4th February 2001

News/Comment|

Editorial/Opinion| Plus| Sports|

Mirror Magazine

Karate over the Parate

Sink or swim crisis for SMI's

debts

and failing companies. Almost everyday the newspapers carry advertisements

of companies that have defaulted in their loans or are unable to pay due

to unavoidable circumstances. The crisis is very serious and affects industrialists

so badly that they are compelled to put up the shutters and discontinue

the workforce. That adds to the unemployment and to human misery. These

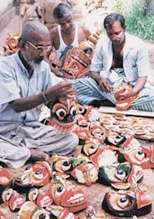

pictures hopefully capture and portray the plight of the industry. Pictures

( one and two) shows workers at a small village unit producing traditional

masks; (3) Ms Indrani Gunasekera, DGM (Legal) at the Hatton National Bank

at a seminar on parate execution; (4) Affected industrialists in a solemn

mood at the same seminar; and -Pictures by Ranjith Perera and M.A. Pushpakumara

debts

and failing companies. Almost everyday the newspapers carry advertisements

of companies that have defaulted in their loans or are unable to pay due

to unavoidable circumstances. The crisis is very serious and affects industrialists

so badly that they are compelled to put up the shutters and discontinue

the workforce. That adds to the unemployment and to human misery. These

pictures hopefully capture and portray the plight of the industry. Pictures

( one and two) shows workers at a small village unit producing traditional

masks; (3) Ms Indrani Gunasekera, DGM (Legal) at the Hatton National Bank

at a seminar on parate execution; (4) Affected industrialists in a solemn

mood at the same seminar; and -Pictures by Ranjith Perera and M.A. Pushpakumara By Chanakya Dissanayake.

Small and Medium Industries (SMI) are the life blood of any developing economy. As the Sri Lankan economy heads steadily into recession and a possible financial crisis, the SMI sector is facing the biggest challenge in contemporary times. Scarred by the unavoidable external shocks created by the rising cost of power and raw materials and the overall depleted purchasing power of its consumer, many SMI's are struggling to survive ... many are facing roadblocks.At the same time the parate executions carried out by the banks on SMI's have also reached record highs. It is a known fact that the SMI's in Sri Lanka don't have any access to equity finance with many thus being highly debt capitalised and facing a situation where they are no longer able to service their loans.

Banks, lending startup and other funds to depositors are also faced

with an unenviable choice — foreclosures by selling the security and recover

the monies owed. But due to the nature of forced sale  transactions,

the value realised at the auction is most of the time far below the market

value. This has resulted in a no win situation for both the bank and the

client.

transactions,

the value realised at the auction is most of the time far below the market

value. This has resulted in a no win situation for both the bank and the

client.

In this special report, the Sunday Times Business looks at the issues from both sides - industry and banks - plus the worst affected party, the humble worker. We wish to make it clear that we are not defending wilful defaulters but giving the genuine SMI entrepreneur a forum to articulate his or her views and cite their problems.

We also acknowledge the enormous difficulties the banks are going through in recovering their depositors funds.

Last Friday alone, eight board resolutions calling for parate execution were widely advertised in a local newspaper by the banks.

As wealth generators and risk takers of the economy, entrepreneurs are treated with a high level of respect in any economy.

However the entrepreneurial spirit in Sri Lanka has not received any encouragement, except random lip service from the politicians.

When all goes well, state authorities are there to share the glory, but when things go wrong and the chips are down the entrepreneur is left alone to fight his battle. No one comes to his rescue. He has to worry about his business, his employees and his family - and the banks.

The need of the hour is a combined effort by both the banks and the government to provide a plan to restructure failing industries.

It is essential since the more potential investors see industries collapsing, the more they are reluctant to invest in Sri Lanka.

In the age of globalisation, local industry is facing some tough challenges

and government backing is needed at this critical hour.

Chapter- 11 reform

Chapter-11 reform proposed by the FCCISL (Federation of Chambers of Commerce and Industry) originates from the United States bankruptcy law. It attempts to revive a sick industry by providing adversary services and financial relief at the first signs of trouble.Main features

1 The provisions are intended to indemnify debtors who have the ability to repay some portion of their debts out of future income, provided they are permitted to re-organise themselves and carry on with their business.

2. This is a method by which the loss of employment to workers of the debtors business could be prevented.

3. Even a unsecured creditor may be treated as a secured creditor.

4. The information about the financial situation of the debtor in the

disclosure will be beneficial to all creditors.

The axe

Views of Mrs Shiranthi Gunawardena, a legal consultant.(excerpts from a paper presented at the FCCISL seminar)

"It is of paramount importance for the business sector that the bank should conduct a proper investigation when a debt goes bad for the purpose of ascertaining the actual reason for the default, prior to using the "Axe" known as the parate execution."

"There is a great need for the evolution of supervisory and monitoring

mechanisms to forestall the business sector becoming liable to parate executions."

Parate is not Karate

What the bankers say........

