Central Bank should be independent

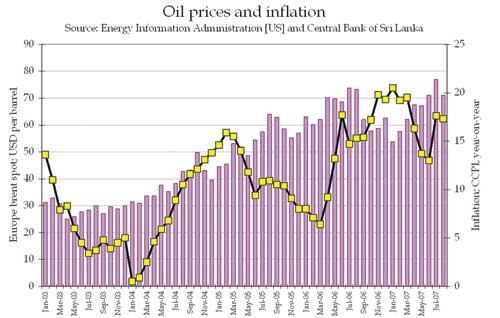

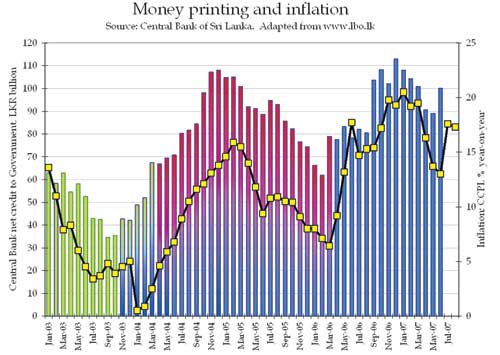

Economists across the board have underscored the pivotal role of the Central Bank (CB) of Sri Lanka in stabilizing the country's economy and the pressing need for it to remain independent. Lead economist at Lirneasia, Harsha De Silva said the CB must be independent if it wants to achieve price stability and to bring down the cost of living. "This is based on the now very well accepted relationship between money printing and inflation," he said. "If the CB gives in to the Treasury and prints money for its expenditure because they don't have the money, then inflation will increase." De Silva, at a recent seminar, explained that this happened during the "Rata Perata" regime of the People's Alliance/JVP when they printed billions to pay for the fuel subsidy. After the money poured into Sri Lanka following the 2004 tsunami disaster, the CB did not print money and inflation came down in 2005. Then again in 2006, Rs.38.6 billion was printed and inflation subsequently increased. "That came down with the CB's announcement that they won't print money but most recently, it has reversed once again with the printing press back in action. This is called 'accommodation monetary policy' meaning accommodating the profligacy of the Treasury." He said there are a number of countries where the governor's job is linked to the inflation target to ensure the Central Bank will act responsibly and without doing 'favours' to the Treasury. "Here we have the Secretary of the Treasury on the Monetary Board, the highest decision making body of the CB, along with the CB Governor and one other person, Tilak de Soyza. There are two vacant slots." De Silva referred to this as a classic case of politization of the CB. "As we all know, Governor Ajith Cabraal is the first politician to have become the Governor. He is a past provincial council member and twice defeated parliamentary candidate for the Colombo district. "We must not let politicians, Cabraal or whoever else, interfere in the workings of the sacred institution that is the CB." De Silva maintains that the relationship between money printing and inflation is not coincidental. On the left hand axis of the first graph is the 'Central Bank net credit to the government' in billions of rupees. This is a proxy for money printed by the CB and given to the government for its expenditure. It consists of CB advances to the Treasury and treasury bills purchased by the CB. On the right hand axis is inflation, measured as year-on-year. This graph shows the relationship between money printing and inflation from January 2003 to July 2007. According to the graph, De Silva said there is clearly a relationship between 'money printed and given to the government' and 'inflation. He explained that as the cumulative printed money increases, inflation also increases with a slight lag. When the amount of money printed reduces, inflation decreases with a slight lag. His argument is that inflation is primarily demand driven or in other words, 'too much money chasing too few goods.' There is an impact from oil but it is not the major driver of inflation, contrary to the various arguments put forward by the state to say inflation is a 'supply push' and is affected by droughts, floods, oil prices and other factors. "The debate is whether the relationship is real. People who don't like this graph (an adaptation from Lanka Business Online) like to say it is spurious. But I am saying how could it be if the relationship has held so tightly since January of 2003," De Silva surmised. (NG) |

|

||

| || Front

Page | News

| Editorial

| Columns

| Sports

| Plus

| Financial

Times | International

| Mirror

| TV

Times | Funday Times || |

| |

Reproduction of articles permitted when used without any alterations to contents and the source. |

© Copyright

2007 Wijeya

Newspapers Ltd.Colombo. Sri Lanka. All Rights Reserved. |