Inflation will conquer us, unless we resolve to contain extravagance

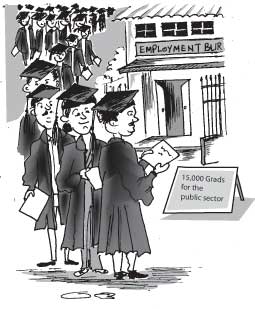

As the budget debate meanders along in parliament, its striking feature is the lack of substance. Hardly any speech focuses on the fiscal and economic issues of the budget. Instead, there is a host of labels—name calling one could say-- of the budget such as a phantom budget, a nothing budget, a development-oriented budget, that are entertaining but not enlightening. The debate is looked at as an opportunity for the opposition to attack the government on many counts and for government members to insult opposition members. The political interest in the Budget in that it seemed to provide the opposition an opportunity to topple the government is also fading away. There is a section of parliament that criticises the budget and the government vehemently and yet refuses to topple it. In fact perhaps the most critical comments on the budget came from the JVP though the economics on which these comments are made are, to use a popular word in the Marxian lexicon, moribund. It appears that some of those most critical of the budget will refrain from voting against it, while expectations of crossovers from the government are receding. These make the political interest in the budget so much less. This brings out the truth of a recent assertion by a parliamentarian that the budget debate in parliament serves no useful purpose, as members of one side speak well of it and the other side speaks ill of it. And the concluding vote is a foregone conclusion. This makes us reminiscent of budget debates of the past that were an educational experience. Some of those of the older generation learnt some of the fundamentals of public finance from the contributions of members of Parliament like N.M. Perera, Colvin R.de Silva, Bernard Soysa, Leslie Gunewardena. Pieter Keuneman, Philip Gunewardena, SWRD Bandaranaike, J.R Jayewardene, U B Wanninayake, to name a few. Alas, there are no such erudite parliamentarians to enlighten us today. Even those of an intellectual calibre in the present parliament—and there are a quite few, make little effort to scrutinise the budget as it should be done. The general tenor of the debate appears to drag them down too, to political polemics. One can hardly learn anything on the economy from parliamentary debates of today. In fact members of parliament have themselves said so. The debate on the Budget outside parliament has focused on several pertinent issues. One of the issues that has come up that is of serious concern is that the estimates of expenditure, as well as those of revenue, tend to be way out and the ultimate out turn of figures would be different from those presented in the Budget. Analysts, point out that this is likely to be so in 2008, as was in the past, as some expenditure of the government for this year is not included in the estimates presented to parliament. Besides this, there is always the possibility of defence expenditure overrunning, if the intensity of the war continues as at present and new hardware has to be imported. The amount allocated for the subsidisation of petroleum too could rise owing to continuing escalation of oil prices to the US$ 100 mark per barrel. There may come a point when the increased prices would have to be passed on to consumers. However, the political unpopularity of this move and its impact on general prices may well result in the government upholding the budget promise of keeping petrol prices stable. This will add considerably to government expenditure. There is also considerable scepticism that the government would contain expenditure within the estimated amounts even though expenditure has been increased substantially. Many commentators do not take the numbers seriously because of the supplemental budget estimates that are expected to be presented in due course. There is serious concern that tax revenues too would not materialise. There are several reasons for this. The credit crunch that firms are experiencing as well as the increasing costs of inputs, especially imported materials, will slow down economic activities. This coupled with the decrease in demand implies that industrial turnover would be reduced and there would be a fall in corporate and small firm profits. This would mean that several tax revenues would be reduced. The impending global slowdown in economic growth, even though it may not lead to epression, would result in lesser demand for several of our key exports, as has happened in the recent past. These developments imply a shortfall in revenue unless some new burdensome taxes are imposed on the people. In the context of these developments containing the budget deficit to 7 per cent of GDP is difficult. Analysts are of the view that the parameters stipulated in the estimates would not materialise as in the past. They contend that revenue collection would not yield the expected amounts and that current expenditure would increase significantly and is likely to increase by more than that estimated in the budget. At best the fiscal deficit may be contained by a curtailment of capital expenditure as has been the fiscal experience in recent years. The 2008 budget too would generate inflationary pressures both due to the unproductive nature of much of government expenditure as well the large fiscal deficit, although much of the deficit is due to the development of infrastructure. These expenditures too are inflationary as their benefits are over a very long period and are very indirect. This is not to deny that the development of infrastructure is much needed, but the large expenditure is inflationary as they may bear fruit only over the long run. Meanwhile this expenditure would create inflationary pressures in the current year. Besides not all infrastructure investment would be productive as many may be politically motivated rather than economically justified. Large infrastructure investment could be excessively costly and cost ineffective. In fact the capital expenditure in the budget for next year could also strain the balance of payments to the extent that there is a high import content in the investments. The fundamental issue that this budget has raised is whether the government is able to contain expenditure within the amounts announced in the budget. If Budget 2008 is to achieve this objective the government must have a strong resolve to ensure that public expenditure is kept within the amounts budgeted. Better still if it could curtail some of the extravagant expenditure that is to be voted on. The budget itself has shown a lack of such a resolve and financial discipline by such measures as employing another 15000 graduates into a public service that is the largest in the world in relation to population. Such measures during the course of 2008 are most likely to result in additional expenditures based on political considerations. Then the prediction of many analysts is likely to come true and render the discussion of the Budget estimates of little relevance. It is generally contended that the government is deliberately misleading the public with rosy scenarios. Sadly, the budget figures and its approach failed to acknowledge the impending crisis or recognise that fiscal discipline has to be taken more seriously. |

|| Front

Page | News | Editorial | Columns | Sports | Plus | Financial

Times | International | Mirror | TV

Times | Funday

Times || |

| |

Reproduction of articles permitted when used without any alterations to contents and the source. |

© Copyright

2007 | Wijeya

Newspapers Ltd.Colombo. Sri Lanka. All Rights Reserved. |