4th February 2001

News/Comment|

Editorial/Opinion| Plus| Business|

Sports| Mirror Magazine

Economy lost billions in war-report

Sri Lanka should have been on par with Asian Tigers

By the Business Editor

As Sri Lanka marks the 53th year of independence from British rule, a new Colombo study has revealed that the country is losing billions of rupees in lost revenue, economic growth and human misery due to the ethnic conflict.If not for the 17-year-long war, Sri Lanka's economy would have grown by seven percent or more compared to the average 4-5 percent now, the research study carried out by the Marga Institute, the country's oldest economic and social research agency noted.

The report titled "Economic, Social and Human cost of the war" - between the period 1983 to 1998 - was commissioned by the National Peace Council (NPC) and released last week, a few days before the February 4 Independence day events. The research team was led by Godfrey Gunatillake, a leading civil society activist and a former civil servant.

The study which gives an insight into a country that should have been - with buoyant economic growth comparable to that of the Asian Tigers - and not what it is, said the direct military spending by both the government and the Liberation Tigers of Tamil Eelam (LTTE) totalled 295 billion rupees while another additional expenditure by the government amounted to 213 billion rupees.

A further 40 billion rupees was spent on law and order between 1983 and 1998 while war spending by the LTTE reached 42 billion rupees according to 1998 prices.

While the study is consistent with an Institute of Policy Studies (IPS) report published more than a year ago on the same issue, its research goes far beyond - to the human cost. Such a cost is incalculable by the magnitude of the deaths and extent of human suffering, a factor, economists said, was now drawing the attention of Sri Lanka's business community in a new-found spirit of social responsibility.

Renewed efforts are underway by J-Biz Forum, a group of top trade and industry chambers in the country, to urge the two main political parties to work together towards finding a solution to the ethnic conflict.

The forum is scheduled to meet President Chandrika Kumaratunga on February 19 to discus macro economic issues and peace prospects.

An earlier attempt by the business community, led by leaders like Lalith Kotelawala and Ken Balendra, to take the peace debate to a new high with the involvement of the private sector saw intense discussions with the People's Alliance, the United National Party and other groups. But that effort ended inconclusively after many meetings.

"I believe the future of Sri Lanka lies in the hands of the two parties," said Ceylon Chamber of Commerce chairman Chandra Jayaratne, when asked to comment on the Marga study and peace prospects. He said he had not seen the study but agreed the economic and human damage to the country owing to the war was enormous.

The report said that the actual value of destroyed and damaged property is estimated at 137 billion rupees and the total of lost output in the north and the east at 273 billion rupees.

The cost to the economy due to the loss of human capital - professionals and others migrating - was a cumulative 112.5 billion rupees. Thousands of people have either fled to the west or sought jobs abroad as professionals due to the uncertain situation in the country.

Lost earnings from the tourism industry totalled 200 billion rupees with a value added net loss of 120 billion rupees while foreign investment in the region of US$ 1 billion could have come into the country, if not for the war, the study noted.

Other notable features of the report include the number of deaths which is estimated at 50,000 to 60,000 up to 1998; more than 10,000 to 15,000 disabled soldiers and many more civilians and Tamil Tiger cadres; and 800,000 people displaced due to the war.

Analysts said on the other hand the war also resulted in some "direct" benefits to the economy like employment of soldiers in the thousands, who otherwise may have ended in the unemployment category and their salaries going to sustain rural economies and raise the quality of life in villages.

But the report noted that the issue - as to the economic benefits of the war - is not whether the economy could not grow or that it has not been able to bear the cost but that "the economy could have grown at a much higher rate if it did not have to bear the costs of the war."

Widows and female-headed households have increased over the years and this group is very vulnerable, the report noted, quoting one widow as saying that "society looks on us with a strange eye ...always they would like to see something wrong in us ... whether we go to school to buy schoolbooks for our children or medicines for an illness ...even the 'baas" who comes to do some work in our house."

The report spoke of how children have been brutalised by the war. "We do not have any toys to play with ... so we make a gun out of some sticks and that is how we play. I can dismantle my father's T 56. Sometimes my father tells me to clean his gun. Now I am quite skilled at dismantling and re-assembling the gun. My main ambition is to join the army," one child living in a conflict area, was quoted as saying.

