sector has been extensively damaged after Tuesdays attack at the BIA," he said.

World opinion is what matters when investment decisions are made, he said. Therefore all the publicity given by the international media would naturally result in a reduction in foreign investments, he said.

Foreign delegations who arrived in Sri Lanka two weeks ago for a joint

forum asked just one pertinent question, "Why are Sri Lankan companies

closing down?" They were referring to the large number of companies crashing.

Tuesdays attack has now further aggravated this situation, the source said.

Stagnant stockmarket stunned again

The Colombo stockmarket re ceived another severe blow with the bomb blast and terrorist attack at Katunayake. An already stagnant and tottering markets remaining foreign investors will probably move out. At the same time local investors would perceive the impact of last week's act of terrorism as one that would weaken the economy directly and indirectly. Economic fundamentals would be weakened further and several particular sectors, such as the hospitality industry, would be affected adversely. Corporate profits are expected to decline.Since April 2000 when the All Share Price Index plunged to below 500 index points it has not raised its head. It is now as low as around 420 index points and likely to dip further. At the end of 1994 this index was near the 1000 mark. At the end of last year it had dipped to 448 index points.

There has been a net outflow of foreign funds in the last three years. In 1998 the net outflow was US$ 23 million and in 1999 US$ 13 million. The outflow of foreign funds from the Colombo bourse reached the highest last year. Foreign outflows amounted to US$ 63 million with inflows being only US$ 19 million. The net outflow was about US$ 43 million. The outflow of foreign funds continues this year. This is one of the factors responsible for pressures on prices. When the Sri Lankan share market received a boost from investors it sent the index to highs of over 1000 index points. Most investors have pulled out. A foreign driven market has been transformed into one of largely domestic investors. At a time when there appeared to be little prospect of attracting foreign funds to the market owing to both domestic, economic and political factors and the global capital market and financial conditions, the terrorist attack sealed its fortunes.

There are many reasons for foreign investors leaving the Colombo bourse. The economic and political conditions in the country are primary reasons. Also several features of the Colombo stockmarket make it unattractive to foreigners. One of these is the ill liquidity in the market that prevents foreign investors quitting the market easily. Large foreign investors find the Colombo market too small and hardly worth their being players as the market capitalisation of the Colombo market is declining. In 1994 market capitalisation was US$ 137 million. In 2000 it had dropped to about US$ 110 million. Since then market capitalisation has dropped further. The factors that motivate foreign investors to enter the market are also global. And these global factors too have been unfavourable.

An expected slow rate of economic growth, an increase in the rate of inflation, the widening trade gap, the global recession, high interest rates, terrorist attacks on economic targets and the prospect of economic disruptions, among other reasons, are responsible for the poor market sentiments currently. This multiplicity of reasons associated with economic fundamentals being weak and the unstable political situation is fuelling an expectation that prices may fall further. There is little that can be done in these circumstances. We may have to wait for better economic conditions, political stability and an improvement in the security situation.

In spite of the inhospitable economic and political environment, there are ways and means by which the fundamental weaknesses of the Colombo Stock Exchange could be remedied so that it may take off when the economic conditions improve. If Sri Lanka's stockmarket is to be revived we need more companies to list on the stock exchange, large privatised enterprises must be listed and a fair amount of shares available for sale and institutional investments must be enlarged in the Colombo bourse.

The stock market is not the economy, nor is the economy the stockmarket.

Yet the performance of the share market does give an indication of business

confidence and the directions of the economy. Both the stockmarket and

the economy are down.

The saga of the takeover of international oil companies

By Charitha P. de Silva

This is the story of the takeover of the oil companies by Sirimavo Bandaranaike's government in 1962 from the viewpoint of a minor participant.I had joined Caltex Ceylon Ltd as an accountant in 1955 shortly after

passing my final examination in accountancy. The oil industry in Sri Lanka

was dominated at that time by Shell (British), Esso (American) and Caltex

(American). They owned all the retail outlets and the bulk storage plants

located in Kolonnawa. As their assessment of strategic retail locations

was based on similar principles, it was usual to find petrol stations (as

they were called) of each of the companies located close to each other.

The three companies were fiercely competitive as we executives realised

in our daily lives. However, they had an understanding that they would

not compete on price in their bulk products, petrol, diesel and kerosene.

This was because earlier in their existence in other parts of the world

they had discovered that price wars were disastrous for all who engaged

in them. Thus their competition was largely restricted to service (and

lubricants). Those were the happier days for motorists when a driver pulling

into a station for some petrol was besieged by workers who swarmed over

his car cleaning the windshield, checking tyre pressures, oil levels and

so on, in pursuit of sales of  every

variety of lubricating oils and accessories. Those were the days when the

customer was king.

every

variety of lubricating oils and accessories. Those were the days when the

customer was king.

