28th November 1999

Front Page|

News/Comment|

Editorial/Opinion| Plus|

Business|

Sports| Sports Plus|

Mirror Magazine

![]()

- Govt's domestic borrowings up

- Vanik counter offers MMBL

- Transporters complain of sudden port changes

- E commerce can escape tax net

- Mind your business

- Declining foreign reserves reflect economic downturn

- Once bitten not shy for Asian Banks

- Cargills profits on the rise

- Apparels smart under negative growth and wage increases

- Loyal Keells customers to be rewarded

- Pepper hots up

- Bangkok seduced into drinking tea

- Technical hitch halts trading

- Patent culture low here

- Plantation IPOs on hold

- Bottomline

- News

- Dipped Products plantation losses curb profits

- Sri Lanka Paint Manufacturers Association inaugurated

- American Eagle completes 15 years of service with AA

- Liberia out of IMO Council; Singapore retains seat

- Norasia launches Asia-Pacific South West services

- FLT claims worldwide leadership in container handling

- Hanjin HI receives orders for four containerships

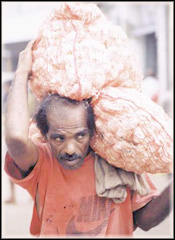

Heavily

burdened, virtually touching the ground. Sweaty bodies wending through

a sea of sweaty bodies, mud and muck, hastily pushing through to their

final destination. They toil in the slush and wrestle their way through,

carrying anything from a few kilos to over 50 kilos at a time to earn a

few measly rupees. A vital component in the chain of modern commerce in

our country... Yes! In fact a very vital component in the transportation

chain, without which food onto your plate and goods into your house. The

Sunday Times Business Desk takes a look at the porters, better known to

us as a 'Kooli' who work day in and day out, in rain and shine to transport

sacks and boxes to and from Sri Lanka's commodities markets. It is estimated

that these presumably able bodied (although some look astonishingly malnourished

and wizened, constitute to well over 10 percent of the employed population.

(Exact figures are not available) Little has changed in this profession

in developing countries since the beginning of commerce. Modern technology

has improved working conditions or in some instances taken over the hard

work in many developed countries. The only noticeable change in this virtually

disrespected and totally taken for granted profession is that like many

others, it is dying a slow and painful death. Though specific statistics

are not available, porters are classified under elementary occupations.

This category declined from 35.5 percent a decade ago to 25.5 percent in

the second quarter of 1998. These workers are seeing that the vicious circle

of poverty stops with them. But this profession will continue into the

next millennium and until Sri Lanka is more technology savvy...

Heavily

burdened, virtually touching the ground. Sweaty bodies wending through

a sea of sweaty bodies, mud and muck, hastily pushing through to their

final destination. They toil in the slush and wrestle their way through,

carrying anything from a few kilos to over 50 kilos at a time to earn a

few measly rupees. A vital component in the chain of modern commerce in

our country... Yes! In fact a very vital component in the transportation

chain, without which food onto your plate and goods into your house. The

Sunday Times Business Desk takes a look at the porters, better known to

us as a 'Kooli' who work day in and day out, in rain and shine to transport

sacks and boxes to and from Sri Lanka's commodities markets. It is estimated

that these presumably able bodied (although some look astonishingly malnourished

and wizened, constitute to well over 10 percent of the employed population.

(Exact figures are not available) Little has changed in this profession

in developing countries since the beginning of commerce. Modern technology

has improved working conditions or in some instances taken over the hard

work in many developed countries. The only noticeable change in this virtually

disrespected and totally taken for granted profession is that like many

others, it is dying a slow and painful death. Though specific statistics

are not available, porters are classified under elementary occupations.

This category declined from 35.5 percent a decade ago to 25.5 percent in

the second quarter of 1998. These workers are seeing that the vicious circle

of poverty stops with them. But this profession will continue into the

next millennium and until Sri Lanka is more technology savvy...

Govt's domestic borrowings up

By Mel Gunasekera

Government has been borrowing heavily in the domestic market in the last few weeks and economists are speculating that the monies may be utilised to fund the on- going war and excessive election spending.

Central Bank officials said that the government has borrowed a total of Rs. 102 bn worth of Treasury Bonds as at end of last week. Central Bank has also reissued Rs. 124.9 bn in treasury bills, adding speculation that further borrowings are on the cards to bridge the 7.9% budget deficit.

There is also speculation that the government may tap the domestic banks once again to borrow US$ 80 mn to fund its recurrent expenditure. The borrowings are expected to come from the foreign currency banking units of local commercial banks.