The study urged all parties - including the business community - to

work towards establishing peace through a negotiated settlement.

Positive, say businessmen

Business and Trade chambers had a positive meeting with Treasury Secretary Dr. P.B. Jayasundara last week on various issues troubling the economy, with another key discussion being scheduled with President Chandrika Kumar-atunga later this month."We had very fruitful discussions on sections of an agenda that we have put forward to the government and now a meeting has been fixed for February 19 with the president to tackle the bigger, macro issues in the economy," said Chandra Jayaratne, chairman of the Ceylon Chamber of Commerce.

One of the decisions of the meeting was an assurance by Dr Jayasundara to study the Central Bank decision to permit exporters to hold onto their export proceeds for a maximum 90 days as many chamber members had difficulties in complying with this rule.

The commerce chamber is the main constituent member of the Joint Business Forum or J-Biz Forum that is lobbying government for a serious look at crucial issues like the political crisis, restive labour, maintenance of law and order and stability, changes in laws concerning trade and commerce, and trade unions and society.

The J-Biz Forum, which includes some of the country's top chambers and business groups, was formed late last year to urge government to quickly tackle a growing political and economic crisis. The forum submitted a memorandum to the government and the opposition United National Party, soon after the October 10 parliamentary polls, listing out the critical areas and suggesting a broad discussion on these problems.

But there was apparently no response from either side until the Finance Ministry agreed to a meeting, which was held last week and various decisions taken.

Chamber officials said that the issues that were discussed included the state of the economy and the free float of the dollar, some problems arising out of the enactment of a new Inland Revenue Act last year and its impact vis-a-vis the Board of Investment (BOI) laws, the old Factories Ordinance which restricts overtime for females, anti-dumping laws and the labelling of imported goods.

They said the old Factories Ordinance was an archaic piece of legislation and restricted overtime work for females which affects productivity of many Free Trade Zone factories where overtime work to meet shipment and buyer deadlines is the norm. This needed to be changed, they said.

The chamber also raised last year's enactment of a new Inland Revenue Act which has created a problem relating to BOI ventures as the BOI Act still confirms to the old Inland Revenue law and concessions offered under it. Treasury officials promised to take care of the anomaly.

Officials said the forum was also informed that the proposed anti-dumping laws would come before parliament in the first quarter of the year while Customs was urged to implement a ruling by the Attorney General on the labelling of imported goods.

Several companies have been affected by Customs regulations which are strict about the country of origin in imports. Most multinationals now outsource their products by making goods in other countries while exporting them from their home base.

Customs have insisted that imported goods should contain the place of manufacture/country of origin and this has affected particularly the information technology industry where outsourcing is common as a cost-effective measure.

On the issue of exporters' proceeds, chamber officials explained to the Treasury that the 90-day ruling was affecting major tea markets like the Middle East and Russia whose buyers operated on a usual 180-day credit facility.

The Central Bank ruling, officials said, was driving market prices down in Colombo and affecting smallholders who produce the bulk of the teas for these markets.

The battle of the booksellers is hotting up. Some years ago, traditional heavyweights in the business

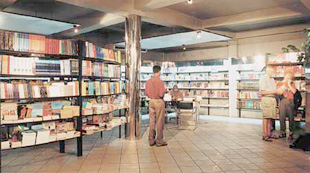

were confronted with new entrants in the in the market like Vijitha Yapa which trimmed overheads and sold books leaving small profit margins. The industry has grown since then and the traditionalists are now gearing up with the "full frontal assault". Plans are afoot by M.D. Gunasena's to open a mega book store right opposite Vijitha Yapa's book store in Colombo. Picture above shows a view of the Gunasena store in Pettah and at right, a frontal view of Yapa book store, Colombo 3.