However, trouble was brewing for the oil companies. Mrs. Bandaranaike's government which was leftist inclined had a number of ministers who had no use for competition and other features of capitalist life. Some of the luminaries of her government were dyed-in-the-wool Marxists such as Dr. N.M. Perera, Dr. Colvin R. de Silva and Pieter Keuneman, and socialists such as T.B. Illangaratne. Some of the public servants were also leftist inclined, and one of them was a brilliant civil servant, G.V.S. de Silva, who had played a major role in drafting the Paddy Lands Act for Philip Gunewardena, a leftist minister who was now in the opposition. GVS had been a classmate of mine at Royal and we were good friends though our careers had parted, with him going into the public service as a civil servant (the elitist top rung of the public service) and me going into the private sector. GVS and another civil servant, Sam Silva convinced T.B. Illangaratne that the country was being exploited by the oil companies and the country could benefit greatly if the bulk oils were imported directly by the government and if a refinery was established to convert crude oil to petroleum, diesel and kerosene. That was the time when nationalisation was in fashion, and the idea of nationalising the petroleum industry was planted in the mind of Illangaratne. The Ceylon Petroleum Corporation was established with Sam Silva at its head, and GVS playing a key role.

At this point of time GVS visited me at home, and urged me to join the Corporation as its Head of Finance (I was only Deputy Chief Accountant of Caltex at that time). When I demurred saying that I was essentially a private sector type and quite happy where I was, he very kindly advised me that there would be no private sector within five years; so I might as well get in at the top levels of the Corporation which would soon be running the whole industry. I declined as well as I could without offending him.

The Corporation then started writing statements to the press, around March 1963, claiming that the government would save foreign exchange to the value of Rs. 22 million (a large sum then) if it imported the entire requirements of the country. The oil companies were asked to reduce the cost at which they were importing their bulk products. They were now faced with a serious impasse because any reduction in prices to Sri Lanka would affect the prices at which they exported to the sub-continent, a very much larger market.

At this stage I was trying my best to convince my Managing Director, Mr. Harry Bernard, that we should write to the newspapers refuting the claims of the corporation, which in my opinion were exaggerated. Bernard who was an extremely nice non-militant man, was reluctant to antagonise the government. In any case Caltex was the smallest of the three oil companies, controlling 20% of the market while Shell had 60%.

Then one Monday, my colleague Douglas Kelly an ex-police officer who was always well informed, came and told us that a gazette had been printed to take over the Caltex installation on that Friday. There was no time to lose. I walked into Bernard's room and asked him "Will you now give me permission to write?". He told me "CP you can write anything you like''! He added a cautious afterthought, "Only show your draft to Blamey". Blamey was the boss of Shell, and was held in respect by both Bernard and Mason, the MD of Esso.

I sat down and drafted an article refuting the Corporation's claims. I pointed out that the saving of Rs. 22 million was based on 'demonstrably false assumptions', and proceeded to explain what they were. I ended up by pointing out that the elimination of the oil companies would result in wholesale unemployment; and many dealers and their employees would be out of business because the CPC would not take over all the petrol stations; and a monopoly in the hands of the CPC would result in a deterioration in the quality of service. The truth of the last of these would be evident only to those who remember what petrol stations were like forty years ago. My closing sentence was to the effect that the considerations I had listed were 'important enough to call for a sober, unhurried review of the whole situation.'

The sentences in my article that gave me the greatest pleasure were:

'Whether the cabinet realised it or not, they took a decision (to place a ceiling on prices) that would inevitably result in the total elimination of the private oil companies. If the government were to maintain at this stage that it was not their desire or intention to eliminate the oil companies, it would be like cutting a ladder from under a man and saying that the intention was not to bring him down, but to collect some firewood'.

Having shown my article to Bernard, who blanched, I took it down (Shell was on the first floor of the Chartered Bank building, while we were on the third) to Blamey. He read it, and when he came to the sentence about 'firewood' a smile played on his lips. At the end of it he said approvingly, 'strong stuff'. Obviously he did not mind that because the article would be under the name of Bernard. He then asked me to show it to Mason of Esso. I walked across to Esso which was down Baillie Street, a few doors away, and showed it to Mason. He was so delighted with it that he insisted on my writing one for him too, then and there. I was given a room and paper, and proceeded to do so. I still have my handwritten draft.