Heavy borrowings are coming at a time when privatisation proceeds have fallen short of expectations compared to previous years. PERC privatised two state farms and Talawakele Plantations this year, with the much awaited Sri Lanka Telecom IPO being put off for next year.

Do we know how much we got from it?

However, interest rates remained stable despite undergoing a sudden jolt a few weeks ago. Money brokers said, one year TBills are trading at 12.5%. TBill rates were expected to fall to between 11.5% to 12%, when the Central Bank reduced the statutory reserve ratio for commercial banks from 12% to 11% releasing Rs. 2.5 bn to 3 bn liquidity into the system.

Meanwhile, the Central Bank reported recently that the estimated overall surplus in the balance of payments and the growth in imports are expected to result in gross official reserves reaching a sufficient level to finance 3.3 months of imports next year. Total reserves are expected to be sufficient to cover 5.2 months of imports next year.

Economic analysts say that Sri Lanka is likely to post a 3.5% GDP growth this year and forecast a 4.6% growth next year.

Central Bank says that while progress is needed in key areas of reform to improve medium term fiscal consolidation and growth prospects, the performance of the economy in 2000 will largely depend on the development of the external sector. Crude oil prices have risen recently, but non-oil commodity prices remain depressed.

In addition, the unbalanced growth performance among industrial countries could lead to macro economic policy adjustments, making the direction of movements of foreign interest rates and exchange rates uncertain.

Sri Lanka's commodity prices are expected to recover somewhat, crude oil prices are expected to increase further due to continued increases in demand and the expected retention of existing quotas by the OPEC. As a consequence, imported inflation is unlikely to be favourable for Sri Lanka in the immediate future.

The trade deficit is expected to widen from 10.4% of GDP in 1999 to 10.6% of GDP in 2000 with a growth of 9.6% in imports and a 10.2% growth in exports next year. However, economic analysts feel imports would touch 10% as Asia is coming out of a recession and the demand in Asia is expected to fuel global prices.

Competition for the domestic apparel industry will remain stiff from East Asian countries, post currency devaluation. However, unutilised quotas especially from the European Union still remain.

With sustained growth in the US economy and Asia climbing out of the

economic misery, the scope for the machinery and electronic exporters remain

high and a buoyancy of such exports are expected to be extended.

Vanik counter offers MMBL

The much publicised deal of the decade, the 'M&M deal' was still holding together despite the seller terminating the original contract.

Last week, Vanik Incorporation made a counter offer of Rs. 525 mn to Mercantile Merchant Bank Ltd (MMBL) for its stake in Forbes & Walker Ltd and Forbes Plantations Ltd. The counter offer was in response to MMBL's offer of Rs. 375 mn to be paid within a year.

MMBL chief Milinda Morogoda said that they were going to respond to Vanik's offer within the course of next week. "We are trying to work things out.

We are also looking at other alternatives like going for the plantations assets first and then looking at Forbes later, because the broking assets are of significant value," he told The Sunday Times Business.

The man very much in the spotlight, Vanik chief, Justin Meegoda preferred to remain cautious on the whole deal, and responded by saying that apart from MMBL there are several others who have expressed serious interest in buying whole or part of the deal. "I don't want to rush into things at the moment as things are still being discussed," he said.

The original deal worth Rs. 625 mn was cancelled by Vanik a few weeks ago, as MMBL failed to pay Rs. 130 mn due to Forbes Ceylon Ltd by the due date.

The original deal outlined that F&W senior management would take up 26% of the new ownership structure, while MMBL would organise a consortium of foreign and local investors, through MMBL Resource Holdings for the balance 79%.

Meegoda also said that Vanik in unlikely to report a profit this year,

as they have to make provisioning for their non performing assets. "We

are working hard at the moment trying to make them perform before the end

of this year," he added.

Transporters complain of sudden port changes

Uninformed policy changes by the Sri Lanka Ports Authority (SLPA) are hampering work and causing unnecessary harassment and delay, container transporters complain.

The latest row between the SLPA and the container transporters took shape last week when security officers at the port held up transporters entering the port.

Among the reasons given for the hold up was that only 60 vehicles were allowed into the port at a time and approval of the O.I.C Container unit had to be obtained for entry on that day.

Transporters said that vehicles being prevented from entering the port was normal, but recently the situation had aggravated. However, while the transporters queued up outside the port to await their turn and obtain the necessary approval, the Foreshore Police had stopped parking, citing lack of provision for a vehicle park.

Transport company officials said that repeated requests made by them to provision a parking lot have fallen on deaf ears. Transporters are requesting the Ports Authority to give them adequate notice when making changes to any procedure.