Fighting by the book…

By Chanakya Dissanayake

Sri Lanka's traditional bookseller, M.D. Gunasena, in a bold attempt to establish itself as the market leader in the rapidly expanding English book retailing market, plans to open a 50-million rupee, four-storey

mega bookstore - right opposite main rival, Vijitha Yapa at Bambalapitiya.

four-storey

mega bookstore - right opposite main rival, Vijitha Yapa at Bambalapitiya.

This move is expected to dawn a new era of competition to the traditionally sober book retailing business.

" We have the resources and the reserves to launch a sustained full frontal attack on our competitors," said the M D Gunasena CEO M H M Faizer. The mega bookstore, modelled after the top end bookstores in Europe, is expected to be opened in mid 2001.

Trade sources said the English book retailing business fell into hard times after the Sinhala only rule in 1956 and the removal of English medium curriculum in 1970's.

However liberalisation in the 1980s and the recent Government policy decision to re-introduce the English curriculum and the growth of professional courses conducted in English has resulted in a resurgence in the language. " We expect the English book market to expand by many folds during the next few years," said Faizer.

Gunasena's is also planning to launch an "Amazon. Com" type on-line bookstore. As the first step it has enabled the customers to view the book lists on line and order through e-mail. " Our next step is to enable on-line ordering through credit card payments.

Sri Lankan expatriates living abroad could benefit immensely from this service," Faizer added.

Currently, Vijitha Yapa enjoys the No 1 slot in the English book retailing business. It has also established itself firmly in the magazine retailership with the exclusive dealerships for almost all the main international magazines.

General Manager of Vijitha Yapa bookshops, Lakshman Siriwardhana told Sunday Times Business that they do not consider the Gunasena's a threat since they have already established themselves as the market leader in the English book market. " We are also expanding rapidly. Vijitha Yapa opened three bookstores simultaneously last year. We are also opening an another branch in the strategic education triangle in Colombo 7."

He further added that Vijitha Yapa will strive to maintain their market share by offering the lowest prices in the market.

As the giant billboards displayed on strategic locations in Colombo

reminds the general public to read more, it also gives a silent signal

about the battle that lies ahead. But unlike most battles the final victory

will lie with the consumer…

"We are playing in a dead stockmarket"

Sri Lanka's stockmarket, in the doldrums due to uncertainty over the free float of the US dollar and the absence of any "feel good" news, reacted in the most traditional way last week - play safe."The market was dead, dead, dead. We are playing in a dead stockmarket," said a top stockbroker, adding that foreign and local players were out of the market, watching and waiting for a clearer picture to emerge vis-a-vis the dollar.

While banks, importers and consumers panicked after the dollar was allowed to float two weeks ago, the only sector that stayed calm was the Colombo bourse. There was no panic, no confusion simply because there was little activity. Turnovers fell to single digit levels from more respectable double digits levels in the previous week.

The dollar stabilised across the week, after the Central Bank cautioned some errant dealers in the market for speculative trading, and was trading at the 88-90-rupee levels but this still did not enthuse the stockmarket whose players played the waiting game.

News of a possible bailout by the International Monetary Fund (IMF) - which spread across the markets last week - was also greeted with half-hearted enthusiasm. "The government may have to agree to some tough pre-loan conditions from the IMF and whether the state would agree to this is a big question," another trader noted.

Analysts said that the IMF had offered a US $400-500 million package to tackle dwindling foreign exchange reserves - which have fallen to $950 million according to an official announcement - and was currently negotiating with the government on loan terms. There was no official confirmation of the prospective loan negotiations.

But an announcement by the Ceylon Electricity Board (CEB) on Wednesday that it planned to raise rates by 25 percent from March 1 gave some credence to news of a bailout. "It looks like the state is setting the ground for the strict IMF conditions," the trader said.

The IMF has often urged the government to trim government spending, cut budget deficits and war costs and do away with subsidies on essential services. The government has not got an IMF facility in the past few years.

Some analysts said stockmarket investors were hoping for a stable picture to emerge this week as to where the dollar is heading. "If the dollar stabilises at the current 88-90-rupee levels this week, then some trading could come back to the market at least from local investors," an analyst noted.

But others felt the depressed market was being hurt by much more than an uncertain dollar. They said they expected the economy - mainly the services sector - to slow down considerably, in the first and second quarters while wholesale trade would be adversely affected as a result of the dollar rising by 11 rupees during a 10-day period, and possibly more in the near future.

