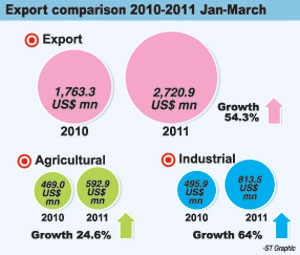

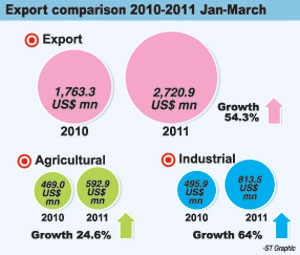

The surge in exports in the first quarter of this year is impressive. This is not only due to the quantum of the increase, but also owing to the significant increase in industrial exports and the underlying factors that have led to the increase in export earnings.

The trade increases to the EU and the USA is another significant factor that augers well for the future of the country’s exports. The increase in export earnings by 54 per cent and the larger increase in industrial exports of 64 per cent, over the performance in the first quarter of last year are most encouraging.

The growth in industrial exports by as much as 64 per cent lends hope for an export based industrial resurgence. Furthermore, there is evidence of exporters regaining markets that they appeared to be losing. Has Sri Lanka gained its international competitiveness? Is the country set to gain by the expected global economic recovery?

Exports march on

The export growth in March this year is unprecedented. Export earnings were especially impressive in March when it reached US $ 1,057 million. This, the Central Bank observes, is the first time that monthly export earnings surpassed the US dollars 1 billion level. If export earnings could continue to be in the region of US 1 billion in the remaining 9 months of the year, it would reduce the trade deficit considerably.

Although the trade performance of a single month cannot be taken for granted to be a trend, just as much as a single swallow does not signal a summer, there is evidence of an increasing trend in industrial exports in the last six months.

Therefore it is quite reasonable to expect this level of exports to be sustained, if not increased. The expectation that the global economy would grow by about 3 per cent this year adds further expectations for the country’s industrial exports.

In March 2011, the largest contribution to the growth in exports was from industrial exports that grew by 64 per cent, averaging the growth rate for the first quarter. What is most significant is that earnings from all major categories of industrial exports increased, despite the withdrawal of the GSP+ scheme by the EU in August 2010. Earnings from textile and garment exports to EU countries and the USA increased substantially.

This is most encouraging for the largest industrial export of the country that had a setback in the early part of 2010. These increases in exports are therefore extremely promising for the garments trade. The Sri Lankan garment industry it appears is capable of competing in international markets without favoured treatment. This is very much in the long term interests of the industrial sector.

Earnings from exports of rubber products increased by 75.6 per cent during March. In fact rubber product exports increased by nearly 85 per cent during the first quarter. There has also been a healthy diversification of the country’s industrial exports.

There has been a perceptible improvement in non-garments exports in the recent months that points toward a more diversified industrial export structure. Other industrial exports such as food, beverages and tobacco, machinery and equipment and petroleum based products also performed well in the first quarter. In the first quarter of 2011 industrial exports other than textiles and garments accounted for a higher proportion of industrial exports; 53 per cent of industrial exports. This diversification augurs well for the long run economic development of the country.

Agricultural exports

Agricultural exports, which accounted for 16 per cent of total export earnings in March 2011, increased by 40.3 per cent owing to increased earnings from tea, rubber, coconut and minor agricultural exports. These gains were mostly due to higher prices in the international market. The average export price of rubber increased by 70.5 per cent to US dollars 5.13 per kg in March 2011, matching the higher oil prices in the international market.

The average export price of tea remained high at US dollars 4.86 per kg during March. Earnings from minor agricultural exports increased by 75 per cent to US dollars 40.3 million in March, 2011 owing to high prices of cocoa products, sesame seeds, nutmeg and mace. However the growth in agricultural export earnings faces a tough road ahead. Prices of tea and rubber may face setbacks owing to the problems of marketing these in Middle Eastern markets that have been disrupted by war. This is particularly so with respect to the tea market in Libya and spices in the region.

Persistent trade gap

Despite this spurt in exports, it has been unable to reduce the trade gap that is reaching a new record deficit of about US $ 7 billion. Despite the improved export performance, the increase in expenditure on imports by 73.0 per cent to US dollars 1,689 million has resulted in the trade deficit increasing to US dollars 632.4 million in the first three months. During the first quarter of 2011, while the cumulative earnings from exports increased by 54.3 per cent to US dollars 2,721 million, the expenditure on imports increased by 39.9 per cent. Since this increase is a larger amount of US $ 4,458 million, the trade gap widened by 22 per cent to US$ 1,737 million.

|

|

Although the increase in imports decelerated somewhat and was a lower rate than the increase in exports, the increase in the value of imports exceeded the export earnings to result in the trade deficit of US$ 1,737 million in the first quarter. On this basis, the projected trade deficit is likely to be in the region of US$ 7 billion, higher than last year’s record deficit of US$5.2 billion.

Despite this large trade deficit, it is most likely that the 2011 balance of payments would register a surplus owing to remittances increasing by 27 per cent in the first quarter and offsetting 73 per cent of the trade deficit. The emerging large trade deficit should not distract us from the achievements in the country’s exports.

Summing up

In the last six months both industrial and agricultural exports have shown very strong growth, more than was expected. There has been a definite turn around that is gaining momentum.

The increase in total export earnings by 54 per cent compared to the same period last year exemplifies this.

The growth in external trade partially reflects the impact of increasing global commodity prices. Rising costs in other countries may be a reason for the strong export growth. It is important to keep prices in check and the rate of exchange stable to ensure the momentum in industrial export growth.

|