SLPA officials were not available for comment at the time of going to

press.

E commerce can escape tax net

By Dinali Goonewardene

A leading tax expert called for tax laws to be revamped to combat legal hiccups from e commerce. "Inland revenue officials should be alerted to cope with special problems arising from the growth of e mail commerce," Council Member, Sri Lanka Institute of Taxation, M S M T Samaratunga told The Sunday Times Business. "The problem is being addressed in other countries such as the United Kingdom," Samaratunga said.

According to existing tax law, non residents should have a fixed place of business in Sri Lanka called a permanent establishment, in order to be taxed. Income tax is charged on profits that can be attributed to the permanent establishment. However an internet trader with no physical presence in Sri Lanka can protect itself from Sri Lankan taxation by not setting up a permanent establishment in Sri Lanka. "With the advent of the internet an international trading company or consulting firm need only establish a website in its own country or a tax haven and advertise its wares or services," Mr Samaratunga said.

A potential customer in Sri Lanka can gain access to the website through an internet service provider. A consequent sale of goods between the website trader in one country and the customer in Sri Lanka can be contractually completed entirely on the internet, short of payment and physical delivery of goods. A foreign consultant's opinion can also be down loaded via the internet. "The traditional concept of taxation based on physical presence within a jurisdiction are quickly being surpassed by technological developments," Samaratunga said.

Quoting from a paper issued by the Revenue and Customs in the UK, titled "electronic commerce - UK taxation policy," Mr Samaratunga said the revenue departments in the UK were looking at emerging risk from taxpayers using the internet to conceal their identity, location and the transaction. Risks from encryption of documents and holding documents in other jurisdictions to prevent tax administrations to prevent tax administrations gaining access to them were also being considered. The UK revenue department was also looking at electronic record keeping systems which allows transactions to take place without leaving an audit trail or where the trail would be easy to destroy.

Questions have been raised about the continuing relevance of the permanent establishment. The report says the government sees no reason to depart from the permanent establishment concept as it is a long standing one which is widely supported. However the UK government believes the permanent establishment concept needs clarifying. The UK is aware that businesses are concerned to know whether a web site on a server could be a permanent establishment and in what circumstances.

Regulatory authorities and professionals in the United States are canvassing

for e commerce not to be taxed as it is difficult to characterise transactions

in terms of identifying the person transacting, the type of service provided

and the country in which the transaction took place. Quantifying which

proportion of the profits is attributable to a country is also difficult.

However analysts feel it is beneficial for the US not to tax e commerce

as it would split world wide revenue between other countries and the US.

Current US tax laws attribute revenue earned world wide to the US.

MIND YOUR BUSINESS

By Business Bug

In place of GST

When the green man announced he would scrap GST, he struck a chord- if not with the masses, at least with those in the corridors of power.

They felt this could have some appeal to the average voter and would therefore be a potentially dangerous political weapon.

Now some top financial whiz kids have been asked to explore the possibility of doing away with the tax- and they have been asked to find out soon, to see whether an early announcement could be made...

The deciding factor

More the merrier, they say and when competition thrives in any business it is the consumer who is the winner.

And so it is in the telecommunications sector where landline networks are now competing with each other.

One network, which has just completed consumer surveys, believes the deciding factor for most subscribers in choosing a network is the connection fee.

So, will we see cut-throat discounts on that, with rivals claiming unfair competition?

Go Private

The blues believe they will win the polls, which is why they are going full steam ahead with the proposed economic reforms.

The lady will not take no for an answer and is very keen to implement some 'difficult' privatisations in the insurance and postal services sectors.

The idea is to push those changes through in the first flush of victory

when no one dares to oppose a justly elected leader...

Declining foreign reserves reflect economic downturn

There is probably no better indicator of our declining economic fortunes and unsatisfactory economic performance than the reducing foreign exchange reserves.The state of our foreign exchange reserves is particularly significant as we are an import export economy and our economic performance and economic situation are reflected in these statistics.

At the end of September this year our external assets were US Dollars 2631 million. During the course of this year our reserves kept falling and by the end of September the position was 9.5 per cent less than the reserves at the end of last year.This declining trend has not been only a feature of the nine months of this year.

Recent years have witnessed a declining trend in our reserves. At the end of 1997 the external assets of the country were US Dollars 3132 million. A year later it had declined to US Dollars 2907 million ,a decrease of US Dollars 225 million or 7 per cent. The decrease in external assets this year has been sharper. In the first 9 months alone, it has decreased by nearly 10 per cent to reach the lowest level of foreign exchange reserves in recent years. Our external assets are about equal to what we had at the end of 1995 ,when it was US Dollars 2907 million, and higher than what it was at the end of 1994 or at the end of 1996.