The opening sentence of my article for Esso was:

'The Ministry of Commerce, Trade, Food and Shipping in its determination to justify the complete takeover of the oil industry has resorted to figures that are calculated to deceive the cabinet and the people of Ceylon'.

I ended up the article with:

'In view of the utter unreliability of the CPC estimates, it becomes a matter of national concern that the government of this country can be deceived and pressurised into making snap decisions that could affect the entire economy of the country. Reprisals by Britain and America could lead to the collapse of our tea and rubber markets on which we depend for our daily bread. Is the government prepared to take such a drastic step merely to fulfil the ambitious dreams of one or two individuals who would like to control the oil industry?

The two articles were rushed to the Ceylon Daily News and appeared on the centre page on the morning of the cabinet meeting on Wednesday. For what happened in cabinet that morning I am indebted to the then cabinet secretary who told me the story shortly after his retirement some years later.

Mrs. B. had stormed into the cabinet room with the newspaper in her hand, and asked "TB! What are you trying to do? Are you trying to bring down our government? Aren't the two men responsible for this, Phillip's men? Get rid of them within a month!"

The immediate aftermath of this exciting episode was that the gazette to take over the Caltex installation was withdrawn. The two men who had been the chief architects of the takeover were transferred out of the CPC, but that did not stop the eventual takeover, which happened about a year later under the aegis of Felix Dias Bandaranaike.

One lesson I have learned from this episode is that there are times when one has to stand up and fight. Fear of confrontation is inimical to the pursuit of justice. The written word can influence events. It is particularly effective with governments and institutions that are concerned with public opinion.

About a year later the government took over the assets of the oil companies under the legislation that had been enacted in 1961. The leftists behind the legislation had designed it to ensure that the compensation paid for the assets would be minimal. The wording of Section 47 of the Ceylon Petroleum Corporation Act No. 28 of 1961 was:

"The amount of compensation to be paid under this Act in respect of any property vested on any date in the Corporation shall be the actual price paid by the owner for the purchase of such property less a reasonable allowance for wear and tear".

Since most of the assets taken over were written off, through depreciation, for accounting purposes in the books of the oil companies it would have meant that there would be negligible compensation for the expropriated assets. However, as a sop to international opinion, the legislation went on to say that if the purchase price was not ascertainable, the compensation would be the market value. It was clear to the legislators that for companies that kept scrupulously correct books of account the purchase price would be ascertainable - and therefore market value would not be payable.

This was a disastrous situation for the oil companies and their best brains were put on the job. In the case of Caltex a brilliant manager called Jim Wollahan came from New York to Colombo and it fell to my lot to liaise with him. This was only because the Chief Accountant of Caltex, Geoffrey Gardiner, was more interested in producing plays (he was an excellent actor) than getting involved in complex affairs such as compensation. He shoved me into the front line and made sure that he was not consulted at any stage. Wollahan sized up the situation very fast and accepted it. We went to our lawyers, Messrs Julius and Creasy, and consulted their senior lawyer, an Englishman called John Byrnell.

He went through the legislation with us and told us regretfully that market value, which should have been the fair basis of compensation, was ruled out by the wording of the legislation. We returned crestfallen to office, but Wollahan continued to argue the matter with me for hours. He was not prepared to accept the unfair situation. He worried the matter from every angle while I played the role of Devil's Advocate. Suddenly he exclaimed "CP, it is going to be market value! We do not know the purchase price of our assets, because we never purchased them. We built them!". It was a brilliant thought, and it became my task to draft a memorandum which became a booklet, "Book No. 1 objections to compensation under purchase price concept". I explained that all our major assets, the Installation at Kolonnawa and the service stations all over the country, were constructed by us, not purchased as such from anybody. None of the indirect costs associated with any installation were attributed in our books to be assets. They were written off as expenses. Therefore the purchase price was not ascertainable!

It was a brilliant argument and it won the day when the legal battle was joined between the oil companies and the government. Once it became clear that we were entitled to market value (the price a willing buyer would pay to a willing seller) we were able to incorporate goodwill into our claim, so that the perfidious plan of the leftists backfired, and government ended up paying millions of rupees more than they had anticipated.

I learnt some lessons from this episode that sustained me throughout my career. The most important lesson was that one had to stand up and fight when justice was threatened. The other was that lawyers are not infallible. Businessmen must decide what is right and wrong and use lawyers to put their decisions into legal shape and form. Lawyers should not be consulted so much on what to do, as on how to do it.

(The writer is the Chairman of Lanka Orix Leasing Company and former Chairman of Aitken Spence group)

![]()

Front Page| News/Comment| Editorial/Opinion| Plus| Business| Sports| Mirror Magazine

Please send your comments and suggestions on this web site to