The widening trade deficit is of serious concern for the balance of payments. Although there was an overall balance of payments surplus in the first seven months of this year, the current account of the balance of payments is in deficit by a significant amount.

The current account deficit is owing to the large trade deficit of as much as US$ 5.1 billion. The overall surplus in the balance of payments has been achieved mainly due to the large amounts of foreign borrowing by the government.

It is not the overall balance of payments surplus achieved in this manner that matters. It is the current account balance that gives the true position with respect to the country's earnings and expenditure of goods and services, including the remittances received. As we pointed out last week, the external finances are in a vulnerable position owing to the massive trade deficit. A closer analysis of the trade balance is necessary to see whether the borrowing to bridge the trade deficit is in the long run interests of the country.

Trade statistics

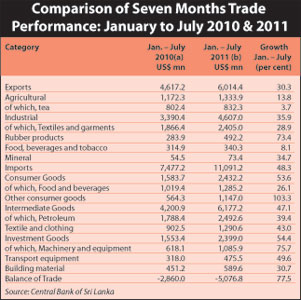

The trade deficit reached US$ 5.1 billion at the end of July despite a significant growth in exports of 30 percent. Although there was an increasing trend in exports, the growth in imports was of a higher magnitude. As the country's imports are larger, even the same proportionate increases in exports as of imports lead to a widening of the trade deficit. What happened in the first seven months of this year is that imports increased by a higher proportion than exports.

While exports grew by 30 per cent over that of the first seven months of 2010, imports increased by 48 per cent during the same period. This meant that import expenditure was very much higher than export earnings. In fact import expenditure was more than two and a half times export earnings.

While export earnings increased by US1.4 billion, import expenditure increased by a massive US$ 3.6 billion resulting in a trade gap of US$ 5.1 billion. This is the reason for the worsening of the trade deficit. The trade deficit was 77 percent higher than the deficit of the first seven months of last year. The main reason for the widening trade deficit is the large increase in import expenditure.

Admittedly there are situations when a large increase in import expenditure could be in the long term interests of a country. If the trade deficit has been brought about by imports that would enhance the future capacity to export, then such imports, though straining the immediate trade balance, would be in the interests of the long-run improvement of the balance of payments. For instance the import of capital goods such as machinery could enhance the productive capacity of the country in due course. Import of raw materials used in export industries would also have the same effect in a much shorter duration, perhaps later in the same year or flow into the export earnings of the next year. Therefore it is necessary to make a qualitative assessment of the import structure to determine whether there is a justification for the country to have as large an import expenditure.

Import expenditure

The largest component of import expenditure has been for intermediate goods. Intermediate goods accounted for 56 percent of import expenditure or US$ 6.18 billion. The largest item of intermediate goods expenditure was for petroleum imports that absorbed US$ 2.49 billion. As much as 40 percent of intermediate goods expenditure or 22.5 percent of total import expenditure was on petroleum. Import expenditure on petroleum increased by nearly 40 percent in the first seven months of this year compared to the same period last year. This increase was due to both increased volume of petroleum imports and the higher oil import prices this year compared to that of 2010.

Import expenditure on investment goods was 26 percent of total imports. Although machinery imports increased by 75 percent to US$ 1085 million and import of transport equipment increased by 50 percent to US$ 375 million, these imports are not the ones that made a serious dent in the trade balance.

It is commonly believed that most capital goods imports are contributors to development. Increases in capital imports are sometimes considered an early indicator of economic development that would contribute to export earnings or to saving import expenditure.

It is, however, not possible to evaluate the development significance of these imports without knowing the end uses. Machinery could be used for purposes that are not directly productive or improve the trade balance over time or whose gestation period before productive gains is long. In any of these cases the beneficial impact on the trade balance, even in the long run, could be moderate.

Consumer imports cost US$ 2.43 billion and accounted for 26 percent of total imports. As much as 56 percent of consumer imports are food, especially wheat flour, sugar and milk. Although prices of food were somewhat stable this year, international prices of food have been on an uptrend and this is an area of vulnerability in the trade balance.

Consumer imports and petroleum imports, that are for the most part consumer imports, together accounted for 42 percent of import expenditure or 82 percent of export earnings this year. Despite the export growth of 30 percent in the first seven months of this year, total export earnings of US$ 6.0 billion were inadequate to even finance the country's imports of intermediate goods of US$ 6.2 billion. These import statistics disclose the weaknesses and vulnerability of the country's trade dependence.

Prospects and prescriptions

The widening trade deficit would grow in the next five months. The projected trade deficit is around 8.5 million to 9 billion US dollars. This is a huge deficit. It is about thrice what was sustained in 2009 and about 70 percent more than last year's record trade gap.

This large trade deficit will cause a severe strain on the balance of payments. This is so as remittances too are not expected to grow by the same extent as before and likely to offset less than two-thirds of the deficit, in comparison with an offsetting of about 80 percent of last year's deficit.

However the Central Bank is quite optimistic about the final outturn of the balance of payments. It contends that significant inflows of foreign exchange from investments in various projects, tourist earnings and to the debt and equity markets together with capital infusions to several commercial banks will strengthen their capital base.

In spite of some favourable factors, there are also unfavourable international developments that would have an adverse impact on the trade balance and balance of payments.

Recessionary conditions in the US and Europe are likely to affect the country's exports that have gained much in recent months. Furthermore the country is facing a setback to tea exports owing to the disruption in several Middle Eastern countries that are important markets for the country's tea. According to the Central Bank "agricultural exports, which accounted for 21.5 per cent of export earnings in July 2011, decreased by 3.6 per cent to US dollars 205 million, mainly due to lower value and volume of tea exports."

These two factors will affect exports and strain the balance of payments adversely. This is especially so as the crisis in the Middle East may also affect remittances of workers that have been an important means of offsetting the large trade deficits incurred.

Conservation and restraint in import expenditure, supported perhaps by a rise in import tariffs on selected imports, could reduce import expenditure.

|