Sri Lanka low and sinking on Freedom Index

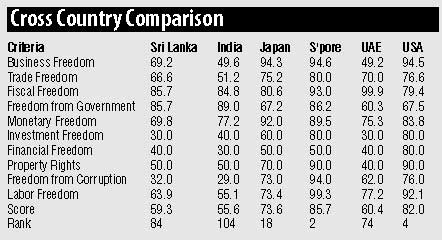

Sri Lanka has been ranked 84th while Hong Kong and Singapore secured the first two slots on the 2007 "Economic Freedom of the World" index, a ranking of over 150 economies by The Heritage Foundation based on free-market measures. Low tax rates, little government interference in the economy, stable legal systems that emphasize private property rights and the enforcement of contracts, and the free voluntary exchange of goods and services within free markets are the hallmarks of economic freedom, according to the Economic Freedom index. Sri Lanka’s score of 59.3% represents a deterioration compared to a year ago. Overall score has been derived from 10 economic freedom scores as per the survey; Business Freedom 69.2% - Starting a business takes an average of 50 days, compared to the world average of 48 days. To maximize entrepreneurship and job creation, it should be easier to start a company. Both obtaining a business license and closing a business are relatively simple. However, enforcement of commercial codes can be deficient, and transparency is lacking. The overall freedom to start, operate, and close a business is relatively well protected by the national regulatory environment. Trade Freedom 66.6% - Import restrictions, restrictive import taxes, numerous import fees, weak enforcement of intellectual property rights, service market barriers, non-transparent government procurement policies, export subsidies, and export controls add to the cost of trade. Consequently, an additional 20 percent is deducted from Sri Lanka's trade freedom score to account for these non-tariff barriers. Fiscal Freedom 85.7% - Sri Lanka has burdensome tax rates. Apart from income taxes other taxes include a value-added tax (VAT), a property tax, and a tax on interest. Freedom from Government 85.7% - Total government expenditures in Sri Lanka, including consumption and transfer payments, are moderate. Monetary Freedom 69.8% - Inflation in Sri Lanka is high. Such unstable prices explain most of the monetary freedom score. The government influences prices through regulation, state-owned enterprises, and subsidies for a wide array of goods, including petroleum products, fertilizer, and electricity. Consequently, an additional 10 percent has been deducted from Sri Lanka's monetary freedom score to account for these policies. Investment Freedom 30.0% - Foreign investment, although generally welcomed, is regulated. Foreign investment is screened and approved on a case-by-case basis. Outward direct investment must be approved by the government. Residents and non-residents may hold foreign exchange accounts subject to requirements, including government approval in some cases. There are strict reporting requirements and limits on payments and transfers. Capital transactions are subject to many restrictions and government approval in some cases. Financial Freedom 40.0% - Sri Lanka's financial system remains subject to extensive government influence but has been growing rapidly as the government has pursued privatization and liberalization. Regulations are largely consistent with international standards, but supervision and enforcement are considered insufficient. Foreign investors are free to access domestic capital markets. This segment considers aspects of capital market, banking and insurance. Property Rights 50.0% - The judiciary is influenced by other branches of government. The system is subject to extensive delays in litigation that lead investors most often to pursue out-of-court settlements. Freedom from Corruption 32.0% - Corruption is perceived as significant. Sri Lanka ranks 78th out of 158 countries in Transparency International's Corruption Perceptions Index for 2005. Labour Freedom 63.9% - The labour market operates under relatively flexible employment regulations that could be improved to enhance overall productivity growth. The non-salary cost of employing a worker is moderate, but dismissing a redundant employee can be difficult. Sri Lanka is ranked 14th out of 30 countries in the Asia–Pacific region, and its overall score is equal to the regional average. Whilst the world and regional (average) scores have improved in the last couple of years India is demonstrating further progress compared to Sri Lanka. Unfortunately Sri Lanka faces serious challenges with investment freedom, financial freedom, monetary freedom, property rights. An improvement in ranking is still a long way ahead if not further weakened as feared by many. |

|

||

| || Front

Page | News

| Editorial

| Columns

| Sports

| Plus

| Financial

Times | International

| Mirror

| TV

Times | Funday Times || |

| |

Reproduction of articles permitted when used without any alterations to contents and the source. |

© Copyright

2007 Wijeya

Newspapers Ltd.Colombo. Sri Lanka. All Rights Reserved. |