Anil Amarasuriya, CEO- Sampath Bank."We will not try to foreclose on securities unless as a last resort. If there is any hope left in the business we will always revive it by restructuring the loan. "

On Chapter 11 style reforms, he said:

"Subjected to modifications, it will be suitable for Sri Lanka. We bankers already practice the essence of Chapter -11, which is doing the utmost to revive the sick industries before resorting to the foreclosure."

"What Sri Lanka needs is an agency to provide managerial and marketing assistance to the sick SMI's. This is essential when the industry is sick and the entrepreneur does not have the necessary expertise to turn the business around. In the Philippines there is a special unit in every bank to restructure the sick industries."

On the SMI sector.........

"SMI sector needs special attention at all times."

"The plight of the investor- ill effects of parate execution

Excerpts from the paper presented by Dr Bandula Perera, Chairman, National Chamber of Industries at the FCCISL seminar on parate executions last week"No matter how well one plans and runs his business today, the SMI sector is faced with a catastrophic situation."

"On one hand the cost of raw materials, fuel, power and water have gone up tremendously. Employees are demanding higher wages, to offset their cost of living increases. As the buying power of people goes down, the local markets for many products have begun to shrink."

"The prevailing process of parate execution under the present context prevents even a defaulter who makes a genuine attempt to re-schedule the loan since the moment an advertisement appears in the newspaper announcing that his business is to be acquired by the bank, he loses the prospect of making any money from that point onwards."

"In view of the above, time has come, to take a good look at the parate

execution process and the relevant debt recovery acts and the administrators

to take immediate steps to help SMIs to survive this difficult period."

This is a warning

A Chief Justice's viewpoint on a parate execution in 1959:"Oh it is excellent to have a giant's strength. But it is tyrannous to use it like a giant," Chief Justice Hema Basnayaka said quoting Shakespeare, in the case of Mendis Silva vs Ceylon State Mortgage Bank in 1959. (Until 1990 only state banks were empowered with the right to parate execute.)

The chief Justice further observed in that case, " I share the views

on the cruel fact that the plaintiff has suffered at the hands of the state

lending institution , whose aid he sought. This case should serve as a

warning to the state legislature against entrusting vast powers to state

agencies without adequate safeguards."

The solution…

Development Corp to assist SMI's

By Akhry Ameer

A Small and Medium Industries Development Corporation is to be established by the Ministry of Constitutional Affairs and Industrial Development to assist the small and medium industrial sector, private sector officials said.A follow up study progress report on the Small and Medium Industrial Development Corporation (SMIDEC) has been prepared and handed over jointly by Japan International Cooperation Agency (JICA) and local experts under technical assistance to the ministry.

The final blueprint is to be finalized together with Japanese consultants this month before an application is made for funding to the JIBC (Japan International Banking Corporation) and cabinet approval is sought. JICA has already pledged US$ 10 million for the proposed corporation, the concept of which was originally conceived almost two years ago under a master plan for the industrial development of the country by JICA and UNIDO.

SMIDEC once established would act as a one-stop shop to assist the small and medium industrial sector. One of the most important functions of the proposed SMIDEC would be its Credit Guarantee Organisation. The Credit Guarantee Organization, a direct answer to the much-talked about parate execution by banks on failing SMI's, plays the role of guarantor after examining the credit worthiness and potentiality of an SMI business.

By charging a credit guarantee fee, the organization would guarantee up to 80% of loans applied for by an SMI applicant provided that banks/financial institutions bear the balance 20%.

In the event of a risk the Credit Guarantee Organization would make payment to cover the debt to the financial institutions on behalf of the SMI. The organization would also carry out mid-term control work and indemnity-right control work to ensure that the SMI business is stable and if ailing, to be guided to stability.

The Sri Lanka Chamber of Small Industries, which has been requested to forward observations on the study, welcomed this move. Its President Mr. Aloy Jayawardene said that this would be of immense benefit to the industry, making the environment conducive preventing possible moral hazards otherwise faced by investors like having to declare their own assets as security.

Other functions of SMIDEC would be to provide technical and management advice, management information service and venture & incubation promotion.

The Venture and Incubation Promotion is similar to the IT incubator concept, with office space, technical, marketing and management advice, funding, etc. being provided to various SMI's.

The technical and management advice and management information service functions would draw expertise from the various institutions like NIBM, NDB, universities according to the needs of SMI's seeking assistance.

Deputy Director (Finance) T.M.B.Menike of the ministry said that though SMIDEC has been scheduled for implementation in the fourth quarter of 2001 it would happen much earlier. Mr. Jayawardene added that he anticipated the SMIDEC to be established by June this year.

According to an industrial census conducted in 1983, 102,721 registered and informal industrial units were recorded - a figure which would be much higher now. A more recent survey conducted by UNDP estimated that SMI's with a fixed asset of Rs. 16 million or less accounted for 90% of establishments which represented 70% of employment in the private sector.

Phase two of the Industrial Master Plan and a subsequent study team has identified low level of technology, marketing knowledge and management skill, high production costs, financing difficulties, lack of entrepreneurship and knowledge of banking and government procedures as problems associated with SMI's.

![]()

Front Page| News/Comment| Editorial/Opinion| Plus| Business| Sports| Mirror Magazine

Please send your comments and suggestions on this web site to