|

Allegations of huge fraud against liquor giant

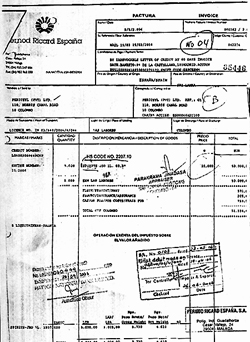

The Customs Department has discovered a huge scam by the Distilleries Corporation of Sri Lanka (DCSL) in under invoicing documents in the import of spirits resulting in defrauding the state in the past 10 years to the tune of more than Rs.1.5 billion in taxes, Customs officials said. They said the department would ask the company tomorrow to furnish more details on its past imports. The officials said the discovery came while ‘stumbling’ on a DCSL invoice after company officials wanted to amend their alcohol spirit importing company name from Periceyl Private Limited (a DCSL subsidiary firm), which is the bottling arm, to DSCL itself. The company has been importing Gin, Brandy and Vodka under Ethyl Alcohol which is the base spirit for arrack, when this import should come under the category of ‘other Ethyl spirits’. The former is cheaper at US$0.62 cents cost including freight (CIF) while the duty is charged at Rs. 125 whereas for other Ethyl spirit the CIF price varies from US$ 5 to $100 per litre. “Here the duty varies and the items are taxed at Rs. 825 to Rs. 880 per litre,” the official explained.

He said there was no need to obtain an import licence

or Excess Permit to import ‘other Ethyl spirits’ but

Ethyl alcohol or arrack was imported under an Import Control and

Excise Permit. However the other spirits were imported after Periceyl

Private Ltd got import control permits (as Ethyl alcohol), an exercise

done since 1993 and thus paid a lower rate of duty, The Sunday Times

found after perusing some documents made available by Customs officials

on these transactions. “The total fraud amounts to Rs. 742.5 million but with value added tax and excise duty it amounts to Rs.1500 million,” he said, adding that if penalties were imposed on inquiry the figure could rise to two to three times this figure. DSCL officials were unavailable for comment despite repeated calls to the company. Customs officials speaking on condition of anonymity confirmed the investigations, but Customs Director General S.A.C.S.W. Jayatilake said that to his knowledge there was no such investigation against DCSL and that probably it was being mixed up with a case pending against another company. | ||||

Copyright © 2006 Wijeya Newspapers

Ltd. All rights reserved. |