A better assessment of the external reserves position is provided by the Central Bank by converting the financial values to the number of months of imports it would finance.This is a more valid comparison as the value of the reserves in relation to the prices which really matter to us is a more significant year to year comparison. According to the Central Bank our foreign exchange reserves have declined in terms of its import capacity since 1994. In 1994 our foreign exchange reserves were adequate to import 7.2 months of imports, but in the next year it was adequate to import only 6.6 months of imports. By the end of 1996 it had a capacity to import only 6 months of imports. The situation improved somewhat at the end of 1997, when our assets were adequate to import 6.4 months of our requirements. But by the end of 1998 the position had deteriorated again and we could finance only 5.9 months of our import requirements.

At the end of September this year we were in a position to finance only five months of our imports. These statistics indicate even more clearly the deterioration that has occurred in our foreign exchange reserves, especially in terms of the months of imports we could finance. In the face of statistics of this nature we tend to find excuses and mitigating circumstances.We also tend to take the position that the situation is not too bad after all.We could blame the deteriorating foreign exchange situation on the Asian crisis and the unfavourable global economic conditions .

We could take the position that foreign exchange reserves of 5 months

imports is not a bad or crisis situation. The fact is that such complacency

does not help us to take corrective actions. It is far better to recognise

that there are serious problems in the economy which are reflected in our

deteriorating foreign exchange position and to take remedial measures sooner

than later. The performance of our external assets is a good reflection

of the overall economic performance. Therefore our economic performance

has to be improved to improve our foreign exchange reserve position.

Once bitten not shy for Asian Banks

Time is money! And we have less than

800 hours before the

clock strikes 12, taking us into the dawn of the

new millennium.

With less that a month to go until 2000, most

countries in the

region say their financial sectors are 100 percent

or near-fully

Y2K compliant. Warburg Dillon Read, in an August

report on

the millennium bug in Asia, said it found banking

one of four

industries that were likely to see limited risks

from Y2K fallout.

The others were airlines, infrastructure and conglomerates.

This

is inspite of the Asian economic crisis that put

many banks' Y2K

plans on hold two years ago. But Asian banks were

one of the

first sectors to address the Y2K problem and,

as a result, are the

best-positioned sector in their respective economies.

It is

understood that most central banks have announced

measures

to prop up funds if nervous customers make heavy

withdrawals

during the new year. The Sunday Times Business

Desk gives

you a brief roundup of the Asian Region's Financial

sector Y2K

status.

Sri Lanka

All 27 licensed commercial banks and other financial institutions including the central bank are Y2K compliant. Only two small banks, who hope to install new computer systems next year are a wee bit off track, but are expected to be compliant before the big day. The central bank has printed extra money and plans to release debt instruments in December that will cover any possible liquidity crisis.

The reserve repurchase facility (repo) with the Central Bank will also be available. Banks have also been told to issue financial statements before the year-end and top up all ATMs. The banks will be closed on December 31 for commercial transactions, but ATM's will remain operational.

India

All 105 commercial banks in India reported full compliance along with the Reserve Bank of India. A lot of small banks in the cooperative sector and finance firms are non-compliant, but central bank officials say they do not anticipate any risk to the system as they are non-computerised or are not part of the payments system.

The central bank has asked all banks to stock cash to ensure smooth cash transactions during the turn of the year. It has also announced a system of liquidity support to banks for a period of two months starting December 1.

Pakistan

Pakistan's banks are on track for Y2K, the head of a banking Y2K committee had told the media recently.Officials said of the 72 financial institutions which come under the State Bank of Pakistan's oversight, the committee felt 27 needed further reviews. The central bank has said in the past that it would take steps to ensure there was enough liquidity in the market at the end of the year.

Bangladesh

The Bangladesh Computer Council, which is overseeing the government's overall Y2K compliance programme, has said over 90 percent of the country's banking sector is Y2K compliant.

It said 56 out of the country's 64 banks, including the central bank, have successfully completed their Y2K roll-over tests. The Bangladesh Bank is now supervising Y2K readiness in the overall financial sector. Banks have set a target of full Y2K compliance by the end of November.

Australia

The Council of Financial Regulators said industry-wide testing of the payments systems had been successfully completed and that financial systems were Year 2000 ready.