"While on the one hand importers are not opening Letters of Credit, banks are placing other restrictions, increasing the paper work and making in more difficult to buy dollars. There is also the issue of high interest rates that is affecting the market," said the research director at a local brokerage.

The uncertainty is set to affect corporate earnings this year while cushioning those with some exposure to plantations and banks that's showing good results this year. Bank earnings have been propped up by high government borrowings in the commercial market to finance the war.

Analysts said conglomerates like Hayleys should do well based on its

exports, John Keells would be sheltered by plantation and bank earnings

while Aitken Spence's plantation and tourism earnings is also seen positive.

Mind your Business

Floating

The floating Dollar shock is still reverberating through the economy though the rupee appears to have somewhat stabilized against its American cousin.While the drama goes on, there have been serious concerns in the corridors of power about what this would do to inflation. And now, with the greens have gone to court against the decision, some senior blue politicians sounded out the Lady to see whether the decision could be reversed.

No, they have been told. The decision was purely economical and will not be reversed for political reasons, the Lady is supposed to have said...

Production shock

More shocks were to follow in the form of a fuel adjustment charge on electricity to be enforced next month and this could be a real setback.The country's premier export earner, the garment industry which heaved a sigh of relief as the rupee fell now find their delight short-lived, due to the surcharge.

Many manufacturers, who expect the surcharge to be withdrawn after about six months are already adjusting their manufacturing schedules to cut down on production in the near future...

The spin-offs

The willow wielders from Britain are here and hectic preparations are underway to get the game staged in Dambulla.At least two hoteliers have realized the potential of this event for tourism and are reportedly prospecting sites for five-star resorts.

And already, land prices are soaring in the city that never sleeps, they say.

Who said that cricket was only a game?

Economy - 53 years after Independence

Fifty-three years after regaining inde pendence we are facing an economic and financial crisis. Perhaps most readers may be of the view that we have nothing much to celebrate this year. The rising cost of living, considerable confusion about the state of the economy and the uncertainty of the exchange rate, among other unfavourable developments, are depressing.The unfavourable developments are not confined to the economy alone. The law and order situation, the war in the North and East, terrorism, poor governance, and many other political and social developments are all reasons for being dissatisfied with the current situation in the country.

These so called non-economic features in fact have an important bearing on the economic condition of the country. The resolution of these other factors would largely determine whether we have anything to celebrate at future anniversaries of independence.

Instead of dwelling on these we chose to discuss the broad issue of the economic changes that have occurred over the last 53 years. At independence the country had a predominantly agricultural economy, tea, rubber, coconut and paddy dominated the economic scene.

Today agriculture contributes only about 20 per cent to national income. Services contribute over 50 per cent to the economic output and manufactures around 20 per cent. These are significant structural changes in the economy. They signify that the country is on a path of development. Apart from these changes in relative contributions to national output by these sectors, there are qualitative differences as well.

In agriculture, food crop cultivation is far more important than the plantations. Tea production, which was predominantly a plantation crop, is now produced to a larger extent on small holdings. During the 53-year period the estates went from private ownership to state ownership then private management and finally back to largely private ownership and management.

Tea production has increased significantly in both the smallholdings and the estates to reach 300 million kilograms last year. The character of industry changed much more than its proportion of contribution to national income. From a few identifiable factories producing cement, chemicals, hardware, glass and paper and cottage or small industries, in the 1950s and 1960s, the country's manufacturing is now of factory industry catering largely to export markets.

Services that were highly concentrated to serving the plantations are now serving varied economic activities. The character and sophistication of banking, financial, transport and communications has changed drastically. Tourism has become one of the important economic activities contributing to the country's income both directly and indirectly. Much of Sri Lanka's growth potential may lie in being a service provider to the rest of the world. With all these developments, the country's degree of dependence on trade has hardly changed .

