|

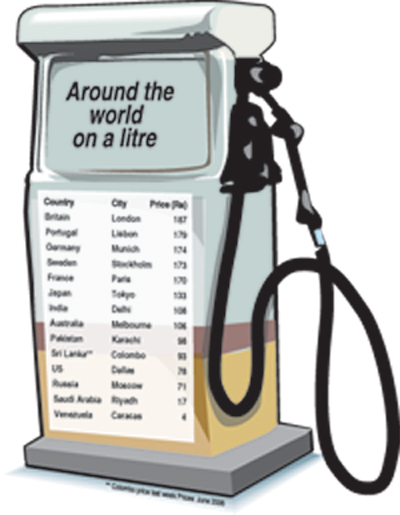

Tax or subsidies – why petrol prices differ around the world

It has been making news for months and has caused all sorts of trouble and strife from governments down to the everyday worker – from increased subsidies to a shift in consumer choice. The subject --- the record price of oil and what that means to countries around the world.

To give an example of the cross-section of the prices different countries pay, you go from paying Rs 180 a litre in Britain to Rs 4 in Venezuela (prices taken from June 2006). Here we have a rich developed country attaching high tax to a commodity that its population will pay because they can, to a country that is presently awash with oil money, thus subsiding fuel heavily for the “betterment” of its people (depending on your political bent). In Sri Lanka petrol is Rs 93 ($0.93 cents) per litre. The cost to produce and deliver petrol to consumers includes the cost of crude oil to refiners, refinery processing costs, marketing and distribution costs, and finally the retail station costs and taxes. The prices paid by consumers at the pump reflect these costs, as well as the profits (and sometimes losses) of refiners, marketers, distributors, and retail station owners. Then there is the proficiency of the refineries in the relevant countries as, of course, it is much cheaper to import crude oil and refine it yourself than import already-refined products. Here we have even more inequalities entering the field: mainly those that produce the crude and those that do not; plus those producing the oil, to what quality that oil is, and so on. As we all know, oil is measured in barrels being pumped per day and the need for a certain number (as well as those in reserve) to help keep a country’s economy going. One barrel comes to 159 litres. Thus, when crude oil prices reached $70 a barrel, it works out at $0.44 a litre. Due to the refining process you actually expand the volume of crude oil so you actually get more litres than the simple division just done. From this, it doesn’t take a degree in rocket science to work out which countries subsidise and which seriously tax. You do have to add on refining costs, transportation fees and profit margins, among others, along the line, but they don’t take up that many cents as seen in some countries, whereas tax does – especially in these environmentally-friendly days where developed countries are taxing high to encourage consumers to move to more economic vehicles (except for the occasional country of course). But that $0.44 is a useful benchmark to go by. Even in each country, prices vary from area to area as transporting the finished product is relatively costly, where insurance rates are quite high. Thus the further away from a refinery, the higher the price the customer pays. On top of that you also have real estate value, meaning if you want to set up a petrol station in a prime zone, you might want to charge more for the fuel you sell (then again the locals can probably afford it). So there are a multitude of reasons why prices vary, even before tax or subsidies come into play. So when there are escalations, it’s not just the poor countries that are hurt and protest, but those in rich countries as well due to the added energy costs. This ranges from a rich nation in Western Europe, where filling up a family car can come to over $100, to rising bus prices in Africa, to kerosene used for cooking. The problem for governments today is to know when to increase (or not) and explain it as it is. Not an easy thing to do to an angry mob. And we won’t even want to touch those governments that are oil rich but the people are still poor …So there you have it. A world of fluctuating prices, but remember that benchmark and see how badly done you are in the real sense. Click here to return to the top Hidden costs There are those who argue that the true cost (the

total costs both visible and hidden paid by western societies to

obtain and use oil) of oil and subsequently petrol are much higher

than wholesale oil markets or retail petrol prices reflect. The hidden costs consist mainly of spending (mainly military) to ensure that tankers, for example, gain safe passage through potentially dangerous waters. It is said that the US alone spends well over $100 billion a year to ensure the free flow of oil from volatile regions of the world. Here the argument is if such hidden costs were reflected in the wholesale and retail prices, instead of being subsidised by taxpayers, petrol would be far more expensive than it is today. This hidden cost has the effect of providing oil and petrol providers with a competitive market advantage over other alternative energy schemes. But of course that is difficult to prove (maybe). Click here to return to the top Dialog to cut outgoing call charges Dialog Telekom, holding the largest market capitalisation at the Colombo bourse said it was cutting outgoing call charges with effect from last Friday, after achieving the 2.5 million subscriber base.

“We are distinctly honoured by the fact that 2.5 million Sri Lankans have placed their faith in us. Our customers have been the backbone of our growth commencing from humble beginnings,” CEO, Dr. Hans Wijayasuriya said, adding that Dialog Telecom will slash outgoing call charges on KIT and post paid packages. Dialog Telekom will also introduce a new time belt (11pm to 6am) named “D2D Late Nite Bonanza”.

Click here to return to the top Mahapola Fairs enriched with IT related educational activities The Mahapola Lottery is playing an active role in the development of student inclination towards the field of Information Technology (IT) with a new programme being initiated by Minister of Trade, Commerce, Consumer Affairs and Marketing Development Jeyaraj Fernandopulle at the 256th Mahapola Trade Fair held at Madduma Bandara Madyama Maha Vidyalaya in Weliveriya in the Gampaha district recently. This IT related programme consisted of activities such as-

| ||||

Copyright © 2006 Wijeya Newspapers

Ltd. All rights reserved. |