A bank bill swap rate (BBSW) will not be set on January 3, (the first working day of the new millennium) said the Australian Financial Markets Association (AFMA). The rate is used as a pricing benchmark in the debt market.

The AFMA said it would review its decision to set a BBSW on December 31 if the New South Wales government declared it a public holiday. December 28 and January 3 have been declared public holidays in Australian states.

China

The finance sector has completed final Y2K tests and is "basically ready" for the new year, state media said in late September. Year-end settlement for domestic banks has been moved to December 30 from December 31.

Hong Kong

Critical systems in all banks in the territory as well as the Hong Kong Monetary Authority (HKMA) are Y2K compliant, an HKMA spokeswoman said. To prevent any liquidity crisis at the turn of the century, the HKMA said in September that it would extend its discount window from November 15 to January 31 and a term repos facility would be made available from December 1 to January 31.

Indonesia

Indonesia's central bank said it was almost 100 percent Y2K compliant. It said it was prepared to allocate funds in the form of cash worth some 70 trillion rupiah should there be any rush by depositors near the new year.

Indonesia currently has 167 commercial banks of which only 20 major banks are IT dependent and have exposure to potential Y2K risk. These 20 banks have been assessed as being 100% Y2K ready. The rest of the banks are mainly small banks and they are not much affected by Y2K problems, a country Y2K website says. Overall, Indonesia has been actively conducting various efforts toward Y2K compliance and today Indonesia has prepared to face the Y2K impact, it added.

Japan

All major banks, regional banks, and second-tier regional banks had completed major systems corrections and dry-run tests by the end of September. Bank of Japan (BOJ) decided in its Policy Board meeting on October 13 that it would respond to Y2K-related fund demand through its open market operations. To deal with individual cases, the BOJ would also extend funds mainly through its regular collateralised bank loans.

The BOJ expects there will be no need to expand the discount window or to extend bank loans under Article 37, which provides for temporary uncollateralised loans in cases of systems breakdowns and emergencies. Banks requiring uncollateralised loans must gain approval from the BOJ Policy Board and will likely face strict borrowing conditions.

Malaysia

According to Bank Negara's website 100 percent of commercial banks, finance companies and insurance companies have been Y2K ready since August 31. December 31 and January 2, 2000 have been declared to be non-transaction days. This is to allow the financial institutions more time to complete year-end processing as well as to give financial institutions additional buffer time to prepare for the contingency procedures such as performing back-up of data and printing critical reports. Ensuring additional currency is available in anticipation of higher demand for cash not only because of Y2K but also for end of year festivities. BNM will standby to inject additional liquidity should the need arise.

Singapore

Banks and financial institutions are prepared for Y2K, the Monetary Authority of Singapore said. It said most financial institutions had completed system testing and were in the final stages of developing and testing of contingency plans. The authority said it would provide Singapore dollar funding to banks and finance companies through repurchase transactions of Singapore government securities.

If the institutions faced exceptional liquidity needs, the firms would be allowed to use the securities held for Minimum Liquid Assets purposes.

Thailand

The Bank of Thailand said it was 100 percent ready for the Y2K, except

for finance firm and two special financial institutions were not 100 percent

ready but it had told them to be compliant by the end of November. Pongpen

Ruengvirayudh, assistant director of the central bank's banking department

has said that in case of any panic, they plan to give commercial banks

more time to lend in the repo market. Pongpen said that by year-end the

central bank would have in reserve more banknotes than usual to facilitate

all transactions.

Cargills profits on the rise

Cargills (Ceylon) Ltd's profit before interest soared 110 per cent to Rs 73 mn for the year ended 31 st March 1999. "The growth in profitability was a result of better inventory and gross profit management," Chairman, Cargills (Ceylon) Ltd, Anthony Page told shareholders in his annual report."The growth in sales also contributed to the increase in profits," Page said. Turnover improved 22 per cent to Rs 2 bn in 1999. The group opened four new Food City stores including two of the Safemart chains acquired during the year. In November 1998 the second KFC restaurant was opened at Union Place. The group's capital expenditure on fixed assets and investments during the year was Rs 91.8 mn. Earnings per share for the year was Rs 6.77. Dividend per share was Rs 2.00. During the year the company increased its issued share capital from Rs 28 mn to Rs 56 mn by means of a bonus issue of 2.8 mn shares of Rs 10.00 each, in proportion of one new share for every share held. The company's debt equity ratio was 1.54 times while interest cover was 1.96 times.

![]()

Front Page| News/Comment| Editorial/Opinion| Plus| Business| Sports| Sports Plus| Mirror Magazine

Please send your comments and suggestions on this web site to