At the time of independence and for nearly three decades afterwards, the Sri Lankan economy was described as an import-export economy. That description remains valid even today in spite of the diversification described above. In 1950 we had a trade dependence of 70 per cent. Today our trade dependence is only slightly less, about 68 per cent. Once again the significant difference lies not in these figures, but the changed character of the trade dependence.

For many years after independence our trade dependence consisted of a few agricultural exports-tea, rubber and coconut and a high dependence on the import of food and other consumer goods. Today manufactured exports dominate the export structure and consumer imports are smaller than intermediate imports. Manufactured exports consist of a large number of items with garment exports dominating industrial exports and in fact all exports. Nevertheless, other industrial exports such as ceramics, leather and rubber goods and food and beverages have been increasing in importance.

This increased industrial exports has not led to a lesser import dependence, in fact it has increased the country's import dependence. However, unlike for several decades after independence when our dependence was for food and consumer items, today the larger dependence is for raw materials for industry. Another important change has been the emergence of workers remittances as a foreign exchange earner. The export of labour to various countries, particularly the Middle East, has made remittances a very important contribution to the balance of payments. These constitute about 5 per cent of GDP. These remittances have added an element of stability to the balance of payments as they have been increasing each year irrespective of the performance of the economy.

In short the nature and character of the Sri Lankan economy has changed significantly during this period. It is a far more diversified economy than at the time of independence. It can also be described as a more modernised and industrialized economy. Yet despite these changes it remains highly vulnerable to the changes in the international market place and global economic developments. It is subject to the harsh forces of an intensely competitive world market. It is precisely owing to this reason that we must become a far more efficient economy.

If we fail to develop efficiencies in our economic production we will

be unable to compete in the international market place. The changes we

have noted in the structure of the economy and the new trade dependence

that has developed makes it imperative for us to be able to compete with

other nations of the world. This requires a thrust on many fronts, including

reforms in our education and value orientation. If we fail to change and

be more competitive we continue to be one of the backward economies of

the world and have little to celebrate even on the 60th anniversary of

independence.

Free float and the manufacturing industry

Point of View

By Jagath Peiris

The Sri Lankan Rupee was allowed to free float last week by the Central Bank.Free floating of a currency is generally accepted as a positive measure in an open economy.

The value of the rupee was controlled to a certain extent with regular planned depreciation by the Central Bank until last week. This encouraged exporters as well as importers.

However, exporters may not have got the real value for their exports and perhaps imports were subsidized.

Even before the free floating, the economy of the country was not in a sound position.

There was substantial depreciation of the rupee during the past few months, which resulted in the increase of cost of living. Sri Lankan manufacturers were also facing problems due to high manufacturing costs and found it difficult to compete with similar goods manufactured in other developing countries.

During the year 2000, the defence expenditure rose. Wages were increased at the request of the government in order to provide some relief to employees.

Due to rise in fuel prices, cost of energy also increased. All this resulted in high cost of production, which narrowed margins of manufacturers.

In such a situation, free floating of the rupee would increase manufacturing cost further.

This would sometimes make certain industries not viable.

All inputs such as cost of raw materials, cost of labour, cost of energy, packing and transport costs are bound to increase. The manufacturers may not be able to increase their price to compensate the increasing prices of these inputs.

As a result some of them may have to wind up their operations.

Immediately after the free float of the rupee, Shell Gas Lanka Limited, which has a monopoly in the supply of gas in Sri Lanka, increased the price of gas by 35%.

This is the third increase in the price of gas within 90 days making the price of Industrial Gas go up by 85% during this period. This is certainly a huge increase for the industry to take up. Also the price of diesel went up by 82% during the one year period up to January 2001. Prices of other inputs are also likely to rise heavily soon.

Even though by free floating the rupee, the depreciation may be about 20%.

However, the raw material and energy cost increases can be much more than this amount.

This in my opinion should be looked into and the government should take steps to control the increase in the price of inputs.

This has to be taken seriously and steps taken immediately to ensure the survival of the manufacturing industry in the country.

The writer is the Managing Director of Royal Fernwood Porcelain Limited.

![]()

Front Page| News/Comment| Editorial/Opinion| Plus| Business| Sports| Mirror Magazine

Please send your comments and suggestions on this web site to